| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

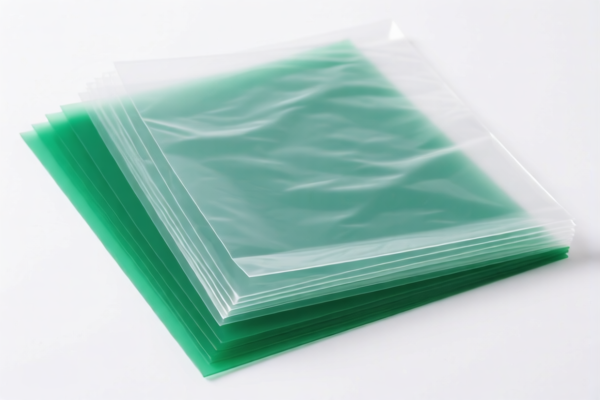

Product Name: Polyethylene Polymer Plastic Sheets (For Construction)

Classification: HS Code 3920598000 and 3921905050

🔍 HS Code Classification Overview

- HS Code 3920598000

- Description: Polyethylene polymer plastic sheets for construction

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to all products after this date)

-

HS Code 3921905050

- Description: Polyethylene polymer plastic sheets for construction

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0% (applies to all products after this date)

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be applied to both HS codes after April 11, 2025.

-

This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

-

No Anti-Dumping Duties:

- No specific anti-dumping duties are currently listed for this product category (polyethylene polymer plastic sheets for construction).

📌 Proactive Advice for Importers

- Verify Material Specifications:

- Ensure the product is indeed made of polyethylene and is intended for construction use.

-

Confirm the exact composition and thickness of the plastic sheets, as this may affect classification.

-

Check Unit Price and Certification Requirements:

- Some customs authorities may require certifications (e.g., material safety, construction compliance) for imported building materials.

-

Confirm if import licenses or special permits are required for this product.

-

Monitor Tariff Updates:

- Keep track of any new regulations or tariff adjustments after April 11, 2025, as this could significantly impact your import costs.

📊 Summary Table for Comparison

| HS Code | Description | Base Tariff | Additional Tariff | Tariff after April 11, 2025 | Total Tax Rate |

|---|---|---|---|---|---|

| 3920598000 | Polyethylene plastic sheets (constr.) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921905050 | Polyethylene plastic sheets (constr.) | 4.8% | 0.0% | 30.0% | 34.8% |

If you need further assistance with customs documentation or classification confirmation, feel free to provide more details about the product.

Product Name: Polyethylene Polymer Plastic Sheets (For Construction)

Classification: HS Code 3920598000 and 3921905050

🔍 HS Code Classification Overview

- HS Code 3920598000

- Description: Polyethylene polymer plastic sheets for construction

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to all products after this date)

-

HS Code 3921905050

- Description: Polyethylene polymer plastic sheets for construction

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0% (applies to all products after this date)

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be applied to both HS codes after April 11, 2025.

-

This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

-

No Anti-Dumping Duties:

- No specific anti-dumping duties are currently listed for this product category (polyethylene polymer plastic sheets for construction).

📌 Proactive Advice for Importers

- Verify Material Specifications:

- Ensure the product is indeed made of polyethylene and is intended for construction use.

-

Confirm the exact composition and thickness of the plastic sheets, as this may affect classification.

-

Check Unit Price and Certification Requirements:

- Some customs authorities may require certifications (e.g., material safety, construction compliance) for imported building materials.

-

Confirm if import licenses or special permits are required for this product.

-

Monitor Tariff Updates:

- Keep track of any new regulations or tariff adjustments after April 11, 2025, as this could significantly impact your import costs.

📊 Summary Table for Comparison

| HS Code | Description | Base Tariff | Additional Tariff | Tariff after April 11, 2025 | Total Tax Rate |

|---|---|---|---|---|---|

| 3920598000 | Polyethylene plastic sheets (constr.) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921905050 | Polyethylene plastic sheets (constr.) | 4.8% | 0.0% | 30.0% | 34.8% |

If you need further assistance with customs documentation or classification confirmation, feel free to provide more details about the product.

Customer Reviews

No reviews yet.