| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

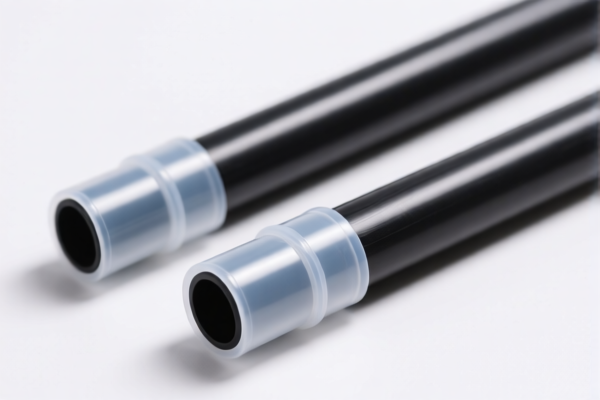

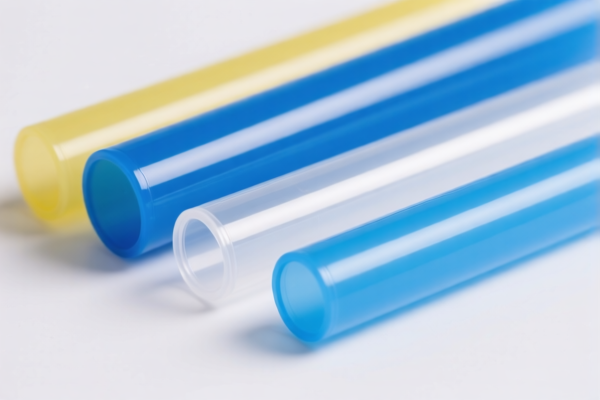

Product Name: Polyethylene Plastic Oil Delivery Tubes

Classification HS Code: 3917210000 (for all applicable descriptions)

🔍 HS Code and Classification Summary:

- HS Code: 3917210000

- Description: Polyethylene plastic tubes, pipes, or pipe fittings (including industrial or oil delivery tubes)

- Total Tax Rate: 58.1%

📊 Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Policy Alerts:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. This is a significant increase from the standard 25.0% additional tariff. -

Action Required: If your product will be imported after this date, you must factor in the higher tariff rate in your cost estimation.

-

No Anti-Dumping Duties Listed:

As of now, there are no specific anti-dumping duties reported for this HS code. However, always verify with the latest customs updates or consult a customs broker for confirmation.

📌 Proactive Advice for Importers:

-

Verify Material and Unit Price:

Ensure the product is indeed made of polyethylene and not a different polymer (e.g., PVC or HDPE), as this could affect classification. -

Check Required Certifications:

Confirm if any technical specifications, safety certifications, or environmental compliance documents are required for importation. -

Review Product Description:

The HS code 3917210000 applies to a wide range of polyethylene tubes, including industrial and oil delivery tubes. Ensure your product description aligns with the customs classification. -

Consult a Customs Broker:

For complex or high-value shipments, it is advisable to work with a customs broker to ensure accurate classification and compliance.

📋 Summary Table:

| Tax Component | Rate | Notes |

|---|---|---|

| Base Tariff | 3.1% | Standard rate |

| Additional Tariff | 25.0% | General additional tariff |

| April 11, 2025 Tariff | 30.0% | Applies after April 11, 2025 |

| Anti-Dumping Duty | N/A | No reported duties for this product |

If you have more details about the product (e.g., thickness, use, or origin), I can provide a more tailored analysis.

Product Name: Polyethylene Plastic Oil Delivery Tubes

Classification HS Code: 3917210000 (for all applicable descriptions)

🔍 HS Code and Classification Summary:

- HS Code: 3917210000

- Description: Polyethylene plastic tubes, pipes, or pipe fittings (including industrial or oil delivery tubes)

- Total Tax Rate: 58.1%

📊 Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Policy Alerts:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. This is a significant increase from the standard 25.0% additional tariff. -

Action Required: If your product will be imported after this date, you must factor in the higher tariff rate in your cost estimation.

-

No Anti-Dumping Duties Listed:

As of now, there are no specific anti-dumping duties reported for this HS code. However, always verify with the latest customs updates or consult a customs broker for confirmation.

📌 Proactive Advice for Importers:

-

Verify Material and Unit Price:

Ensure the product is indeed made of polyethylene and not a different polymer (e.g., PVC or HDPE), as this could affect classification. -

Check Required Certifications:

Confirm if any technical specifications, safety certifications, or environmental compliance documents are required for importation. -

Review Product Description:

The HS code 3917210000 applies to a wide range of polyethylene tubes, including industrial and oil delivery tubes. Ensure your product description aligns with the customs classification. -

Consult a Customs Broker:

For complex or high-value shipments, it is advisable to work with a customs broker to ensure accurate classification and compliance.

📋 Summary Table:

| Tax Component | Rate | Notes |

|---|---|---|

| Base Tariff | 3.1% | Standard rate |

| Additional Tariff | 25.0% | General additional tariff |

| April 11, 2025 Tariff | 30.0% | Applies after April 11, 2025 |

| Anti-Dumping Duty | N/A | No reported duties for this product |

If you have more details about the product (e.g., thickness, use, or origin), I can provide a more tailored analysis.

Customer Reviews

No reviews yet.