| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901205000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901909000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901101000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

Product Name: Polyisobutylene Raw Material for Agricultural Film

Classification: Based on the provided HS codes and descriptions, the product is likely classified under HS Code 3901205000 or 3901101000, depending on the specific form and properties of the polyisobutylene (a type of polyolefin).

✅ HS Code Classification Overview

- HS Code 3901205000

- Description: Polyethylene raw material for agricultural film, classified under Chapter 3901 (Plastics and articles thereof, of plastics, primary shapes).

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for raw polyethylene used in the production of agricultural films.

-

HS Code 3901101000

- Description: Polyethylene with a density less than 0.94, classified under Chapter 3901.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for specific types of polyethylene with defined physical properties.

-

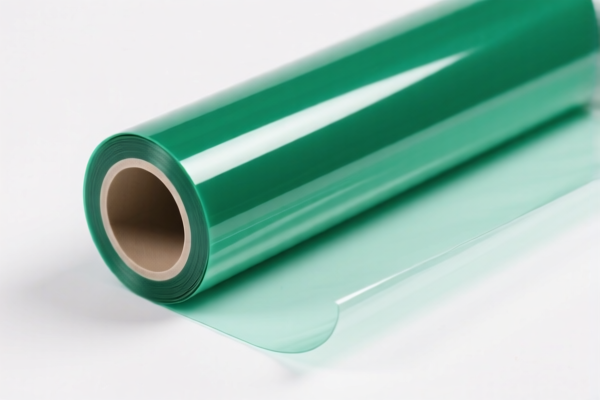

HS Code 3920100000 / 3920995000

- Description: These codes are for finished plastic films (e.g., agricultural films), not raw materials.

- Total Tax Rates:

- 3920100000: 59.2% (Base: 4.2%, Additional: 25.0%, Special: 30.0%)

- 3920995000: 60.8% (Base: 5.8%, Additional: 25.0%, Special: 30.0%)

- Note: These are not suitable for raw polyisobutylene, as they pertain to finished products.

⚠️ Key Tax Rate Changes (April 11, 2025)

- All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy, and importers must be aware of the effective date to avoid unexpected costs.

📌 Proactive Advice for Importers

- Verify Material Specifications: Ensure the product is raw polyisobutylene and not a finished film or processed product.

- Check Unit Price and Form: Confirm whether the product is in primary form (e.g., pellets, powder) or finished form (e.g., film).

- Certifications Required: Some HS codes may require technical specifications, material safety data sheets (MSDS), or customs declarations.

- Consult with Customs Broker: For accurate classification and to avoid misclassification penalties.

📊 Summary Table

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) |

|---|---|---|---|---|---|

| 3901205000 | Polyethylene raw material for film | 61.5% | 6.5% | 25.0% | 30.0% |

| 3901101000 | Polyethylene (density < 0.94) | 61.5% | 6.5% | 25.0% | 30.0% |

| 3920100000 | Plastic film (finished product) | 59.2% | 4.2% | 25.0% | 30.0% |

| 3920995000 | Other plastic sheets (finished product) | 60.8% | 5.8% | 25.0% | 30.0% |

If you have more details about the physical form, density, or intended use of the polyisobutylene, I can help refine the HS code further.

Product Name: Polyisobutylene Raw Material for Agricultural Film

Classification: Based on the provided HS codes and descriptions, the product is likely classified under HS Code 3901205000 or 3901101000, depending on the specific form and properties of the polyisobutylene (a type of polyolefin).

✅ HS Code Classification Overview

- HS Code 3901205000

- Description: Polyethylene raw material for agricultural film, classified under Chapter 3901 (Plastics and articles thereof, of plastics, primary shapes).

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for raw polyethylene used in the production of agricultural films.

-

HS Code 3901101000

- Description: Polyethylene with a density less than 0.94, classified under Chapter 3901.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for specific types of polyethylene with defined physical properties.

-

HS Code 3920100000 / 3920995000

- Description: These codes are for finished plastic films (e.g., agricultural films), not raw materials.

- Total Tax Rates:

- 3920100000: 59.2% (Base: 4.2%, Additional: 25.0%, Special: 30.0%)

- 3920995000: 60.8% (Base: 5.8%, Additional: 25.0%, Special: 30.0%)

- Note: These are not suitable for raw polyisobutylene, as they pertain to finished products.

⚠️ Key Tax Rate Changes (April 11, 2025)

- All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy, and importers must be aware of the effective date to avoid unexpected costs.

📌 Proactive Advice for Importers

- Verify Material Specifications: Ensure the product is raw polyisobutylene and not a finished film or processed product.

- Check Unit Price and Form: Confirm whether the product is in primary form (e.g., pellets, powder) or finished form (e.g., film).

- Certifications Required: Some HS codes may require technical specifications, material safety data sheets (MSDS), or customs declarations.

- Consult with Customs Broker: For accurate classification and to avoid misclassification penalties.

📊 Summary Table

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) |

|---|---|---|---|---|---|

| 3901205000 | Polyethylene raw material for film | 61.5% | 6.5% | 25.0% | 30.0% |

| 3901101000 | Polyethylene (density < 0.94) | 61.5% | 6.5% | 25.0% | 30.0% |

| 3920100000 | Plastic film (finished product) | 59.2% | 4.2% | 25.0% | 30.0% |

| 3920995000 | Other plastic sheets (finished product) | 60.8% | 5.8% | 25.0% | 30.0% |

If you have more details about the physical form, density, or intended use of the polyisobutylene, I can help refine the HS code further.

Customer Reviews

No reviews yet.