| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320020 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

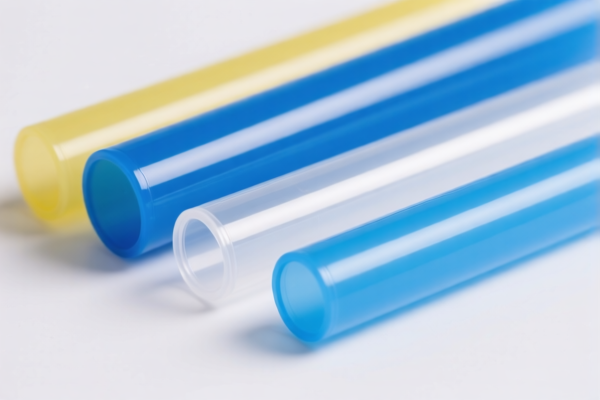

Here is the structured classification and tariff information for Polyethylene Plastic Drainage Tubes based on the provided HS codes:

🔍 HS CODE: 3917210000

Product Description: Polyethylene plastic tubes

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 3917320020

Product Description: Polyethylene plastic tubes

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 3917320050

Product Description: Polyethylene (PE) fittings

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 3917390050

Product Description: Plastic tubes and fittings

Total Tax Rate: 33.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 3917400050

Product Description: Non-pressure drainage/ventilation (DWV) piping system fittings

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are mentioned for polyethylene products in this context.

- Material and Certification: Ensure the product is indeed made of polyethylene (PE) and confirm the material composition and unit price for accurate classification.

- Certifications: Check if any customs or industry certifications are required for import (e.g., RoHS, REACH, or specific product standards).

✅ Proactive Advice:

- Confirm the exact product description and material to ensure correct HS code selection.

- Review the import date to determine if the April 11, 2025, tariff applies.

- Consult with a customs broker or trade compliance expert for real-time updates on tariff changes and documentation requirements. Here is the structured classification and tariff information for Polyethylene Plastic Drainage Tubes based on the provided HS codes:

🔍 HS CODE: 3917210000

Product Description: Polyethylene plastic tubes

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 3917320020

Product Description: Polyethylene plastic tubes

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 3917320050

Product Description: Polyethylene (PE) fittings

Total Tax Rate: 58.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 3917390050

Product Description: Plastic tubes and fittings

Total Tax Rate: 33.1%

Tariff Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 3917400050

Product Description: Non-pressure drainage/ventilation (DWV) piping system fittings

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are mentioned for polyethylene products in this context.

- Material and Certification: Ensure the product is indeed made of polyethylene (PE) and confirm the material composition and unit price for accurate classification.

- Certifications: Check if any customs or industry certifications are required for import (e.g., RoHS, REACH, or specific product standards).

✅ Proactive Advice:

- Confirm the exact product description and material to ensure correct HS code selection.

- Review the import date to determine if the April 11, 2025, tariff applies.

- Consult with a customs broker or trade compliance expert for real-time updates on tariff changes and documentation requirements.

Customer Reviews

No reviews yet.