Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901909000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901101000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921190010 | Doc | 61.5% | CN | US | 2025-05-12 |

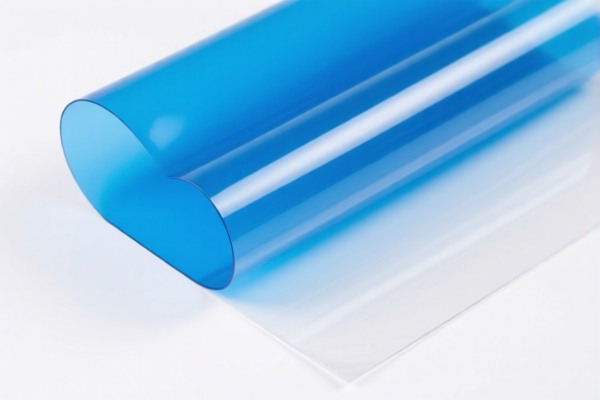

Product Name: Polyethylene Polymer Composite Foils

Classification HS Codes and Tax Information:

✅ HS CODE: 3901400000

- Description: Polyethylene composite film falls under this code as it is a primary form of polyethylene polymer product, and the specific gravity is not explicitly stated to be greater than 0.94.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is in its primary form and not further processed.

✅ HS CODE: 3901909000

- Description: This code applies to products made from ethylene polymers (including polyethylene), and the product fits within the scope of HS codes starting with 3901.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for other ethylene polymer products not specifically listed elsewhere.

✅ HS CODE: 3901101000

- Description: This code applies to polyethylene composite films as they are considered products of ethylene polymers, fitting the description of Chapter 3901.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyethylene in its primary form, including composite films.

✅ HS CODE: 3920991000

- Description: This code applies to "polyethylene composite film" as it fits the description of "other plastics" under Chapter 3920, which includes films, sheets, and foils.

- Total Tax Rate: 61.0%

- Tax Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is a composite film made of polyethylene and not further processed.

✅ HS CODE: 3921190010

- Description: This code applies to "polyethylene composite material film" as it fits the description of "honeycomb plastic sheets, films, foils, and strips" under Chapter 3921.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for composite films with a specific structure (e.g., honeycomb).

📌 Important Notes and Recommendations:

- Tariff Changes After April 11, 2025: All listed codes will be subject to an additional 30% tariff. Ensure your import timeline accounts for this.

- Material Verification: Confirm the exact composition and structure of the composite film (e.g., whether it is a honeycomb structure or a simple composite).

- Certifications Required: Check if any certifications (e.g., RoHS, REACH, or customs documentation) are required for import.

- Unit Price and Classification: Verify the unit price and ensure the product is correctly classified to avoid misclassification penalties.

Pro Tip: If the product is used in specific industries (e.g., electronics, packaging), additional regulations or preferential tariffs may apply. Always consult with a customs broker or legal expert for final confirmation.

Product Name: Polyethylene Polymer Composite Foils

Classification HS Codes and Tax Information:

✅ HS CODE: 3901400000

- Description: Polyethylene composite film falls under this code as it is a primary form of polyethylene polymer product, and the specific gravity is not explicitly stated to be greater than 0.94.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is in its primary form and not further processed.

✅ HS CODE: 3901909000

- Description: This code applies to products made from ethylene polymers (including polyethylene), and the product fits within the scope of HS codes starting with 3901.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for other ethylene polymer products not specifically listed elsewhere.

✅ HS CODE: 3901101000

- Description: This code applies to polyethylene composite films as they are considered products of ethylene polymers, fitting the description of Chapter 3901.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyethylene in its primary form, including composite films.

✅ HS CODE: 3920991000

- Description: This code applies to "polyethylene composite film" as it fits the description of "other plastics" under Chapter 3920, which includes films, sheets, and foils.

- Total Tax Rate: 61.0%

- Tax Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable if the product is a composite film made of polyethylene and not further processed.

✅ HS CODE: 3921190010

- Description: This code applies to "polyethylene composite material film" as it fits the description of "honeycomb plastic sheets, films, foils, and strips" under Chapter 3921.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for composite films with a specific structure (e.g., honeycomb).

📌 Important Notes and Recommendations:

- Tariff Changes After April 11, 2025: All listed codes will be subject to an additional 30% tariff. Ensure your import timeline accounts for this.

- Material Verification: Confirm the exact composition and structure of the composite film (e.g., whether it is a honeycomb structure or a simple composite).

- Certifications Required: Check if any certifications (e.g., RoHS, REACH, or customs documentation) are required for import.

- Unit Price and Classification: Verify the unit price and ensure the product is correctly classified to avoid misclassification penalties.

Pro Tip: If the product is used in specific industries (e.g., electronics, packaging), additional regulations or preferential tariffs may apply. Always consult with a customs broker or legal expert for final confirmation.

Customer Reviews

No reviews yet.