| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920200055 | Doc | 59.2% | CN | US | 2025-05-12 |

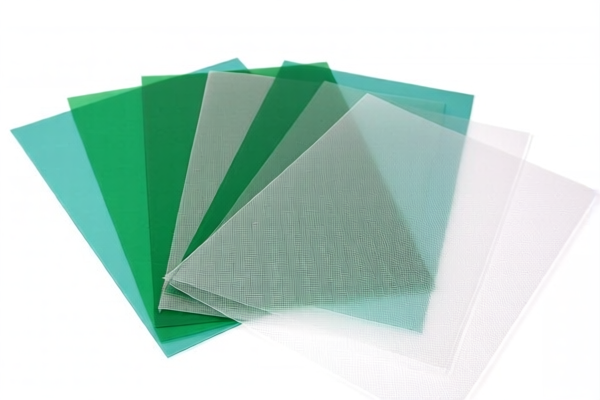

Product Classification and Customs Tariff Analysis for "Polyethylene Polymer Plastic Anti UV Sheets"

✅ HS CODE: 3920995000

Product Description: Plastic UV-resistant sheets

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is the most commonly applicable code for general plastic UV-resistant sheets.

- High total tax rate due to the combination of base and additional tariffs.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 3920690000

Product Description: Polyester UV-resistant sheets

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Slightly lower base tariff compared to 3920995000.

- Same additional and special tariffs as above.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 3921905050

Product Description: Plastic UV-resistant sheets (general)

Total Tax Rate: 34.8%

Tax Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Lower total tax rate due to no additional tariff.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

- This code may be more favorable for cost-sensitive imports.

✅ HS CODE: 3920632000

Product Description: Polycarbonate UV-resistant sheets

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Similar to 3920995000, with the same high tax rate.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 3920200055

Product Description: Propylene plastic UV-resistant sheets

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Slightly lower base tariff than 3920995000.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the product is made of polyethylene, polycarbonate, polyester, or propylene, as this will determine the correct HS code.

- Check Unit Price and Certification: Some HS codes may require specific certifications (e.g., UV resistance testing reports) to qualify for classification.

- Monitor Tariff Changes: The 30.0% special tariff after April 11, 2025, will significantly increase costs. Consider adjusting import timelines or seeking duty relief options.

- Consult Customs Broker: For complex classifications, a customs broker can help ensure accurate HS code selection and compliance.

Let me know if you need help determining the most suitable HS code for your specific product. Product Classification and Customs Tariff Analysis for "Polyethylene Polymer Plastic Anti UV Sheets"

✅ HS CODE: 3920995000

Product Description: Plastic UV-resistant sheets

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is the most commonly applicable code for general plastic UV-resistant sheets.

- High total tax rate due to the combination of base and additional tariffs.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 3920690000

Product Description: Polyester UV-resistant sheets

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Slightly lower base tariff compared to 3920995000.

- Same additional and special tariffs as above.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 3921905050

Product Description: Plastic UV-resistant sheets (general)

Total Tax Rate: 34.8%

Tax Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Lower total tax rate due to no additional tariff.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

- This code may be more favorable for cost-sensitive imports.

✅ HS CODE: 3920632000

Product Description: Polycarbonate UV-resistant sheets

Total Tax Rate: 60.8%

Tax Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Similar to 3920995000, with the same high tax rate.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 3920200055

Product Description: Propylene plastic UV-resistant sheets

Total Tax Rate: 59.2%

Tax Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Slightly lower base tariff than 3920995000.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm whether the product is made of polyethylene, polycarbonate, polyester, or propylene, as this will determine the correct HS code.

- Check Unit Price and Certification: Some HS codes may require specific certifications (e.g., UV resistance testing reports) to qualify for classification.

- Monitor Tariff Changes: The 30.0% special tariff after April 11, 2025, will significantly increase costs. Consider adjusting import timelines or seeking duty relief options.

- Consult Customs Broker: For complex classifications, a customs broker can help ensure accurate HS code selection and compliance.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.