| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921190010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3923210080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

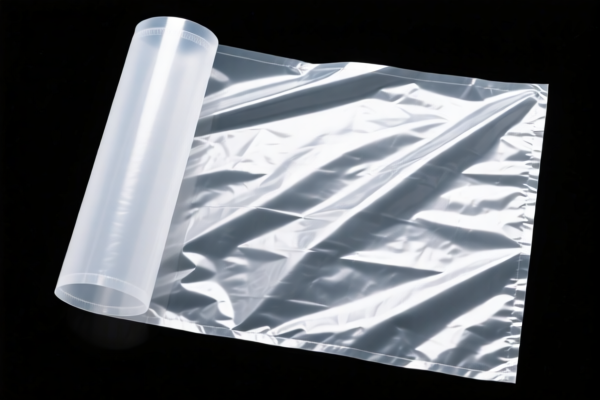

Here is the structured classification and tariff information for the Polyethylene Polymer Plastic Anti-Fog Films based on the provided HS codes and tax details:

✅ HS CODE: 3921190010

Product Name: 聚乙烯防雾微孔薄膜 (Polyethylene Anti-Fog Microporous Film)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code is specific to microporous films made of polyethylene with anti-fog properties.

- Ensure the product is not classified under a more specific code (e.g., 3921190010 is more specific than 3921190090).

✅ HS CODE: 3920992000

Product Name: 防雾塑料薄膜 (Anti-Fog Plastic Film)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This is a general category for anti-fog plastic films, not specifically polyethylene.

- If the product is polyethylene-based, consider checking if a more specific code (like 3921190010) applies.

✅ HS CODE: 3902900010

Product Name: 聚丁烯树脂防雾剂 (Polybutene Resin Anti-Fog Agent)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code is for anti-fog agents, not films or membranes.

- If the product is a film or membrane, this code is not applicable.

✅ HS CODE: 3923210080

Product Name: 聚乙烯塑料防尘袋 (Polyethylene Plastic Dust Bag)

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.0%

- Key Notes:

- This is for dust bags, not anti-fog films.

- If the product is anti-fog, this code is not applicable.

✅ HS CODE: 3920100000

Product Name: 聚乙烯保护膜 (Polyethylene Protective Film)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This is for protective films, not specifically anti-fog.

- If the product is anti-fog, check if it can be classified under 3921190010.

📌 Proactive Advice for Importers:

- Verify the product's exact composition and function (e.g., is it a film, membrane, or agent? Is it anti-fog or protective?).

- Check the unit price and material composition to ensure the correct HS code is applied.

- Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Be aware of the April 11, 2025, tariff increase and plan accordingly for cost management.

- Consult a customs broker or classification expert if the product is borderline between categories.

Let me know if you need help with a specific product description or customs documentation. Here is the structured classification and tariff information for the Polyethylene Polymer Plastic Anti-Fog Films based on the provided HS codes and tax details:

✅ HS CODE: 3921190010

Product Name: 聚乙烯防雾微孔薄膜 (Polyethylene Anti-Fog Microporous Film)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code is specific to microporous films made of polyethylene with anti-fog properties.

- Ensure the product is not classified under a more specific code (e.g., 3921190010 is more specific than 3921190090).

✅ HS CODE: 3920992000

Product Name: 防雾塑料薄膜 (Anti-Fog Plastic Film)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This is a general category for anti-fog plastic films, not specifically polyethylene.

- If the product is polyethylene-based, consider checking if a more specific code (like 3921190010) applies.

✅ HS CODE: 3902900010

Product Name: 聚丁烯树脂防雾剂 (Polybutene Resin Anti-Fog Agent)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Key Notes:

- This code is for anti-fog agents, not films or membranes.

- If the product is a film or membrane, this code is not applicable.

✅ HS CODE: 3923210080

Product Name: 聚乙烯塑料防尘袋 (Polyethylene Plastic Dust Bag)

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.0%

- Key Notes:

- This is for dust bags, not anti-fog films.

- If the product is anti-fog, this code is not applicable.

✅ HS CODE: 3920100000

Product Name: 聚乙烯保护膜 (Polyethylene Protective Film)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Key Notes:

- This is for protective films, not specifically anti-fog.

- If the product is anti-fog, check if it can be classified under 3921190010.

📌 Proactive Advice for Importers:

- Verify the product's exact composition and function (e.g., is it a film, membrane, or agent? Is it anti-fog or protective?).

- Check the unit price and material composition to ensure the correct HS code is applied.

- Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Be aware of the April 11, 2025, tariff increase and plan accordingly for cost management.

- Consult a customs broker or classification expert if the product is borderline between categories.

Let me know if you need help with a specific product description or customs documentation.

Customer Reviews

No reviews yet.