| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

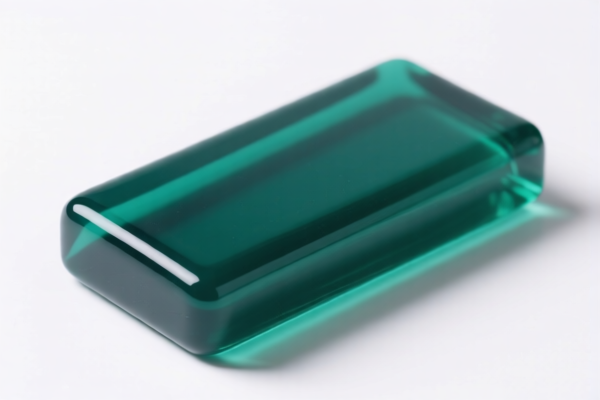

Product Name: Polyether Resin for Adhesives

Classification: HS Code 3907210000 or 3907290000 (depending on specific form and use)

🔍 HS Code Classification Overview

- HS Code 3907210000:

- Description: Polyether resin

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3907290000:

- Description: Other polyether (including polyether resin particles, powder, and adhesive forms)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes and Alerts

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on all products classified under these HS codes after April 11, 2025.

-

This is a time-sensitive policy and may significantly increase import costs.

-

No Anti-Dumping Duties Mentioned:

- No specific anti-dumping duties on iron or aluminum are currently applicable for this product category.

📦 Customs Compliance Recommendations

- Verify Product Form and Use:

-

Confirm whether the product is classified as "polyether resin" (3907210000) or "other polyether" (3907290000), especially if it is in powder, particle, or adhesive form.

-

Check Unit Price and Material Composition:

-

Ensure the product description and technical specifications align with the HS code classification to avoid misclassification penalties.

-

Certifications and Documentation:

-

Confirm if any certifications (e.g., REACH, RoHS, or customs compliance documents) are required for import into the destination country.

-

Monitor Tariff Updates:

- Stay informed about any changes in tariff policies, especially the April 11, 2025 deadline for the special tariff.

✅ Proactive Action Checklist

- [ ] Confirm the exact HS code based on product form and use (resin, powder, adhesive, etc.)

- [ ] Review the latest customs tariff schedule for 2025

- [ ] Ensure all product documentation and certifications are in order

- [ ] Calculate total import cost including base, additional, and special tariffs

- [ ] Consult with a customs broker or legal expert if unsure about classification

Let me know if you need help with HS code verification or customs documentation!

Product Name: Polyether Resin for Adhesives

Classification: HS Code 3907210000 or 3907290000 (depending on specific form and use)

🔍 HS Code Classification Overview

- HS Code 3907210000:

- Description: Polyether resin

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS Code 3907290000:

- Description: Other polyether (including polyether resin particles, powder, and adhesive forms)

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes and Alerts

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on all products classified under these HS codes after April 11, 2025.

-

This is a time-sensitive policy and may significantly increase import costs.

-

No Anti-Dumping Duties Mentioned:

- No specific anti-dumping duties on iron or aluminum are currently applicable for this product category.

📦 Customs Compliance Recommendations

- Verify Product Form and Use:

-

Confirm whether the product is classified as "polyether resin" (3907210000) or "other polyether" (3907290000), especially if it is in powder, particle, or adhesive form.

-

Check Unit Price and Material Composition:

-

Ensure the product description and technical specifications align with the HS code classification to avoid misclassification penalties.

-

Certifications and Documentation:

-

Confirm if any certifications (e.g., REACH, RoHS, or customs compliance documents) are required for import into the destination country.

-

Monitor Tariff Updates:

- Stay informed about any changes in tariff policies, especially the April 11, 2025 deadline for the special tariff.

✅ Proactive Action Checklist

- [ ] Confirm the exact HS code based on product form and use (resin, powder, adhesive, etc.)

- [ ] Review the latest customs tariff schedule for 2025

- [ ] Ensure all product documentation and certifications are in order

- [ ] Calculate total import cost including base, additional, and special tariffs

- [ ] Consult with a customs broker or legal expert if unsure about classification

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.