| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917320020 | Doc | 58.1% | CN | US | 2025-05-12 |

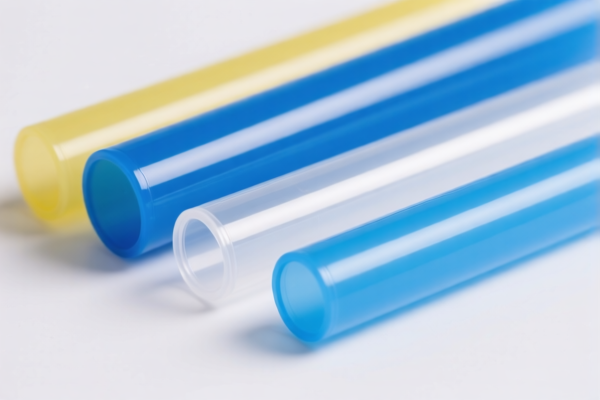

Product Classification: Polyethylene Plastic Water Tubes

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3901400000

- Description: Polyethylene Water Pipes

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for general polyethylene water pipes, not specifically for drinking water.

-

HS CODE: 3917210000

- Description: Polyethylene Plastic Pipes

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for general polyethylene plastic pipes, not necessarily for drinking water.

-

HS CODE: 3917390050

- Description: Plastic Water Pipes

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to general plastic water pipes, with no additional tariffs currently in effect.

-

HS CODE: 3917400050

- Description: Plastic Water Pipes

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code may apply to specific types of plastic water pipes, possibly with higher base tariffs.

-

HS CODE: 3917320020

- Description: Polyethylene Drinking Water Pipes

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for polyethylene pipes used for drinking water, which may require additional certifications.

Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning. -

Material and Certification Requirements:

- If the product is intended for drinking water, ensure it meets relevant safety and certification standards (e.g., food-grade or potable water compliance).

-

Verify the material composition (e.g., whether it is 100% polyethylene or mixed with other materials) to ensure correct classification.

-

Unit Price and Tax Calculation:

- The total tax rate is calculated as:

Total Tax = Base Tariff + Additional Tariff + Special Tariff (if applicable) -

For example, for HS CODE 3901400000:

6.5% + 25.0% + 30.0% = 61.5% -

Anti-Dumping Duties:

- No specific anti-dumping duties are mentioned for polyethylene water tubes in the provided data. However, always check for any ongoing investigations or duties related to the product category.

Proactive Advice:

- Confirm the exact product description and intended use (e.g., for drinking water or general use) to ensure the correct HS code is applied.

- Check with customs or a compliance expert if the product includes additives or coatings that may affect classification.

-

Keep updated records of material specifications and certifications to avoid delays in customs clearance. Product Classification: Polyethylene Plastic Water Tubes

HS CODEs and Tax Details (April 2025 Update): -

HS CODE: 3901400000

- Description: Polyethylene Water Pipes

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for general polyethylene water pipes, not specifically for drinking water.

-

HS CODE: 3917210000

- Description: Polyethylene Plastic Pipes

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for general polyethylene plastic pipes, not necessarily for drinking water.

-

HS CODE: 3917390050

- Description: Plastic Water Pipes

- Total Tax Rate: 33.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to general plastic water pipes, with no additional tariffs currently in effect.

-

HS CODE: 3917400050

- Description: Plastic Water Pipes

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code may apply to specific types of plastic water pipes, possibly with higher base tariffs.

-

HS CODE: 3917320020

- Description: Polyethylene Drinking Water Pipes

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for polyethylene pipes used for drinking water, which may require additional certifications.

Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning. -

Material and Certification Requirements:

- If the product is intended for drinking water, ensure it meets relevant safety and certification standards (e.g., food-grade or potable water compliance).

-

Verify the material composition (e.g., whether it is 100% polyethylene or mixed with other materials) to ensure correct classification.

-

Unit Price and Tax Calculation:

- The total tax rate is calculated as:

Total Tax = Base Tariff + Additional Tariff + Special Tariff (if applicable) -

For example, for HS CODE 3901400000:

6.5% + 25.0% + 30.0% = 61.5% -

Anti-Dumping Duties:

- No specific anti-dumping duties are mentioned for polyethylene water tubes in the provided data. However, always check for any ongoing investigations or duties related to the product category.

Proactive Advice:

- Confirm the exact product description and intended use (e.g., for drinking water or general use) to ensure the correct HS code is applied.

- Check with customs or a compliance expert if the product includes additives or coatings that may affect classification.

- Keep updated records of material specifications and certifications to avoid delays in customs clearance.

Customer Reviews

No reviews yet.