Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3920300000 | Doc | 60.8% | CN | US | 2025-05-12 |

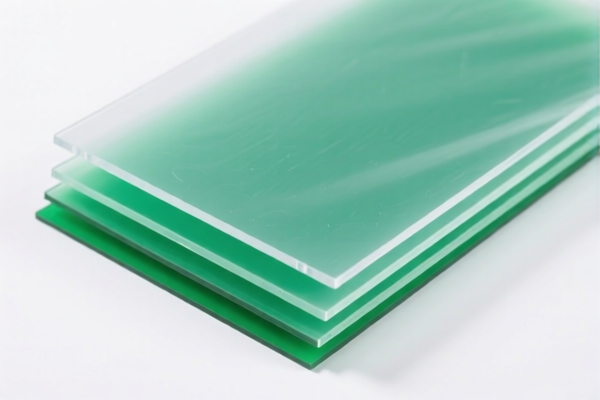

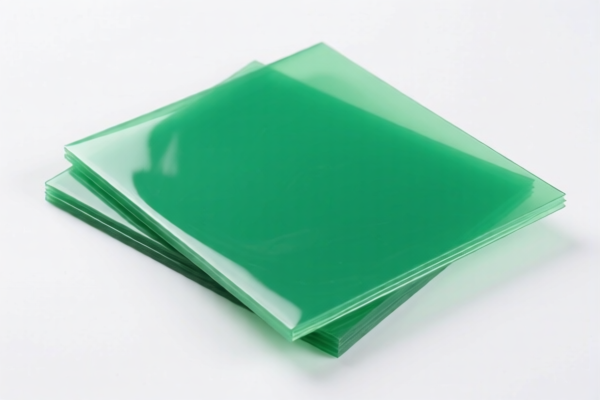

Product Name: Polyethylene Polymer Plastic Structural Sheets

Classification HS Code: 3920100000

🔍 HS Code Details:

- HS Code: 3920100000

- Description: Polyethylene plastic sheets (structural)

- Total Tax Rate: 59.2%

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable for this product category.

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-dumping duties: This product is not subject to anti-dumping duties on iron or aluminum, as it is a polymer-based plastic product.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed made of polyethylene and not a blend or composite that may fall under a different HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination country.

- Consult Customs Broker: For accurate classification and to avoid delays in customs clearance, it is recommended to consult a licensed customs broker or a customs compliance expert.

📌 Alternative HS Codes for Reference:

- 3920995000: Other non-cellulose, non-reinforced plastic sheets, films, foils, and strips (layered, supported, or combined with other materials) – 60.8% total tax

- 3921905050: Other plastic sheets, films, foils, and strips – 34.8% total tax

- 3925900000: Other plastic building hardware products – 60.3% total tax

- 3920300000: Non-cellulose, non-reinforced polystyrene polymer plastic sheets, films, foils, and strips – 60.8% total tax

If you are exporting or importing this product, ensure that the HS code used matches the actual product description and composition to avoid penalties or delays.

Product Name: Polyethylene Polymer Plastic Structural Sheets

Classification HS Code: 3920100000

🔍 HS Code Details:

- HS Code: 3920100000

- Description: Polyethylene plastic sheets (structural)

- Total Tax Rate: 59.2%

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable for this product category.

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-dumping duties: This product is not subject to anti-dumping duties on iron or aluminum, as it is a polymer-based plastic product.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed made of polyethylene and not a blend or composite that may fall under a different HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination country.

- Consult Customs Broker: For accurate classification and to avoid delays in customs clearance, it is recommended to consult a licensed customs broker or a customs compliance expert.

📌 Alternative HS Codes for Reference:

- 3920995000: Other non-cellulose, non-reinforced plastic sheets, films, foils, and strips (layered, supported, or combined with other materials) – 60.8% total tax

- 3921905050: Other plastic sheets, films, foils, and strips – 34.8% total tax

- 3925900000: Other plastic building hardware products – 60.3% total tax

- 3920300000: Non-cellulose, non-reinforced polystyrene polymer plastic sheets, films, foils, and strips – 60.8% total tax

If you are exporting or importing this product, ensure that the HS code used matches the actual product description and composition to avoid penalties or delays.

Customer Reviews

No reviews yet.