| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3923210095 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3812399000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 9403994010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

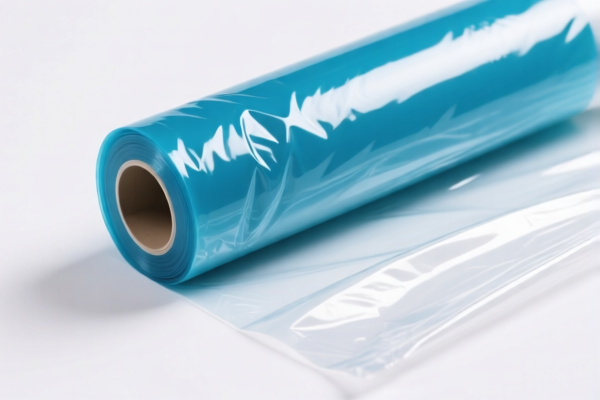

Product Classification and Customs Tariff Analysis for "Polyethylene Polymer Plastic Anti Mildew Films"

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product:

✅ HS CODE: 3920992000

Product Description: Plastic Anti-Mildew Film

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes: This code is for general-purpose plastic anti-mildew films. Ensure the product is not classified under a more specific category.

✅ HS CODE: 3923210095

Product Description: Polyethylene Anti-Mildew Bags

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.0%

- Notes: This code applies to polyethylene bags with anti-mildew properties. Confirm the product is not a composite or multi-layered item.

✅ HS CODE: 3812399000

Product Description: Plastic Anti-Mildew Agents

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.0%

- Notes: This code is for chemical agents used to prevent mildew in plastics. Ensure the product is not classified as a pesticide or chemical additive.

✅ HS CODE: 9403994010

Product Description: Plastic Anti-Mildew Fence Panels

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This code applies to plastic fence panels with anti-mildew properties. Verify that the product is not classified under a different category like "furniture" or "construction materials."

✅ HS CODE: 3901400000

Product Description: Polyethylene Anti-Leakage Membrane

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for polyethylene membranes used for waterproofing. Ensure the product is not used for agricultural or industrial purposes, which may fall under different classifications.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above products are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy—plan your import schedule accordingly.

- Material Verification: Confirm the exact composition and structure of the product (e.g., single-layer vs. multi-layer, whether it contains additives or is a chemical agent).

- Certifications Required: Some products may require specific certifications (e.g., environmental, safety, or chemical compliance) depending on the end use.

- Unit Price and Classification: The final HS code may vary based on the unit price and product description. Always double-check with customs or a classification expert if in doubt.

Let me know if you need help with customs documentation or classification confirmation. Product Classification and Customs Tariff Analysis for "Polyethylene Polymer Plastic Anti Mildew Films"

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product:

✅ HS CODE: 3920992000

Product Description: Plastic Anti-Mildew Film

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes: This code is for general-purpose plastic anti-mildew films. Ensure the product is not classified under a more specific category.

✅ HS CODE: 3923210095

Product Description: Polyethylene Anti-Mildew Bags

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.0%

- Notes: This code applies to polyethylene bags with anti-mildew properties. Confirm the product is not a composite or multi-layered item.

✅ HS CODE: 3812399000

Product Description: Plastic Anti-Mildew Agents

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.0%

- Notes: This code is for chemical agents used to prevent mildew in plastics. Ensure the product is not classified as a pesticide or chemical additive.

✅ HS CODE: 9403994010

Product Description: Plastic Anti-Mildew Fence Panels

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This code applies to plastic fence panels with anti-mildew properties. Verify that the product is not classified under a different category like "furniture" or "construction materials."

✅ HS CODE: 3901400000

Product Description: Polyethylene Anti-Leakage Membrane

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for polyethylene membranes used for waterproofing. Ensure the product is not used for agricultural or industrial purposes, which may fall under different classifications.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above products are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy—plan your import schedule accordingly.

- Material Verification: Confirm the exact composition and structure of the product (e.g., single-layer vs. multi-layer, whether it contains additives or is a chemical agent).

- Certifications Required: Some products may require specific certifications (e.g., environmental, safety, or chemical compliance) depending on the end use.

- Unit Price and Classification: The final HS code may vary based on the unit price and product description. Always double-check with customs or a classification expert if in doubt.

Let me know if you need help with customs documentation or classification confirmation.

Customer Reviews

No reviews yet.