Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320020 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

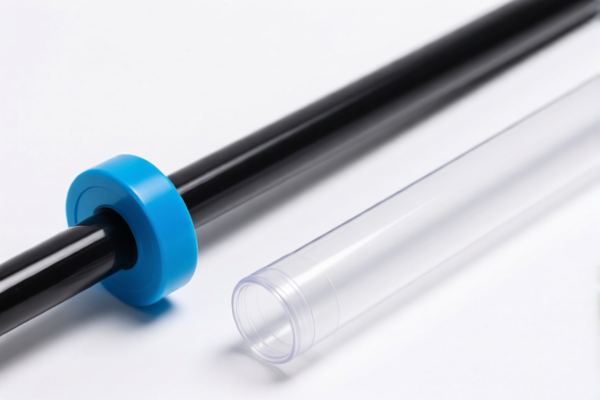

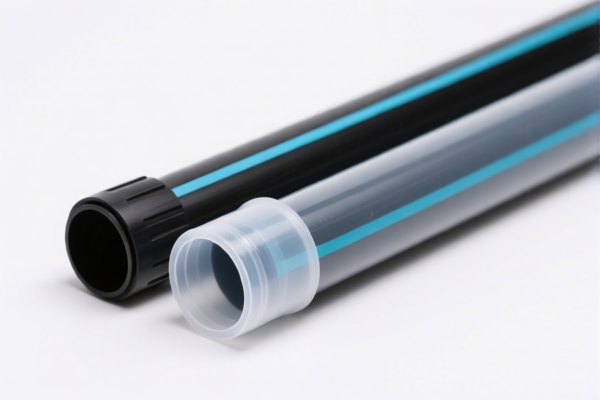

Product Classification: Polyethylene Plastic Agricultural Irrigation Tubes

HS CODEs and Tax Information Summary:

- HS CODE: 3917320020

- Description: Polyethylene agricultural irrigation tubes.

- Total Tax Rate: 58.1%

-

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3917210000

- Description: Polyethylene agricultural irrigation tubes.

- Total Tax Rate: 58.1%

-

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3917310000

- Description: Agricultural irrigation plastic tubes.

- Total Tax Rate: 58.1%

-

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3917220000

- Description: Polypropylene agricultural irrigation tubes.

- Total Tax Rate: 58.1%

-

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3917320050

- Description: Plastic irrigation tubes for farmland.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

- All listed HS codes have the same total tax rate of 58.1%, with the same breakdown of base, additional, and special tariffs.

- Special Tariff after April 11, 2025: A 30.0% additional tariff will apply after this date. Ensure your import timeline is planned accordingly.

- No anti-dumping duties on iron or aluminum are mentioned for these products, as they are plastic-based.

- Material and Certification Check: Confirm the exact material (e.g., polyethylene, polypropylene) and whether any certifications (e.g., ISO, CE, or local agricultural standards) are required for import compliance.

✅ Proactive Advice:

- Verify the exact material of the irrigation tubes (e.g., polyethylene vs. polypropylene) to ensure correct HS code classification.

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Review required documentation such as product specifications, certificates of origin, and compliance with local agricultural standards.

-

Monitor the April 11, 2025, deadline for the special tariff to avoid unexpected cost increases. Product Classification: Polyethylene Plastic Agricultural Irrigation Tubes

HS CODEs and Tax Information Summary: -

HS CODE: 3917320020

- Description: Polyethylene agricultural irrigation tubes.

- Total Tax Rate: 58.1%

-

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3917210000

- Description: Polyethylene agricultural irrigation tubes.

- Total Tax Rate: 58.1%

-

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3917310000

- Description: Agricultural irrigation plastic tubes.

- Total Tax Rate: 58.1%

-

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3917220000

- Description: Polypropylene agricultural irrigation tubes.

- Total Tax Rate: 58.1%

-

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3917320050

- Description: Plastic irrigation tubes for farmland.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

- All listed HS codes have the same total tax rate of 58.1%, with the same breakdown of base, additional, and special tariffs.

- Special Tariff after April 11, 2025: A 30.0% additional tariff will apply after this date. Ensure your import timeline is planned accordingly.

- No anti-dumping duties on iron or aluminum are mentioned for these products, as they are plastic-based.

- Material and Certification Check: Confirm the exact material (e.g., polyethylene, polypropylene) and whether any certifications (e.g., ISO, CE, or local agricultural standards) are required for import compliance.

✅ Proactive Advice:

- Verify the exact material of the irrigation tubes (e.g., polyethylene vs. polypropylene) to ensure correct HS code classification.

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Review required documentation such as product specifications, certificates of origin, and compliance with local agricultural standards.

- Monitor the April 11, 2025, deadline for the special tariff to avoid unexpected cost increases.

Customer Reviews

No reviews yet.