| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400020 | Doc | 60.3% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Polyethylene Joints and related products, based on the provided HS codes and tax details:

📦 Product Classification Overview

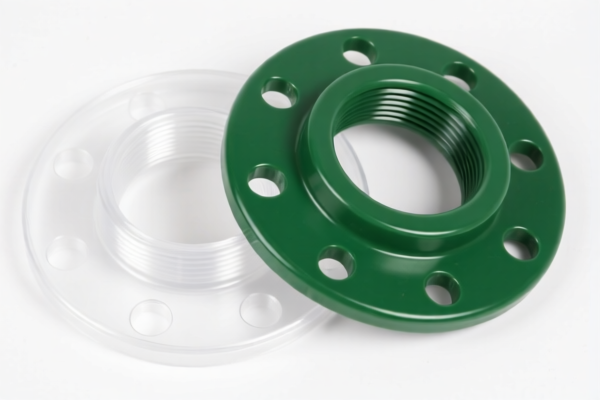

- Product Type: Polyethylene Joints (and related plastic joints)

- HS Code Format: 10-digit HS code (as per China's Harmonized System)

📊 Tariff Breakdown by HS Code

1. HS Code: 3917220000

Product: Polypropylene Joints

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is subject to the April 11 Special Tariff and additional tariffs.

2. HS Code: 3917400060

Product: Polyvinyl Chloride (PVC) Joints (various types)

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to multiple types of PVC joints (e.g., general PVC joints, pipe joints, drainage joints).

3. HS Code: 3917400095

Product: Polyvinyl Chloride (PVC) Pipe Joints

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to pipe joints made of PVC.

4. HS Code: 3917400020

Product: Polyvinyl Chloride (PVC) Drainage Pipe Joints

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to drainage pipe joints made of PVC.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff:

- Applies to all listed products.

-

This is a time-sensitive policy and will increase the total tax rate by 30.0% after April 11, 2025.

-

No Anti-Dumping Duties Mentioned:

-

No specific anti-dumping duties on iron or aluminum are listed for these products.

-

Material and Certification Requirements:

- Verify the material composition (e.g., polyethylene, polypropylene, PVC) to ensure correct HS code classification.

- Confirm if certifications (e.g., RoHS, REACH, or import permits) are required for customs clearance.

✅ Proactive Advice for Importers

- Double-check the product description to ensure it matches the HS code (e.g., "pipe joints" vs. "general joints").

- Review the material and structure of the joints (e.g., whether they are for drainage, general use, or specific piping systems).

- Keep updated records of the unit price and material specifications for customs documentation.

- Monitor the April 11, 2025 deadline to avoid unexpected tax increases.

Let me know if you need help with customs documentation templates or HS code verification tools. Here is the structured classification and tariff information for Polyethylene Joints and related products, based on the provided HS codes and tax details:

📦 Product Classification Overview

- Product Type: Polyethylene Joints (and related plastic joints)

- HS Code Format: 10-digit HS code (as per China's Harmonized System)

📊 Tariff Breakdown by HS Code

1. HS Code: 3917220000

Product: Polypropylene Joints

Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is subject to the April 11 Special Tariff and additional tariffs.

2. HS Code: 3917400060

Product: Polyvinyl Chloride (PVC) Joints (various types)

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to multiple types of PVC joints (e.g., general PVC joints, pipe joints, drainage joints).

3. HS Code: 3917400095

Product: Polyvinyl Chloride (PVC) Pipe Joints

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to pipe joints made of PVC.

4. HS Code: 3917400020

Product: Polyvinyl Chloride (PVC) Drainage Pipe Joints

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to drainage pipe joints made of PVC.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff:

- Applies to all listed products.

-

This is a time-sensitive policy and will increase the total tax rate by 30.0% after April 11, 2025.

-

No Anti-Dumping Duties Mentioned:

-

No specific anti-dumping duties on iron or aluminum are listed for these products.

-

Material and Certification Requirements:

- Verify the material composition (e.g., polyethylene, polypropylene, PVC) to ensure correct HS code classification.

- Confirm if certifications (e.g., RoHS, REACH, or import permits) are required for customs clearance.

✅ Proactive Advice for Importers

- Double-check the product description to ensure it matches the HS code (e.g., "pipe joints" vs. "general joints").

- Review the material and structure of the joints (e.g., whether they are for drainage, general use, or specific piping systems).

- Keep updated records of the unit price and material specifications for customs documentation.

- Monitor the April 11, 2025 deadline to avoid unexpected tax increases.

Let me know if you need help with customs documentation templates or HS code verification tools.

Customer Reviews

No reviews yet.