Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

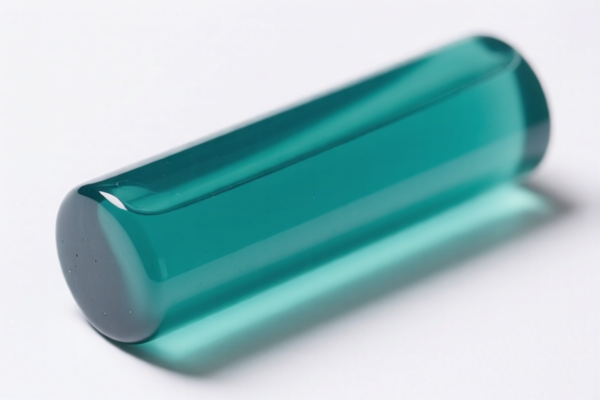

Product Classification: Polyether Resin (Coating Grade)

HS CODE: 3907290000

🔍 Classification Summary

- Product Name: Polyether Resin (Coating Grade)

- HS Code: 3907290000

- Total Tax Rate: 61.5%

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes

- April 11 Special Tariff: A 30.0% additional tariff will be applied to this product after April 11, 2025. This is likely due to trade policy adjustments or anti-dumping measures.

- No Specific Anti-Dumping Duties Listed: No additional anti-dumping duties on iron or aluminum are mentioned for this product.

- Multiple Product Variants: The same HS code (3907290000) applies to various grades of polyether resin, including:

- Coating grade

- Injection molding grade

- Blow molding grade

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm the exact grade and application (e.g., coating, injection, blow molding) to ensure correct classification.

- Check Unit Price and Certification: Some customs authorities may require documentation such as material safety data sheets (MSDS), technical specifications, or origin certificates.

- Monitor Tariff Updates: Stay informed about any changes in tariffs after April 11, 2025, as this could significantly impact your import costs.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure full compliance and avoid delays.

📚 Additional Information

- HS Code 3907290000 is part of the broader category of "Other polyether resins" under Chapter 39 (Plastics and articles thereof).

- Other HS Code Mentioned: 3907995050 (for "Coating grade polyester resin") has the same tax structure, but it is a different chemical type (polyester vs. polyether).

Let me know if you need help with customs documentation or further classification details.

Product Classification: Polyether Resin (Coating Grade)

HS CODE: 3907290000

🔍 Classification Summary

- Product Name: Polyether Resin (Coating Grade)

- HS Code: 3907290000

- Total Tax Rate: 61.5%

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes

- April 11 Special Tariff: A 30.0% additional tariff will be applied to this product after April 11, 2025. This is likely due to trade policy adjustments or anti-dumping measures.

- No Specific Anti-Dumping Duties Listed: No additional anti-dumping duties on iron or aluminum are mentioned for this product.

- Multiple Product Variants: The same HS code (3907290000) applies to various grades of polyether resin, including:

- Coating grade

- Injection molding grade

- Blow molding grade

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm the exact grade and application (e.g., coating, injection, blow molding) to ensure correct classification.

- Check Unit Price and Certification: Some customs authorities may require documentation such as material safety data sheets (MSDS), technical specifications, or origin certificates.

- Monitor Tariff Updates: Stay informed about any changes in tariffs after April 11, 2025, as this could significantly impact your import costs.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure full compliance and avoid delays.

📚 Additional Information

- HS Code 3907290000 is part of the broader category of "Other polyether resins" under Chapter 39 (Plastics and articles thereof).

- Other HS Code Mentioned: 3907995050 (for "Coating grade polyester resin") has the same tax structure, but it is a different chemical type (polyester vs. polyether).

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.