| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

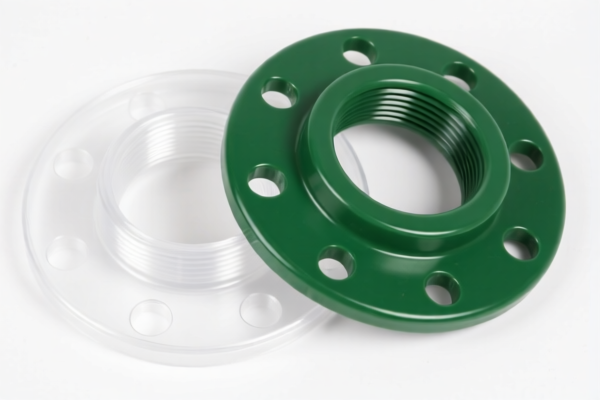

Product Classification: Plastic Flanges (Polyethylene, Polypropylene, PVC, etc.)

Below is the detailed HS code classification and tariff information for the declared product "Polyethylene Flanges" and related plastic flanges:

🔍 HS CODE: 3917210000

Product Description: Polyethylene Flange Fittings

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies specifically to polyethylene flange fittings.

🔍 HS CODE: 3917220000

Product Description: Polypropylene Flanges

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to polypropylene flanges.

🔍 HS CODE: 3917400060

Product Description: PVC (Polyvinyl Chloride) Pipe Flanges

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is specific to PVC pipe flanges.

🔍 HS CODE: 3917400095

Product Description: Plastic Pipe Flanges (General)

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code covers general plastic pipe flanges, excluding PVC and polyethylene.

🔍 HS CODE: 3917390050

Product Description: Plastic Pipe Flanges (General)

Total Tax Rate: 33.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to plastic pipe flanges with a lower base tariff, possibly for certain materials or specifications.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Material Verification: Ensure the material type (e.g., polyethylene, polypropylene, PVC) is clearly specified to avoid misclassification.

- Certifications: Check if customs certifications or technical documents (e.g., material composition, origin, etc.) are required for compliance.

- Unit Price: Confirm the unit price and quantity for accurate tax calculation, as customs may apply different rates based on value.

✅ Proactive Advice:

- Double-check the material of the flange to ensure the correct HS code is used.

- Review the product description and technical specifications to avoid misclassification.

- Plan ahead for the April 11, 2025 tariff increase to avoid unexpected costs.

- Consult with customs brokers or legal advisors if the product is part of a larger shipment or involves multiple materials.

Let me know if you need help with HS code selection or customs documentation! Product Classification: Plastic Flanges (Polyethylene, Polypropylene, PVC, etc.)

Below is the detailed HS code classification and tariff information for the declared product "Polyethylene Flanges" and related plastic flanges:

🔍 HS CODE: 3917210000

Product Description: Polyethylene Flange Fittings

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies specifically to polyethylene flange fittings.

🔍 HS CODE: 3917220000

Product Description: Polypropylene Flanges

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to polypropylene flanges.

🔍 HS CODE: 3917400060

Product Description: PVC (Polyvinyl Chloride) Pipe Flanges

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is specific to PVC pipe flanges.

🔍 HS CODE: 3917400095

Product Description: Plastic Pipe Flanges (General)

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code covers general plastic pipe flanges, excluding PVC and polyethylene.

🔍 HS CODE: 3917390050

Product Description: Plastic Pipe Flanges (General)

Total Tax Rate: 33.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to plastic pipe flanges with a lower base tariff, possibly for certain materials or specifications.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Material Verification: Ensure the material type (e.g., polyethylene, polypropylene, PVC) is clearly specified to avoid misclassification.

- Certifications: Check if customs certifications or technical documents (e.g., material composition, origin, etc.) are required for compliance.

- Unit Price: Confirm the unit price and quantity for accurate tax calculation, as customs may apply different rates based on value.

✅ Proactive Advice:

- Double-check the material of the flange to ensure the correct HS code is used.

- Review the product description and technical specifications to avoid misclassification.

- Plan ahead for the April 11, 2025 tariff increase to avoid unexpected costs.

- Consult with customs brokers or legal advisors if the product is part of a larger shipment or involves multiple materials.

Let me know if you need help with HS code selection or customs documentation!

Customer Reviews

No reviews yet.