| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

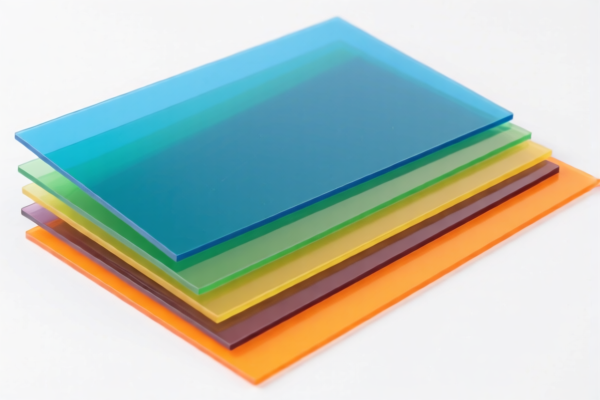

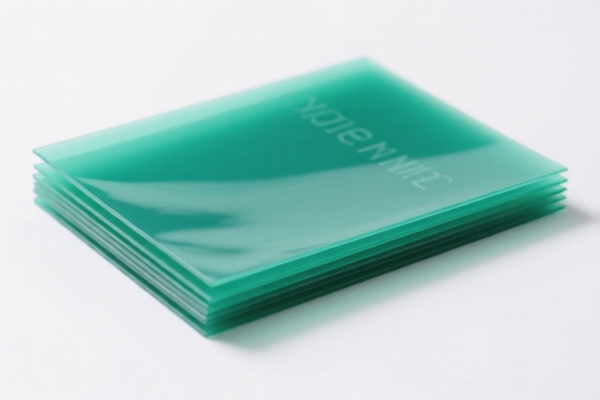

Product Name: Polyethylene Polymer Composite Sheets

Classification HS Code: 3920100000, 3920991000, 3920690000, 3920631000, 3920610000

🔍 HS Code Classification Overview

Below are the HS codes and corresponding tariff details for polyethylene polymer composite sheets:

✅ HS Code: 3920100000

Description: Plastic products of polyethylene polymer laminated or combined with other materials in a similar manner.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for polyethylene composite sheets.

✅ HS Code: 3920991000

Description: Other plastic products laminated or combined with other materials in a similar manner.

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to other types of composite plastic sheets, not specifically polyethylene.

✅ HS Code: 3920690000

Description: Non-cellular and non-reinforced plastic sheets combined with other materials.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyester composite sheets, not polyethylene.

✅ HS Code: 3920631000

Description: Plastic sheets laminated or combined with other materials in a similar manner.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polycarbonate composite sheets.

✅ HS Code: 3920610000

Description: Non-cellular and non-reinforced plastic sheets laminated or combined with other materials.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polycarbonate composite sheets that are non-cellular and non-reinforced.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Anti-dumping duties: Not applicable for these products (no mention of anti-dumping duties on iron or aluminum).

- Material Verification: Confirm the exact composition of the composite sheets (e.g., polyethylene, polycarbonate, polyester) to ensure correct HS code classification.

- Certifications: Check if any customs or industry certifications are required for import (e.g., RoHS, REACH, or specific product standards).

- Unit Price: Verify the unit price and quantity for accurate tax calculation, as customs may apply different rates based on value.

📌 Proactive Advice

- Double-check the material composition of the composite sheets to avoid misclassification.

- Consult a customs broker or HS code expert if the product contains multiple layers or mixed materials.

- Keep documentation (e.g., product specifications, invoices, and certificates) ready for customs inspection.

Let me know if you need help with certification requirements or import documentation for these products.

Product Name: Polyethylene Polymer Composite Sheets

Classification HS Code: 3920100000, 3920991000, 3920690000, 3920631000, 3920610000

🔍 HS Code Classification Overview

Below are the HS codes and corresponding tariff details for polyethylene polymer composite sheets:

✅ HS Code: 3920100000

Description: Plastic products of polyethylene polymer laminated or combined with other materials in a similar manner.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for polyethylene composite sheets.

✅ HS Code: 3920991000

Description: Other plastic products laminated or combined with other materials in a similar manner.

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to other types of composite plastic sheets, not specifically polyethylene.

✅ HS Code: 3920690000

Description: Non-cellular and non-reinforced plastic sheets combined with other materials.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyester composite sheets, not polyethylene.

✅ HS Code: 3920631000

Description: Plastic sheets laminated or combined with other materials in a similar manner.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polycarbonate composite sheets.

✅ HS Code: 3920610000

Description: Non-cellular and non-reinforced plastic sheets laminated or combined with other materials.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polycarbonate composite sheets that are non-cellular and non-reinforced.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Anti-dumping duties: Not applicable for these products (no mention of anti-dumping duties on iron or aluminum).

- Material Verification: Confirm the exact composition of the composite sheets (e.g., polyethylene, polycarbonate, polyester) to ensure correct HS code classification.

- Certifications: Check if any customs or industry certifications are required for import (e.g., RoHS, REACH, or specific product standards).

- Unit Price: Verify the unit price and quantity for accurate tax calculation, as customs may apply different rates based on value.

📌 Proactive Advice

- Double-check the material composition of the composite sheets to avoid misclassification.

- Consult a customs broker or HS code expert if the product contains multiple layers or mixed materials.

- Keep documentation (e.g., product specifications, invoices, and certificates) ready for customs inspection.

Let me know if you need help with certification requirements or import documentation for these products.

Customer Reviews

No reviews yet.