Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 6305330040 | Doc | 45.9% | CN | US | 2025-05-12 |

| 3923210095 | Doc | 58.0% | CN | US | 2025-05-12 |

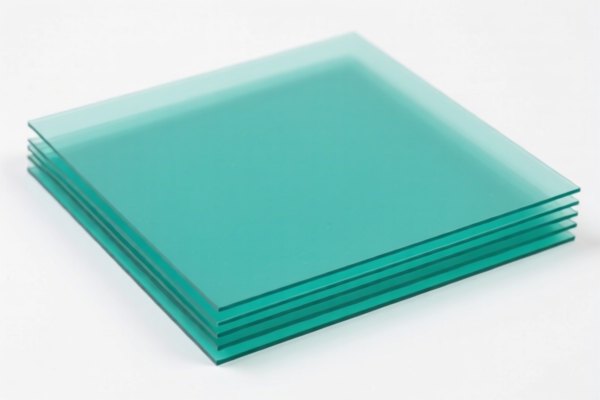

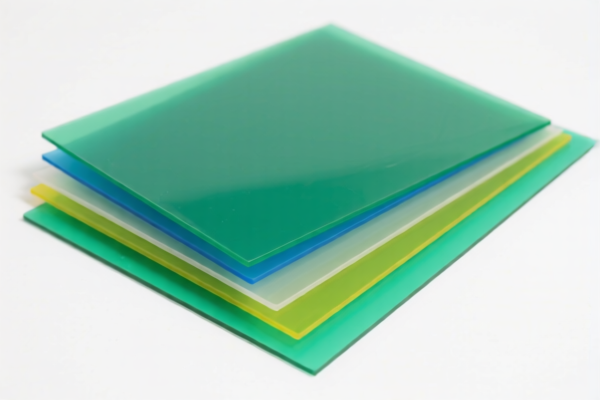

Product Classification: Polyethylene Polymer Plastic Composite Sheets for Packaging

Below is the detailed HS code classification and tariff information for your product:

✅ HS CODE: 3920100000

- Description: Polyethylene polymer plastic composite sheets for packaging.

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes: This is a commonly used code for general-purpose plastic composite sheets.

✅ HS CODE: 3920991000

- Description: Polyethylene polymer plastic composite sheets for packaging.

- Total Tax Rate: 61.0%

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes: This code is for other plastic composite sheets not specifically covered under 3920100000.

✅ HS CODE: 3921904010

- Description: Polyethylene polymer plastic composite sheets for packaging.

- Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes: This code may apply to specific types of composite sheets with different material compositions.

✅ HS CODE: 6305330040

- Description: Polyethylene polymer plastic composite sheets for packaging.

- Total Tax Rate: 45.9%

- Base Tariff Rate: 8.4%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes: This code is for textile articles or products of plastic, which may be used for packaging but are not strictly polymer sheets.

✅ HS CODE: 3923210095

- Description: Polyethylene polymer plastic composite sheets for packaging.

- Total Tax Rate: 58.0%

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes: This code may apply to specific types of plastic sheets with special additives or coatings.

⚠️ Important Reminders:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- Material Verification: Confirm the exact composition and structure of the composite sheets (e.g., whether it contains other polymers or additives) to ensure correct classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific packaging regulations) are required for import into your destination country.

- Unit Price: Be aware that the total tax rate is applied to the FOB or CIF value, so ensure accurate pricing and documentation.

📌 Proactive Advice:

- Consult a customs broker or classification expert if the product contains multiple materials or is used for specialized packaging.

- Keep updated records of product specifications and HS code classifications to avoid delays at customs.

- Monitor policy changes related to the April 11, 2025 tariff and any potential anti-dumping duties (if applicable).

Let me know if you need help with a specific HS code or customs documentation. Product Classification: Polyethylene Polymer Plastic Composite Sheets for Packaging

Below is the detailed HS code classification and tariff information for your product:

✅ HS CODE: 3920100000

- Description: Polyethylene polymer plastic composite sheets for packaging.

- Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes: This is a commonly used code for general-purpose plastic composite sheets.

✅ HS CODE: 3920991000

- Description: Polyethylene polymer plastic composite sheets for packaging.

- Total Tax Rate: 61.0%

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes: This code is for other plastic composite sheets not specifically covered under 3920100000.

✅ HS CODE: 3921904010

- Description: Polyethylene polymer plastic composite sheets for packaging.

- Total Tax Rate: 34.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes: This code may apply to specific types of composite sheets with different material compositions.

✅ HS CODE: 6305330040

- Description: Polyethylene polymer plastic composite sheets for packaging.

- Total Tax Rate: 45.9%

- Base Tariff Rate: 8.4%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes: This code is for textile articles or products of plastic, which may be used for packaging but are not strictly polymer sheets.

✅ HS CODE: 3923210095

- Description: Polyethylene polymer plastic composite sheets for packaging.

- Total Tax Rate: 58.0%

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Notes: This code may apply to specific types of plastic sheets with special additives or coatings.

⚠️ Important Reminders:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- Material Verification: Confirm the exact composition and structure of the composite sheets (e.g., whether it contains other polymers or additives) to ensure correct classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific packaging regulations) are required for import into your destination country.

- Unit Price: Be aware that the total tax rate is applied to the FOB or CIF value, so ensure accurate pricing and documentation.

📌 Proactive Advice:

- Consult a customs broker or classification expert if the product contains multiple materials or is used for specialized packaging.

- Keep updated records of product specifications and HS code classifications to avoid delays at customs.

- Monitor policy changes related to the April 11, 2025 tariff and any potential anti-dumping duties (if applicable).

Let me know if you need help with a specific HS code or customs documentation.

Customer Reviews

No reviews yet.