| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

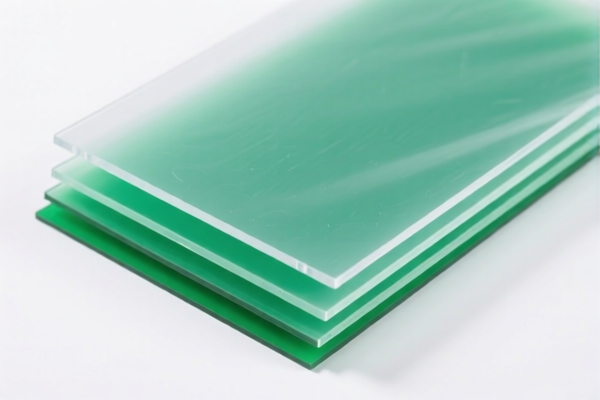

Here is the detailed classification and tariff information for Polyethylene Polymer Plastic Sheets for Construction, based on the provided HS codes and tax details:

🔍 HS CODE: 3920100000

Product Description: Polyethylene Plastic Sheets for Construction

Total Tax Rate: 59.2%

Breakdown of Tariffs:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category.

Key Notes: - This code is specific to polyethylene sheets used in construction. - The April 11, 2025 special tariff significantly increases the total tax burden.

🔍 HS CODE: 3925900000

Product Description: Polyvinyl Chloride (PVC) Plastic Sheets for Construction

Total Tax Rate: 60.3%

Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category.

Key Notes: - This code applies to PVC sheets used in construction. - The April 11, 2025 special tariff increases the total tax burden.

🔍 HS CODE: 3921905050

Product Description: Other Plastic Sheets (not polyethylene or PVC) for Construction

Total Tax Rate: 34.8%

Breakdown of Tariffs:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category.

Key Notes: - This code is for other types of plastic sheets used in construction (e.g., polystyrene, etc.). - No additional tariff is currently applied, but the April 11, 2025 special tariff will increase the total tax.

🔍 HS CODE: 3921110000

Product Description: Polystyrene Foam Plastic Sheets for Construction

Total Tax Rate: 60.3%

Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category.

Key Notes: - This code is for polystyrene foam sheets used in construction. - The April 11, 2025 special tariff increases the total tax burden.

🔍 HS CODE: 3903190000

Product Description: Polystyrene Plastic Sheets (not foam) for Construction

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category.

Key Notes: - This code is for solid polystyrene sheets used in construction. - The April 11, 2025 special tariff increases the total tax burden.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is correctly classified based on its material type (e.g., polyethylene, PVC, polystyrene, etc.).

- Check Unit Price: High tax rates may affect cost competitiveness; consider this in pricing strategy.

- Certifications Required: Confirm if any technical or safety certifications are needed for import into the destination country.

- Monitor April 11, 2025 Policy: Be prepared for a 30% increase in tariffs after this date, which could significantly impact your import costs.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is borderline between categories.

Let me know if you need help with customs documentation or tariff calculation tools. Here is the detailed classification and tariff information for Polyethylene Polymer Plastic Sheets for Construction, based on the provided HS codes and tax details:

🔍 HS CODE: 3920100000

Product Description: Polyethylene Plastic Sheets for Construction

Total Tax Rate: 59.2%

Breakdown of Tariffs:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category.

Key Notes: - This code is specific to polyethylene sheets used in construction. - The April 11, 2025 special tariff significantly increases the total tax burden.

🔍 HS CODE: 3925900000

Product Description: Polyvinyl Chloride (PVC) Plastic Sheets for Construction

Total Tax Rate: 60.3%

Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category.

Key Notes: - This code applies to PVC sheets used in construction. - The April 11, 2025 special tariff increases the total tax burden.

🔍 HS CODE: 3921905050

Product Description: Other Plastic Sheets (not polyethylene or PVC) for Construction

Total Tax Rate: 34.8%

Breakdown of Tariffs:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category.

Key Notes: - This code is for other types of plastic sheets used in construction (e.g., polystyrene, etc.). - No additional tariff is currently applied, but the April 11, 2025 special tariff will increase the total tax.

🔍 HS CODE: 3921110000

Product Description: Polystyrene Foam Plastic Sheets for Construction

Total Tax Rate: 60.3%

Breakdown of Tariffs:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category.

Key Notes: - This code is for polystyrene foam sheets used in construction. - The April 11, 2025 special tariff increases the total tax burden.

🔍 HS CODE: 3903190000

Product Description: Polystyrene Plastic Sheets (not foam) for Construction

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category.

Key Notes: - This code is for solid polystyrene sheets used in construction. - The April 11, 2025 special tariff increases the total tax burden.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is correctly classified based on its material type (e.g., polyethylene, PVC, polystyrene, etc.).

- Check Unit Price: High tax rates may affect cost competitiveness; consider this in pricing strategy.

- Certifications Required: Confirm if any technical or safety certifications are needed for import into the destination country.

- Monitor April 11, 2025 Policy: Be prepared for a 30% increase in tariffs after this date, which could significantly impact your import costs.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is borderline between categories.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.