| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

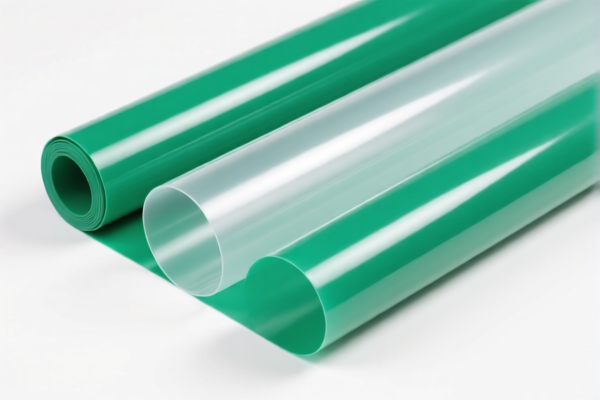

Product Name: Polyethylene Polymer Plastic Shading Films

Classification: Plastic products used for shading, primarily made of polyethylene.

🔍 HS Code Classification Overview

Below are the HS codes and corresponding tariff details for Polyethylene Polymer Plastic Shading Films:

📦 1. HS Code: 3901400000

Description: Polyethylene polymer plastic products, suitable for polyethylene shading films.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

📦 2. HS Code: 3920100000

Description: Plastic sheets, plates, films, suitable for polyethylene shading films.

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

📦 3. HS Code: 3921904090

Description: Flexible plastic sheets, plates, films, foils, and strips, suitable for shading films.

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

📦 4. HS Code: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips, suitable for shading films.

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

📦 5. HS Code: 3925900000

Description: Other plastic products, suitable for plastic shading covers.

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Material Verification: Confirm the exact composition of the product (e.g., whether it is 100% polyethylene or contains additives), as this may affect classification.

- Certifications: Check if any customs or import certifications are required (e.g., product standards, origin documentation).

- Unit Price: Ensure the unit price is correctly declared, as this may influence the application of anti-dumping or other duties.

- Classification Accuracy: Double-check the HS code with customs authorities or a qualified customs broker to avoid misclassification penalties.

✅ Proactive Advice

- Consult a customs expert if the product contains additives or is used for specific applications (e.g., agricultural, construction).

- Track policy updates related to April 11, 2025 tariffs to adjust pricing and compliance strategies accordingly.

- Maintain detailed documentation on product specifications and origin to support customs declarations.

Product Name: Polyethylene Polymer Plastic Shading Films

Classification: Plastic products used for shading, primarily made of polyethylene.

🔍 HS Code Classification Overview

Below are the HS codes and corresponding tariff details for Polyethylene Polymer Plastic Shading Films:

📦 1. HS Code: 3901400000

Description: Polyethylene polymer plastic products, suitable for polyethylene shading films.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

📦 2. HS Code: 3920100000

Description: Plastic sheets, plates, films, suitable for polyethylene shading films.

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

📦 3. HS Code: 3921904090

Description: Flexible plastic sheets, plates, films, foils, and strips, suitable for shading films.

Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

📦 4. HS Code: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips, suitable for shading films.

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

📦 5. HS Code: 3925900000

Description: Other plastic products, suitable for plastic shading covers.

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this category.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Material Verification: Confirm the exact composition of the product (e.g., whether it is 100% polyethylene or contains additives), as this may affect classification.

- Certifications: Check if any customs or import certifications are required (e.g., product standards, origin documentation).

- Unit Price: Ensure the unit price is correctly declared, as this may influence the application of anti-dumping or other duties.

- Classification Accuracy: Double-check the HS code with customs authorities or a qualified customs broker to avoid misclassification penalties.

✅ Proactive Advice

- Consult a customs expert if the product contains additives or is used for specific applications (e.g., agricultural, construction).

- Track policy updates related to April 11, 2025 tariffs to adjust pricing and compliance strategies accordingly.

- Maintain detailed documentation on product specifications and origin to support customs declarations.

Customer Reviews

No reviews yet.