| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3923210080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901909000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901101000 | Doc | 61.5% | CN | US | 2025-05-12 |

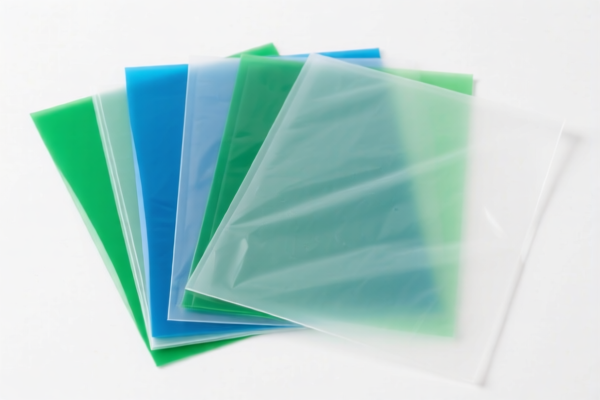

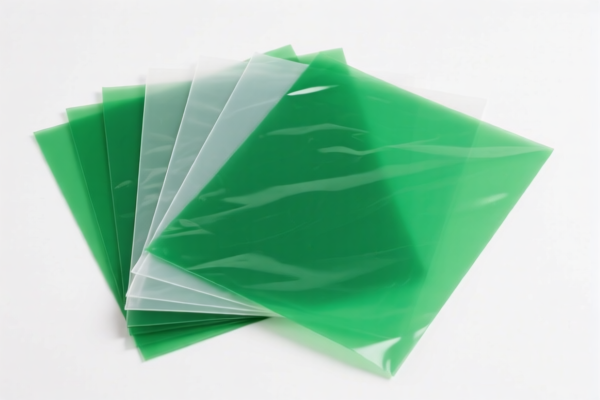

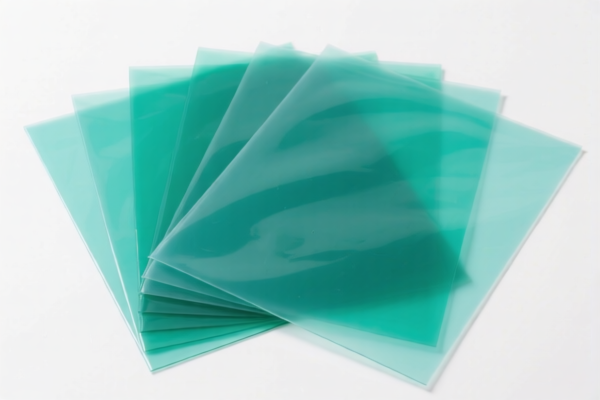

Product Name: Polyethylene Polymer Plastic Laminated Sheets

Classification HS Codes and Tax Details:

✅ HS CODE: 3920991000

Description: Applicable to polyethylene composite film, classified under HS code 3920.

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for composite films made of polyethylene.

✅ HS CODE: 3923210080

Description: Applicable to polyethylene plastic composite bags, made from polyethylene polymer.

- Total Tax Rate: 58.0%

- Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for plastic bags made from polyethylene.

✅ HS CODE: 3901400000

Description: Applicable to polyethylene composite film, in the primary form of ethylene polymer.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for raw or primary forms of ethylene polymer-based composite films.

✅ HS CODE: 3901909000

Description: Applicable to polyethylene composite film, as a product of ethylene polymer.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for finished or processed products of ethylene polymer-based composite films.

✅ HS CODE: 3901101000

Description: Applicable to polyethylene composite film, classified under HS code 3901.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyethylene composite films under the broader category of 3901.

📌 Important Notes and Recommendations:

- Tariff Changes After April 11, 2025: A 30.0% additional tariff will be applied to all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition and structure of the product (e.g., whether it is a film, bag, or composite material) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Be aware that the total tax rate is applied to the CIF (Cost, Insurance, Freight) value, so ensure accurate pricing and documentation.

If you have more details about the product (e.g., thickness, use, or whether it is a finished product), I can help further refine the classification.

Product Name: Polyethylene Polymer Plastic Laminated Sheets

Classification HS Codes and Tax Details:

✅ HS CODE: 3920991000

Description: Applicable to polyethylene composite film, classified under HS code 3920.

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for composite films made of polyethylene.

✅ HS CODE: 3923210080

Description: Applicable to polyethylene plastic composite bags, made from polyethylene polymer.

- Total Tax Rate: 58.0%

- Breakdown:

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for plastic bags made from polyethylene.

✅ HS CODE: 3901400000

Description: Applicable to polyethylene composite film, in the primary form of ethylene polymer.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for raw or primary forms of ethylene polymer-based composite films.

✅ HS CODE: 3901909000

Description: Applicable to polyethylene composite film, as a product of ethylene polymer.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for finished or processed products of ethylene polymer-based composite films.

✅ HS CODE: 3901101000

Description: Applicable to polyethylene composite film, classified under HS code 3901.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyethylene composite films under the broader category of 3901.

📌 Important Notes and Recommendations:

- Tariff Changes After April 11, 2025: A 30.0% additional tariff will be applied to all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition and structure of the product (e.g., whether it is a film, bag, or composite material) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Be aware that the total tax rate is applied to the CIF (Cost, Insurance, Freight) value, so ensure accurate pricing and documentation.

If you have more details about the product (e.g., thickness, use, or whether it is a finished product), I can help further refine the classification.

Customer Reviews

No reviews yet.