| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

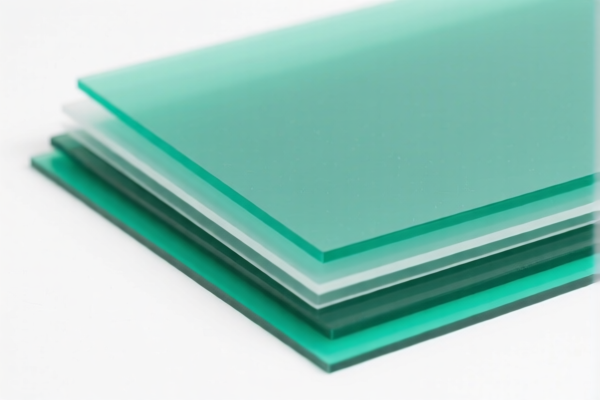

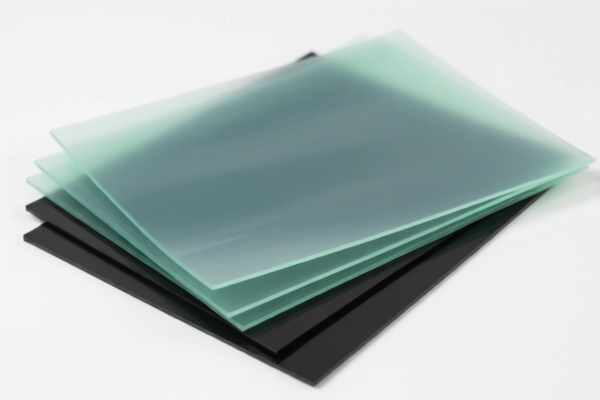

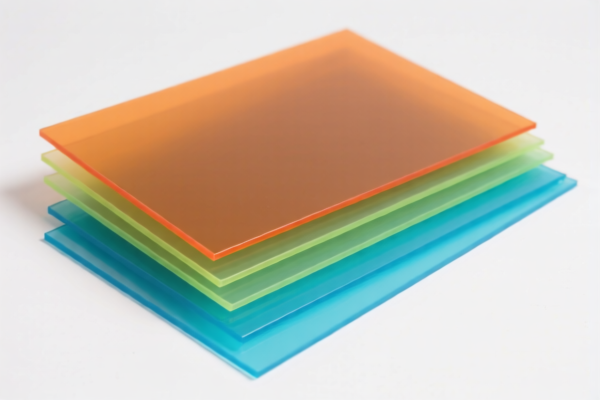

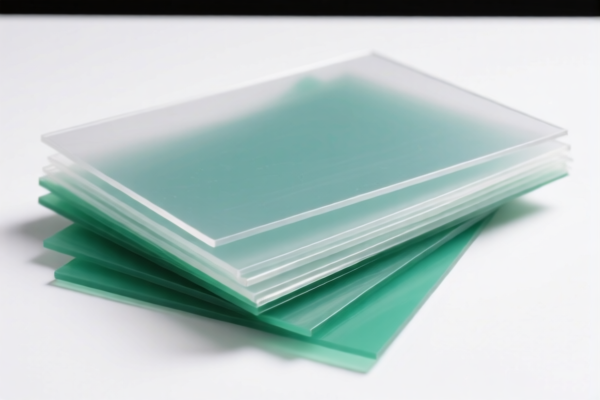

Product Name: Polyethylene Polymer Composite Material Sheets

Classification HS Codes and Tax Details:

✅ HS CODE: 3920100000

Description: Applicable to polyethylene composite material sheets that meet the description of "ethylene polymers" and "laminated, supported, or combined in a similar manner with other materials."

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is suitable for polyethylene-based composite sheets with layered or combined structures.

- Ensure the product is clearly identified as polyethylene-based and not mixed with other polymer types.

✅ HS CODE: 3920991000

Description: Applicable to polyethylene composite material sheets that fall under the category of "other plastics" and have a "laminated, supported, or combined in a similar manner with other materials" structure.

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Key Notes:

- This code is for composite sheets made from other plastics (not polyethylene) with layered or combined structures.

- Confirm the material composition to avoid misclassification.

✅ HS CODE: 3921902550

Description: Applicable to plastic composite sheets containing textile materials (e.g., polyester fiber), provided the weight does not exceed 1.492 kg/m².

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- Verify the weight per square meter of the composite sheet.

- If the weight exceeds 1.492 kg/m², this code may not apply.

- Ensure the textile content is clearly documented.

✅ HS CODE: 3920690000

Description: Applicable to polyester composite boards that are non-cellular and non-reinforced, and combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for non-reinforced, non-cellular polyester composite boards.

- Confirm the material is not reinforced with fibers or other additives.

✅ HS CODE: 3920631000

Description: Applicable to polycarbonate composite boards that are "laminated or combined in a similar manner with other materials."

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for polycarbonate-based composite boards with layered or combined structures.

- Ensure the product is not misclassified as polyethylene or other polymer types.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact polymer type (e.g., polyethylene, polycarbonate, polyester) and whether it is combined with other materials (e.g., textile, metal, etc.).

- Check Weight Limits: For codes like 3921902550, ensure the weight per square meter is within the specified limit.

- Document Certifications: Some codes may require specific certifications or documentation (e.g., material composition reports, weight measurements).

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes. Ensure compliance with updated regulations.

- Consult Customs Authority: For complex or borderline cases, seek clarification from local customs or a customs broker.

Let me know if you need help with a specific product or documentation.

Product Name: Polyethylene Polymer Composite Material Sheets

Classification HS Codes and Tax Details:

✅ HS CODE: 3920100000

Description: Applicable to polyethylene composite material sheets that meet the description of "ethylene polymers" and "laminated, supported, or combined in a similar manner with other materials."

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is suitable for polyethylene-based composite sheets with layered or combined structures.

- Ensure the product is clearly identified as polyethylene-based and not mixed with other polymer types.

✅ HS CODE: 3920991000

Description: Applicable to polyethylene composite material sheets that fall under the category of "other plastics" and have a "laminated, supported, or combined in a similar manner with other materials" structure.

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Key Notes:

- This code is for composite sheets made from other plastics (not polyethylene) with layered or combined structures.

- Confirm the material composition to avoid misclassification.

✅ HS CODE: 3921902550

Description: Applicable to plastic composite sheets containing textile materials (e.g., polyester fiber), provided the weight does not exceed 1.492 kg/m².

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- Verify the weight per square meter of the composite sheet.

- If the weight exceeds 1.492 kg/m², this code may not apply.

- Ensure the textile content is clearly documented.

✅ HS CODE: 3920690000

Description: Applicable to polyester composite boards that are non-cellular and non-reinforced, and combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for non-reinforced, non-cellular polyester composite boards.

- Confirm the material is not reinforced with fibers or other additives.

✅ HS CODE: 3920631000

Description: Applicable to polycarbonate composite boards that are "laminated or combined in a similar manner with other materials."

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This code is for polycarbonate-based composite boards with layered or combined structures.

- Ensure the product is not misclassified as polyethylene or other polymer types.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact polymer type (e.g., polyethylene, polycarbonate, polyester) and whether it is combined with other materials (e.g., textile, metal, etc.).

- Check Weight Limits: For codes like 3921902550, ensure the weight per square meter is within the specified limit.

- Document Certifications: Some codes may require specific certifications or documentation (e.g., material composition reports, weight measurements).

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all listed codes. Ensure compliance with updated regulations.

- Consult Customs Authority: For complex or borderline cases, seek clarification from local customs or a customs broker.

Let me know if you need help with a specific product or documentation.

Customer Reviews

No reviews yet.