| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907210000 | Doc | 61.5% | CN | US | 2025-05-12 |

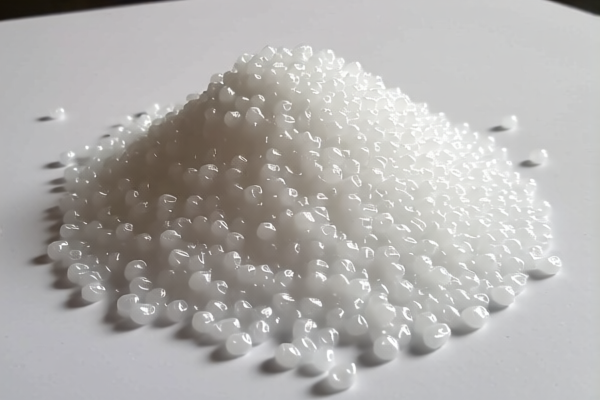

Product Name: Polyether Resin for Coatings

HS Code Classification: Based on the provided data, the product falls under the following HS codes:

🔍 HS Code Classification Overview

- HS Code: 3907210000

- Description: Polyether resins, in primary form (excluding polyether resins listed in other subheadings).

-

Total Tax Rate: 61.5%

-

HS Code: 3907290000

- Description: Other polyether resins, in primary form (including polyether resins not specifically listed elsewhere).

- Total Tax Rate: 61.5%

📊 Tariff Breakdown (Applicable as of Now)

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

⚠️ Important Note: The additional 30.0% tariff will be applied after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm the exact chemical composition and form (e.g., primary form vs. modified form) of the polyether resin to ensure correct HS code classification.

- Unit Price: The final tax amount will depend on the declared value and unit price of the product.

- Certifications: Check if any certifications (e.g., REACH, RoHS, or specific import permits) are required for the product in the destination country.

- Documentation: Ensure all technical data sheets, material safety data sheets (MSDS), and product specifications are available for customs inspection.

📌 Proactive Advice

- Double-check HS Code: Even small differences in product formulation can lead to different HS codes and tax rates.

- Monitor Policy Updates: Stay informed about any changes in tariff policies, especially those related to the April 11, 2025, deadline.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

Let me know if you need help determining the most accurate HS code for your specific product formulation.

Product Name: Polyether Resin for Coatings

HS Code Classification: Based on the provided data, the product falls under the following HS codes:

🔍 HS Code Classification Overview

- HS Code: 3907210000

- Description: Polyether resins, in primary form (excluding polyether resins listed in other subheadings).

-

Total Tax Rate: 61.5%

-

HS Code: 3907290000

- Description: Other polyether resins, in primary form (including polyether resins not specifically listed elsewhere).

- Total Tax Rate: 61.5%

📊 Tariff Breakdown (Applicable as of Now)

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

⚠️ Important Note: The additional 30.0% tariff will be applied after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm the exact chemical composition and form (e.g., primary form vs. modified form) of the polyether resin to ensure correct HS code classification.

- Unit Price: The final tax amount will depend on the declared value and unit price of the product.

- Certifications: Check if any certifications (e.g., REACH, RoHS, or specific import permits) are required for the product in the destination country.

- Documentation: Ensure all technical data sheets, material safety data sheets (MSDS), and product specifications are available for customs inspection.

📌 Proactive Advice

- Double-check HS Code: Even small differences in product formulation can lead to different HS codes and tax rates.

- Monitor Policy Updates: Stay informed about any changes in tariff policies, especially those related to the April 11, 2025, deadline.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

Let me know if you need help determining the most accurate HS code for your specific product formulation.

Customer Reviews

No reviews yet.