| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

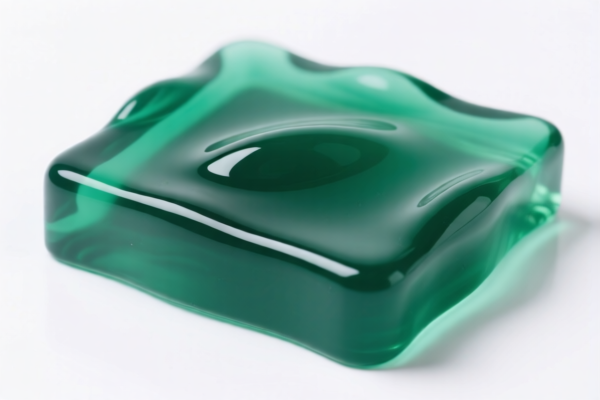

Product Classification: Polyether Resin Modified Grade

HS CODEs and Tax Information Summary:

- HS CODE: 3907210000

- Product Description: Polyether Modified Resin

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3907290000

- Product Description:

- Polyether Resin Modified Resin

- Modified Polyether Resin

- Polyether Resin Modified Plastic

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3911902500

- Product Description: Modified Polypheylene Oxide Resin

- Total Tax Rate: 61.1%

- Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

- Starting April 11, 2025, an additional 30.0% tariff will be applied to all the above HS codes. This is a significant increase from the current 25.0% additional tariff.

-

Ensure your import planning accounts for this change to avoid unexpected costs.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are listed for this product category in the provided data. However, always verify with customs or a compliance expert if your product is subject to any ongoing investigations or duties.

-

Certifications and Documentation:

- Confirm the material composition and unit price to ensure correct classification.

-

Check if any certifications (e.g., REACH, RoHS, or specific import permits) are required for the product in the destination country.

-

Classification Accuracy:

- The HS codes provided are based on the product description "Polyether Resin Modified Grade." Ensure that your product matches the exact description and technical specifications of the HS code used. If in doubt, consult a customs broker or classification expert.

✅ Proactive Advice:

- Verify the exact product name and technical specifications to ensure the correct HS code is applied.

- Monitor the April 11, 2025, tariff change and adjust your import strategy accordingly.

-

Keep records of product composition and pricing for customs audits and compliance. Product Classification: Polyether Resin Modified Grade

HS CODEs and Tax Information Summary: -

HS CODE: 3907210000

- Product Description: Polyether Modified Resin

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3907290000

- Product Description:

- Polyether Resin Modified Resin

- Modified Polyether Resin

- Polyether Resin Modified Plastic

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3911902500

- Product Description: Modified Polypheylene Oxide Resin

- Total Tax Rate: 61.1%

- Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

- Starting April 11, 2025, an additional 30.0% tariff will be applied to all the above HS codes. This is a significant increase from the current 25.0% additional tariff.

-

Ensure your import planning accounts for this change to avoid unexpected costs.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are listed for this product category in the provided data. However, always verify with customs or a compliance expert if your product is subject to any ongoing investigations or duties.

-

Certifications and Documentation:

- Confirm the material composition and unit price to ensure correct classification.

-

Check if any certifications (e.g., REACH, RoHS, or specific import permits) are required for the product in the destination country.

-

Classification Accuracy:

- The HS codes provided are based on the product description "Polyether Resin Modified Grade." Ensure that your product matches the exact description and technical specifications of the HS code used. If in doubt, consult a customs broker or classification expert.

✅ Proactive Advice:

- Verify the exact product name and technical specifications to ensure the correct HS code is applied.

- Monitor the April 11, 2025, tariff change and adjust your import strategy accordingly.

- Keep records of product composition and pricing for customs audits and compliance.

Customer Reviews

No reviews yet.