Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

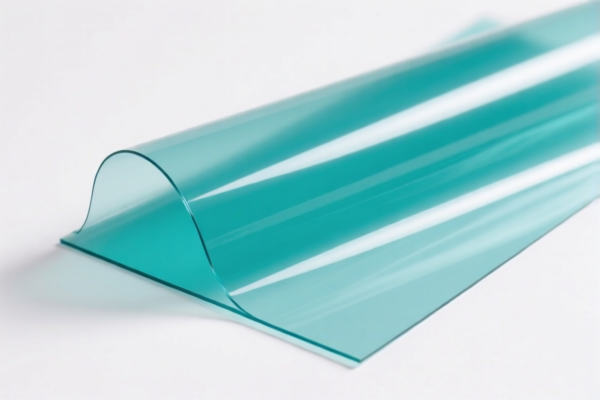

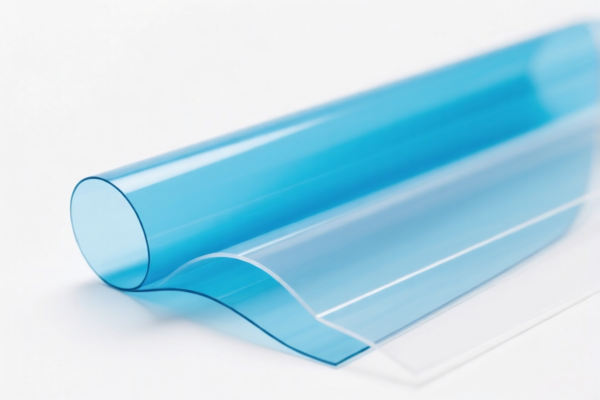

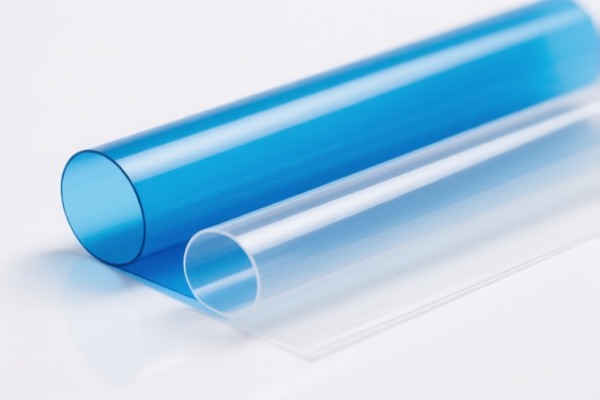

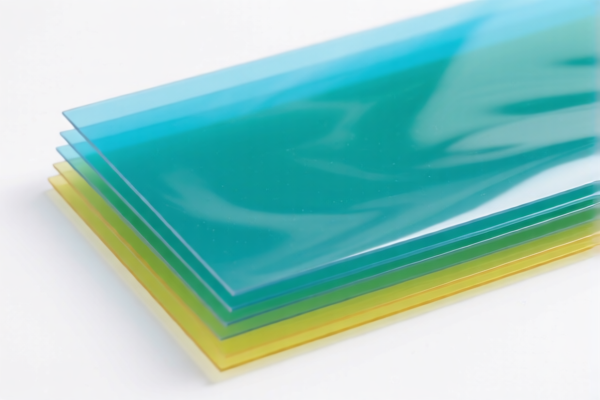

Product Classification: Polyethylene Polymer Plastic Thin Films

HS CODE: 3920100000

🔍 Classification Summary

- Product: Polyethylene polymer plastic thin films

- HS CODE: 3920100000

- Total Tax Rate: 59.2%

📊 Tariff Breakdown

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

⚠️ Important Notes

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-dumping duties are currently listed for this product category.

- No specific anti-dumping duties on iron and aluminum apply here, as this is a polymer product.

📌 Proactive Advice for Importers

- Verify Material Specifications: Ensure the product is indeed polyethylene polymer and not misclassified under other HS codes (e.g., 3920991000 for other plastic films).

- Check Thickness and Form: Confirm if the film is thin (e.g., <0.152 mm), flexible, and uncoiled, as this may affect classification.

- Review Certification Requirements: Some countries may require specific certifications (e.g., RoHS, REACH) for plastic films.

- Monitor Tariff Updates: Stay informed about any changes in the 2025 tariff schedule, especially the April 11 deadline.

📋 Alternative HS Codes for Reference

- 3920991000 – Other plastic films (e.g., non-cellulose, non-reinforced, flexible, >0.152 mm, uncoiled)

- 3921904090 – Flexible plastic films (lower tax rate, but ensure it fits the description)

- 3903190000 – Styrene polymer films (not applicable for polyethylene)

Let me know if you need help determining the most accurate HS code based on your product's full specifications.

Product Classification: Polyethylene Polymer Plastic Thin Films

HS CODE: 3920100000

🔍 Classification Summary

- Product: Polyethylene polymer plastic thin films

- HS CODE: 3920100000

- Total Tax Rate: 59.2%

📊 Tariff Breakdown

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

⚠️ Important Notes

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-dumping duties are currently listed for this product category.

- No specific anti-dumping duties on iron and aluminum apply here, as this is a polymer product.

📌 Proactive Advice for Importers

- Verify Material Specifications: Ensure the product is indeed polyethylene polymer and not misclassified under other HS codes (e.g., 3920991000 for other plastic films).

- Check Thickness and Form: Confirm if the film is thin (e.g., <0.152 mm), flexible, and uncoiled, as this may affect classification.

- Review Certification Requirements: Some countries may require specific certifications (e.g., RoHS, REACH) for plastic films.

- Monitor Tariff Updates: Stay informed about any changes in the 2025 tariff schedule, especially the April 11 deadline.

📋 Alternative HS Codes for Reference

- 3920991000 – Other plastic films (e.g., non-cellulose, non-reinforced, flexible, >0.152 mm, uncoiled)

- 3921904090 – Flexible plastic films (lower tax rate, but ensure it fits the description)

- 3903190000 – Styrene polymer films (not applicable for polyethylene)

Let me know if you need help determining the most accurate HS code based on your product's full specifications.

Customer Reviews

No reviews yet.