Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

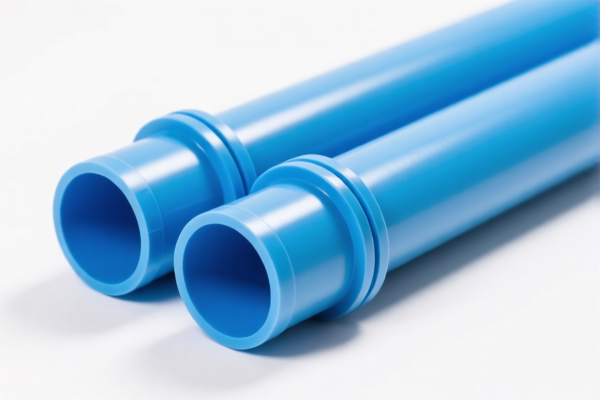

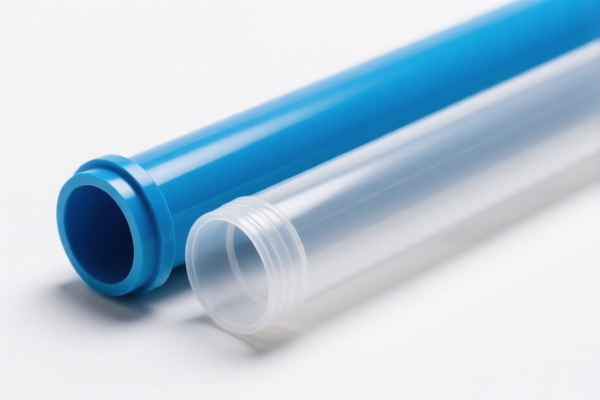

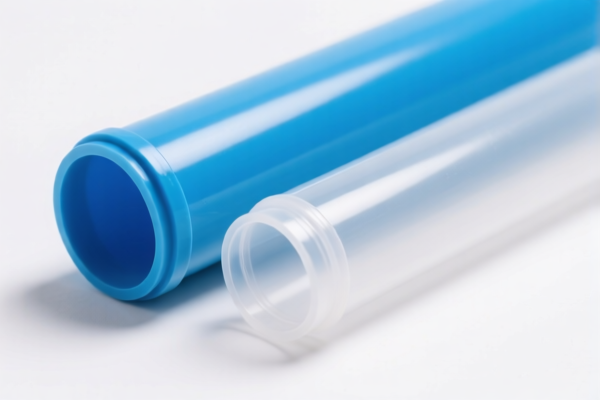

Product Classification: Polyethylene Plastic Pipelines

HS CODE: 3917210000

Here is the detailed breakdown of the customs classification and tariff information for polyethylene plastic pipelines:

- HS CODE: 3917210000

- Description: Polyethylene plastic pipelines, tubes, industrial pipes, and other industrial plastic tubes are classified under this code.

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff Imposed After April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

📌 Key Notes and Alerts:

- Time-sensitive Policy: The additional tariff of 30.0% applies after April 11, 2025. Ensure your import timeline aligns with this to avoid unexpected costs.

- No Anti-dumping duties are currently listed for this product category.

- No specific anti-dumping duties on iron or aluminum are applicable here, as this is a plastic product.

✅ Proactive Advice:

- Verify Material: Confirm that the product is indeed made of polyethylene and not a blend or composite material, which may fall under a different HS code.

- Check Unit Price: The total tax rate will affect the final cost, so ensure you understand the pricing structure and tax implications.

- Certifications Required: Depending on the end-use (e.g., industrial, construction), certain certifications (e.g., ISO, CE, or fire resistance) may be required for customs clearance.

- Consult a Customs Broker: For complex shipments or large volumes, it's advisable to work with a customs broker to ensure full compliance and avoid delays.

Let me know if you need help with further classification or documentation!

Product Classification: Polyethylene Plastic Pipelines

HS CODE: 3917210000

Here is the detailed breakdown of the customs classification and tariff information for polyethylene plastic pipelines:

- HS CODE: 3917210000

- Description: Polyethylene plastic pipelines, tubes, industrial pipes, and other industrial plastic tubes are classified under this code.

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff Imposed After April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

📌 Key Notes and Alerts:

- Time-sensitive Policy: The additional tariff of 30.0% applies after April 11, 2025. Ensure your import timeline aligns with this to avoid unexpected costs.

- No Anti-dumping duties are currently listed for this product category.

- No specific anti-dumping duties on iron or aluminum are applicable here, as this is a plastic product.

✅ Proactive Advice:

- Verify Material: Confirm that the product is indeed made of polyethylene and not a blend or composite material, which may fall under a different HS code.

- Check Unit Price: The total tax rate will affect the final cost, so ensure you understand the pricing structure and tax implications.

- Certifications Required: Depending on the end-use (e.g., industrial, construction), certain certifications (e.g., ISO, CE, or fire resistance) may be required for customs clearance.

- Consult a Customs Broker: For complex shipments or large volumes, it's advisable to work with a customs broker to ensure full compliance and avoid delays.

Let me know if you need help with further classification or documentation!

Customer Reviews

No reviews yet.