| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3901205000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Polyethylene Polymer Plastic Sheets (For Packaging) based on the provided HS codes and tax details:

✅ Product Classification Overview

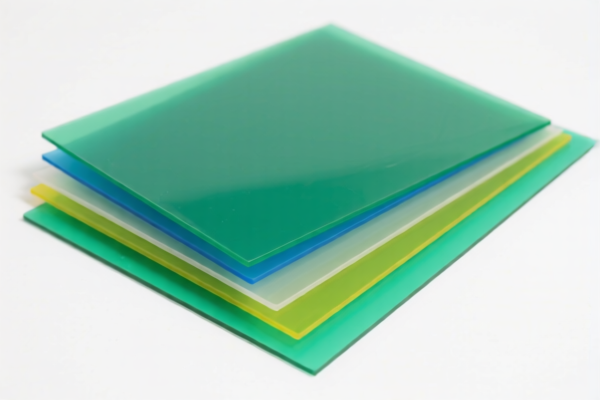

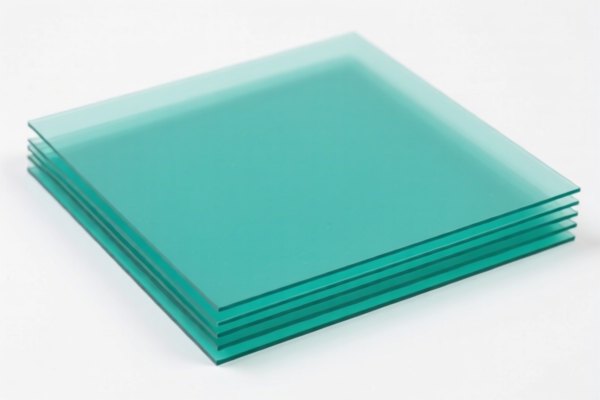

Product Name: Polyethylene Polymer Plastic Sheets (For Packaging)

Classification Basis: Plastic sheets, used primarily for packaging purposes.

📦 HS Code Classification and Tax Details

1. HS Code: 3921905050

Description: Other plastic sheets, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is suitable if the plastic sheets are not specifically classified under more detailed categories.

2. HS Code: 3901205000

Description: Primary forms of polyethylene polymers

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to raw polyethylene polymer in its primary form, not finished products like sheets.

3. HS Code: 3920598000

Description: Other plastic sheets, films, foils, and strips

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This is a more specific category for plastic sheets, possibly including packaging-grade materials.

4. HS Code: 3924905650

Description: Plastic-made tableware, kitchen utensils, other household or sanitary or toilet articles

Total Tax Rate: 40.9%

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is for finished plastic products like containers or utensils, not raw sheets.

5. HS Code: 3921125000

Description: Other plastic products

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This is a general category for other plastic products not covered by more specific codes.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if applicable for polyethylene products.

- Material and Certification: Ensure the product is correctly classified based on material (e.g., polyethylene), thickness, and intended use (e.g., packaging). Certifications like REACH, RoHS, or customs documentation may be required.

🛠️ Proactive Advice for Users

- Verify Material and Unit Price: Confirm the exact polymer type (e.g., LDPE, HDPE) and whether it's virgin or recycled.

- Check Required Certifications: Some HS codes may require specific documentation or certifications for import.

- Consult a Customs Broker: For complex classifications or high-value shipments, professional assistance is recommended.

- Monitor Tariff Updates: Stay informed about any changes in tariffs, especially after April 11, 2025.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for Polyethylene Polymer Plastic Sheets (For Packaging) based on the provided HS codes and tax details:

✅ Product Classification Overview

Product Name: Polyethylene Polymer Plastic Sheets (For Packaging)

Classification Basis: Plastic sheets, used primarily for packaging purposes.

📦 HS Code Classification and Tax Details

1. HS Code: 3921905050

Description: Other plastic sheets, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is suitable if the plastic sheets are not specifically classified under more detailed categories.

2. HS Code: 3901205000

Description: Primary forms of polyethylene polymers

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code applies to raw polyethylene polymer in its primary form, not finished products like sheets.

3. HS Code: 3920598000

Description: Other plastic sheets, films, foils, and strips

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This is a more specific category for plastic sheets, possibly including packaging-grade materials.

4. HS Code: 3924905650

Description: Plastic-made tableware, kitchen utensils, other household or sanitary or toilet articles

Total Tax Rate: 40.9%

- Base Tariff: 3.4%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is for finished plastic products like containers or utensils, not raw sheets.

5. HS Code: 3921125000

Description: Other plastic products

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This is a general category for other plastic products not covered by more specific codes.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if applicable for polyethylene products.

- Material and Certification: Ensure the product is correctly classified based on material (e.g., polyethylene), thickness, and intended use (e.g., packaging). Certifications like REACH, RoHS, or customs documentation may be required.

🛠️ Proactive Advice for Users

- Verify Material and Unit Price: Confirm the exact polymer type (e.g., LDPE, HDPE) and whether it's virgin or recycled.

- Check Required Certifications: Some HS codes may require specific documentation or certifications for import.

- Consult a Customs Broker: For complex classifications or high-value shipments, professional assistance is recommended.

- Monitor Tariff Updates: Stay informed about any changes in tariffs, especially after April 11, 2025.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.