Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3901909000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3901205000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917400060 | Doc | 60.3% | CN | US | 2025-05-12 |

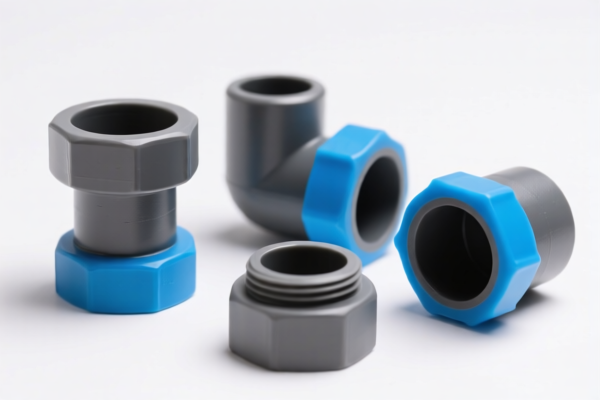

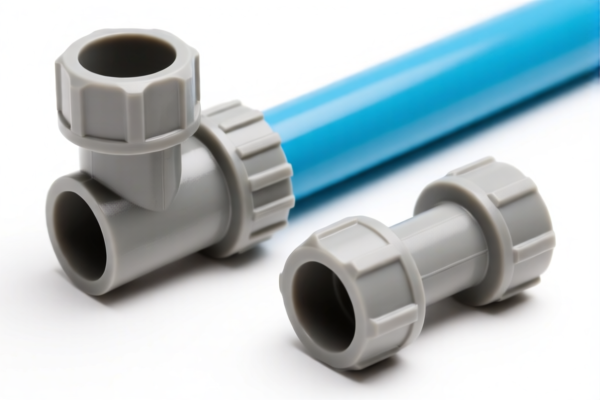

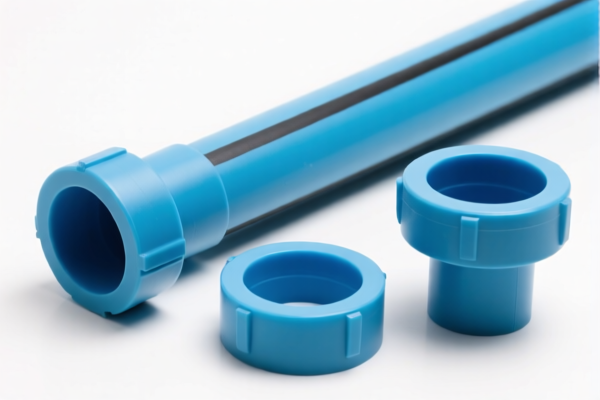

Product Classification: Polyethylene Pipe Fittings

HS CODEs and Tax Information Summary

Below is a structured breakdown of the HS codes and associated tariffs for polyethylene pipe fittings, based on your input:

✅ HS CODE: 3917400095

- Description: Polyethylene pipe fittings (plastic products)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This is the most commonly applicable code for general polyethylene pipe fittings.

- Ensure the product is not classified under other HS codes (e.g., 3901 or 3917210000) if it is a finished product, not raw material.

✅ HS CODE: 3901909000

- Description: Ethylene polymer products (polyethylene) – includes finished products like pipe fittings

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is for ethylene polymer products, which may include finished pipe fittings.

- Higher tax rate compared to 3917400095.

- Confirm the product is not a raw material (e.g., pellets or resins) to avoid misclassification.

✅ HS CODE: 3917210000

- Description: Valves and pipe fittings of polyethylene (ethylene polymer)

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Notes:

- This code is for valves and fittings made of polyethylene.

- Lower base tariff than other codes, but still subject to the same additional and special tariffs.

- Ensure the product is not a general pipe fitting (e.g., elbows, tees) unless it is specifically a valve.

✅ HS CODE: 3901205000

- Description: Polyethylene in primary form (e.g., pellets, resins) with density ≥ 0.94

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is for raw polyethylene material, not finished products.

- Not applicable for finished pipe fittings.

- Misclassification here could lead to customs penalties.

✅ HS CODE: 3917400060

- Description: Polyvinyl chloride (PVC) pipe fittings

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code is for PVC pipe fittings, not polyethylene.

- Ensure the product is not PVC to avoid misclassification.

- If the product is polyethylene, this code is not applicable.

📌 Proactive Advice for Importers

- Verify Material: Confirm whether the product is polyethylene or PVC to avoid misclassification.

- Check Unit Price: Higher tax rates may apply if the product is classified under 3901 or 3901909000.

- Certifications: Ensure compliance with any required technical standards or certifications (e.g., ISO, CE, etc.) for import.

- Tariff Changes: Be aware that additional tariffs will apply after April 11, 2025, and these are not negotiable.

- Consult Customs Broker: For complex classifications, seek professional advice to avoid delays or penalties.

Let me know if you need help with certification requirements or customs documentation for these products.

Product Classification: Polyethylene Pipe Fittings

HS CODEs and Tax Information Summary

Below is a structured breakdown of the HS codes and associated tariffs for polyethylene pipe fittings, based on your input:

✅ HS CODE: 3917400095

- Description: Polyethylene pipe fittings (plastic products)

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This is the most commonly applicable code for general polyethylene pipe fittings.

- Ensure the product is not classified under other HS codes (e.g., 3901 or 3917210000) if it is a finished product, not raw material.

✅ HS CODE: 3901909000

- Description: Ethylene polymer products (polyethylene) – includes finished products like pipe fittings

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is for ethylene polymer products, which may include finished pipe fittings.

- Higher tax rate compared to 3917400095.

- Confirm the product is not a raw material (e.g., pellets or resins) to avoid misclassification.

✅ HS CODE: 3917210000

- Description: Valves and pipe fittings of polyethylene (ethylene polymer)

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Notes:

- This code is for valves and fittings made of polyethylene.

- Lower base tariff than other codes, but still subject to the same additional and special tariffs.

- Ensure the product is not a general pipe fitting (e.g., elbows, tees) unless it is specifically a valve.

✅ HS CODE: 3901205000

- Description: Polyethylene in primary form (e.g., pellets, resins) with density ≥ 0.94

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is for raw polyethylene material, not finished products.

- Not applicable for finished pipe fittings.

- Misclassification here could lead to customs penalties.

✅ HS CODE: 3917400060

- Description: Polyvinyl chloride (PVC) pipe fittings

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code is for PVC pipe fittings, not polyethylene.

- Ensure the product is not PVC to avoid misclassification.

- If the product is polyethylene, this code is not applicable.

📌 Proactive Advice for Importers

- Verify Material: Confirm whether the product is polyethylene or PVC to avoid misclassification.

- Check Unit Price: Higher tax rates may apply if the product is classified under 3901 or 3901909000.

- Certifications: Ensure compliance with any required technical standards or certifications (e.g., ISO, CE, etc.) for import.

- Tariff Changes: Be aware that additional tariffs will apply after April 11, 2025, and these are not negotiable.

- Consult Customs Broker: For complex classifications, seek professional advice to avoid delays or penalties.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.