Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

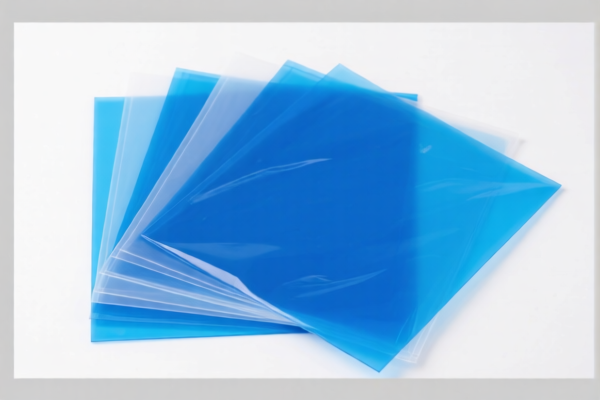

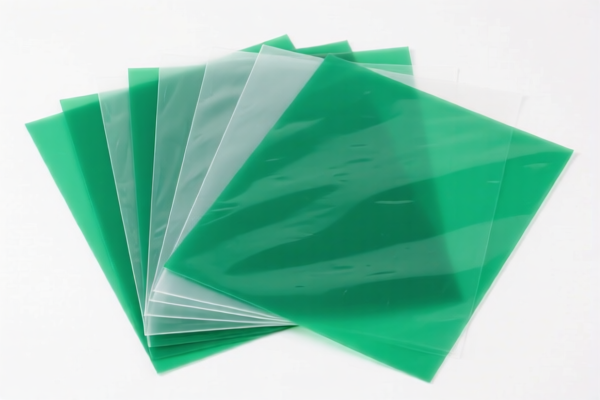

Product Name: Polyethylene Terephthalate (PET) Plastic Sheets

Classification: Plastic sheets, films, and related products

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3920598000

Description: Other plastic products

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

⚠️ Important Notes and Recommendations:

- Tariff Increase Alert: Starting April 11, 2025, an additional 30% tariff will be applied to both HS codes. This is a significant increase and may impact your import costs.

- Material Verification: Confirm the exact composition of the PET sheets (e.g., whether it contains additives or is recycled) to ensure correct classification.

- Certifications Required: Check if any customs documentation or certifications (e.g., Material Safety Data Sheet, product standards) are required for import.

- Unit Price Consideration: Be aware that the total tax rate is applied to the FOB or CIF value, so ensure the unit price is correctly declared to avoid overpayment.

📌 Proactive Advice:

- Consult a customs broker or import specialist to confirm the most accurate classification and tax implications.

- Monitor policy updates related to import tariffs, especially after April 11, 2025.

- Maintain detailed records of product specifications and supplier documentation to support customs declarations.

Product Name: Polyethylene Terephthalate (PET) Plastic Sheets

Classification: Plastic sheets, films, and related products

✅ HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

✅ HS CODE: 3920598000

Description: Other plastic products

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

⚠️ Important Notes and Recommendations:

- Tariff Increase Alert: Starting April 11, 2025, an additional 30% tariff will be applied to both HS codes. This is a significant increase and may impact your import costs.

- Material Verification: Confirm the exact composition of the PET sheets (e.g., whether it contains additives or is recycled) to ensure correct classification.

- Certifications Required: Check if any customs documentation or certifications (e.g., Material Safety Data Sheet, product standards) are required for import.

- Unit Price Consideration: Be aware that the total tax rate is applied to the FOB or CIF value, so ensure the unit price is correctly declared to avoid overpayment.

📌 Proactive Advice:

- Consult a customs broker or import specialist to confirm the most accurate classification and tax implications.

- Monitor policy updates related to import tariffs, especially after April 11, 2025.

- Maintain detailed records of product specifications and supplier documentation to support customs declarations.

Customer Reviews

No reviews yet.