| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

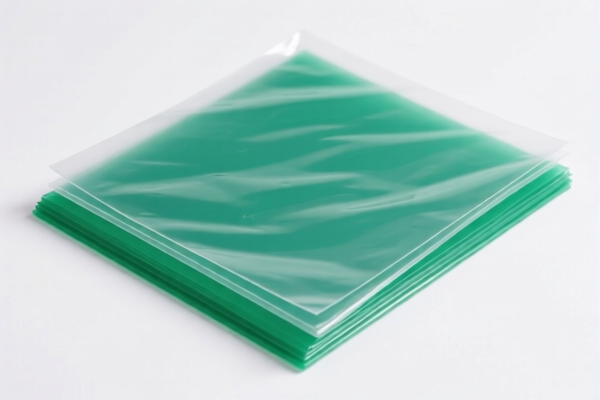

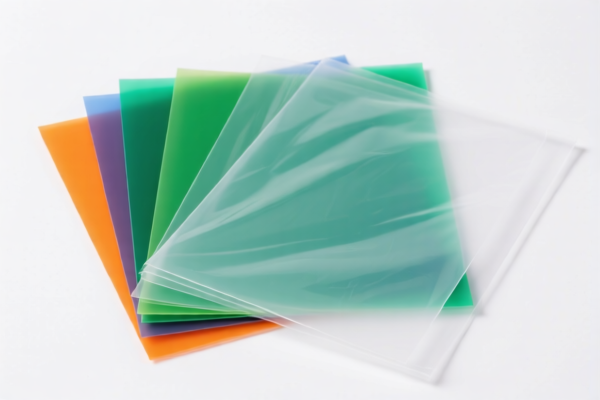

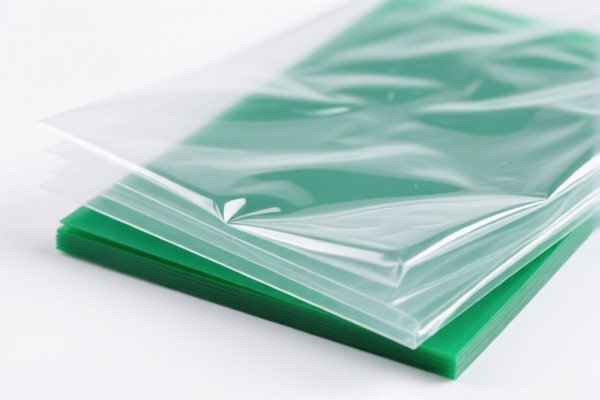

Product Name: Polyethylene Polymer Plastic Sheets

Classification HS CODEs and Tax Details:

- HS CODE: 3920100000

- Description: Polyethylene plastic sheets

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to specific types of polyethylene sheets, likely with defined thickness or use.

-

HS CODE: 3920991000

- Description: Polyethylene plastic sheets (other than those in 3920100000)

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code covers other polyethylene sheets not included in the more specific 3920100000 category.

-

HS CODE: 3921905050

- Description: Polyethylene plastic sheets (possibly with specific additives or properties)

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to polyethylene sheets with specific technical characteristics or formulations.

Key Tax Rate Changes (April 11, 2025):

- All three HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy, so ensure your import timeline aligns with this change.

Proactive Advice:

- Verify Material Specifications: Confirm the exact type of polyethylene (e.g., LDPE, HDPE, LLDPE) and any additives, as this may affect the correct HS code.

- Check Unit Price and Certification: Ensure you have the necessary documentation (e.g., material safety data sheets, certificates of origin) to support the classification.

- Consult Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

Let me know if you need help determining the most accurate HS code based on your product’s specifications.

Product Name: Polyethylene Polymer Plastic Sheets

Classification HS CODEs and Tax Details:

- HS CODE: 3920100000

- Description: Polyethylene plastic sheets

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to specific types of polyethylene sheets, likely with defined thickness or use.

-

HS CODE: 3920991000

- Description: Polyethylene plastic sheets (other than those in 3920100000)

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code covers other polyethylene sheets not included in the more specific 3920100000 category.

-

HS CODE: 3921905050

- Description: Polyethylene plastic sheets (possibly with specific additives or properties)

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply to polyethylene sheets with specific technical characteristics or formulations.

Key Tax Rate Changes (April 11, 2025):

- All three HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy, so ensure your import timeline aligns with this change.

Proactive Advice:

- Verify Material Specifications: Confirm the exact type of polyethylene (e.g., LDPE, HDPE, LLDPE) and any additives, as this may affect the correct HS code.

- Check Unit Price and Certification: Ensure you have the necessary documentation (e.g., material safety data sheets, certificates of origin) to support the classification.

- Consult Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

Let me know if you need help determining the most accurate HS code based on your product’s specifications.

Customer Reviews

No reviews yet.