| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3906100000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

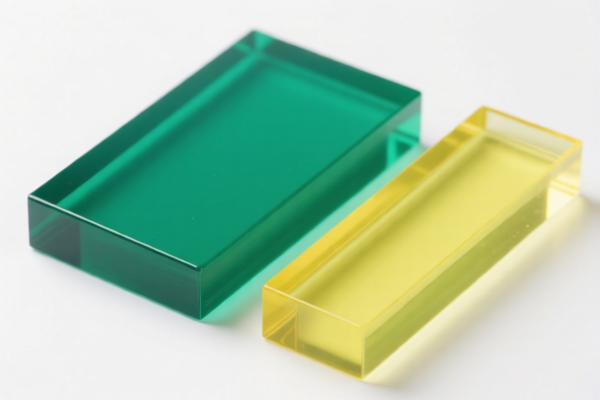

Product Name: Polymethyl Methacrylate Resin

Classification: HS Code 3906100000 and 3907610050

✅ HS Code Classification Summary:

- HS CODE 3906100000

- Description: Polymethyl Methacrylate Resin (PMMA) – this code is a perfect match for the declared product.

-

Total Tax Rate: 61.3%

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE 3907610050

- Description: "Other" category for acrylic polymers, which may include PMMA if the viscosity number is not specified.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes:

- April 11, 2025 Special Tariff:

- Applies to both HS codes.

- 30.0% additional tariff will be imposed after April 11, 2025.

-

This is a time-sensitive policy and must be considered in cost planning.

-

Anti-dumping duties:

- Not applicable for this product (no mention of anti-dumping duties on PMMA).

🛠️ Proactive Advice:

- Verify Material Specifications:

-

Confirm whether the product is pure PMMA resin or contains additives, as this may affect classification.

-

Check Unit Price and Certification:

- Ensure the unit price is correctly declared for accurate tax calculation.

-

Confirm if certifications (e.g., REACH, RoHS) are required for import.

-

Prefer HS Code 3906100000 if Possible:

- This code is more specific and accurate for PMMA resin.

- Using the more specific code may reduce the risk of customs scrutiny or reclassification.

📌 Summary of Tax Rates:

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3906100000 | 6.3% | 25.0% | 30.0% | 61.3% |

| 3907610050 | 6.5% | 25.0% | 30.0% | 61.5% |

If you have more details about the product (e.g., viscosity, additives, or intended use), I can help refine the classification further.

Product Name: Polymethyl Methacrylate Resin

Classification: HS Code 3906100000 and 3907610050

✅ HS Code Classification Summary:

- HS CODE 3906100000

- Description: Polymethyl Methacrylate Resin (PMMA) – this code is a perfect match for the declared product.

-

Total Tax Rate: 61.3%

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE 3907610050

- Description: "Other" category for acrylic polymers, which may include PMMA if the viscosity number is not specified.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes:

- April 11, 2025 Special Tariff:

- Applies to both HS codes.

- 30.0% additional tariff will be imposed after April 11, 2025.

-

This is a time-sensitive policy and must be considered in cost planning.

-

Anti-dumping duties:

- Not applicable for this product (no mention of anti-dumping duties on PMMA).

🛠️ Proactive Advice:

- Verify Material Specifications:

-

Confirm whether the product is pure PMMA resin or contains additives, as this may affect classification.

-

Check Unit Price and Certification:

- Ensure the unit price is correctly declared for accurate tax calculation.

-

Confirm if certifications (e.g., REACH, RoHS) are required for import.

-

Prefer HS Code 3906100000 if Possible:

- This code is more specific and accurate for PMMA resin.

- Using the more specific code may reduce the risk of customs scrutiny or reclassification.

📌 Summary of Tax Rates:

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|

| 3906100000 | 6.3% | 25.0% | 30.0% | 61.3% |

| 3907610050 | 6.5% | 25.0% | 30.0% | 61.5% |

If you have more details about the product (e.g., viscosity, additives, or intended use), I can help refine the classification further.

Customer Reviews

No reviews yet.