| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

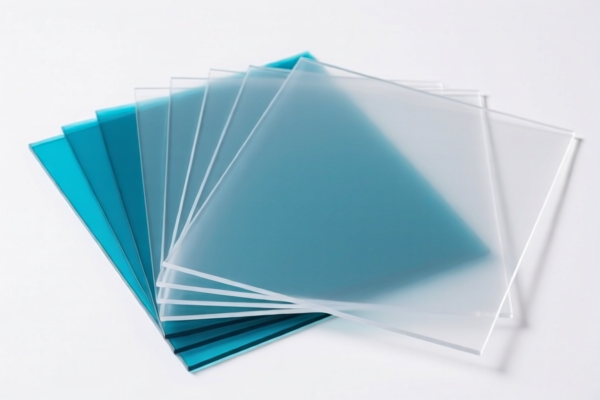

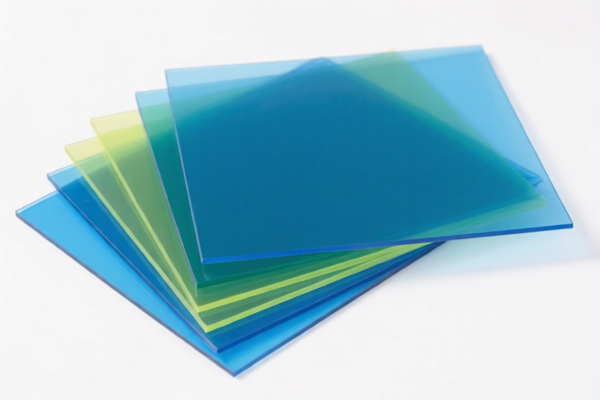

Product Name: Polymethyl Methacrylate Sheets (PMMA Sheets)

Classification: Plastic products, specifically sheets made of acrylic polymers (PMMA)

✅ HS CODE: 3920594000

Description: Plastic sheets, films, foils, and strips made of acrylic polymers (e.g., PMMA)

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost of importation.

- No Anti-dumping duties are currently listed for this product category.

- No specific anti-dumping duties on iron/aluminum apply here, as this is a plastic product.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of polymethyl methacrylate (PMMA) and not a composite or modified version that might fall under a different HS code.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., fire resistance, safety, or environmental compliance) are required for import.

- Monitor Tariff Updates: Keep an eye on the April 11, 2025, deadline for the special tariff increase.

- Consider Alternative HS Codes: If your product contains additives (e.g., flame retardants), it may fall under a different code such as 3920515050 (which has a higher base tariff of 6.5%).

📊 Comparison with Other Codes:

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3920594000 | Acrylic polymer sheets (pure PMMA) | 55.0% | Base 0.0% |

| 3920515050 | Acrylic sheets with flame retardants | 61.5% | Base 6.5% |

| 3926909989 | Other plastic products (general category) | 42.8% | Lower tax, but less specific |

🛠️ Recommendation:

If your product is pure PMMA without additives, HS CODE 3920594000 is the most accurate and appropriate classification. If it contains flame retardants or other additives, consider 3920515050. Always confirm with customs or a classification expert to avoid delays or penalties.

Product Name: Polymethyl Methacrylate Sheets (PMMA Sheets)

Classification: Plastic products, specifically sheets made of acrylic polymers (PMMA)

✅ HS CODE: 3920594000

Description: Plastic sheets, films, foils, and strips made of acrylic polymers (e.g., PMMA)

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost of importation.

- No Anti-dumping duties are currently listed for this product category.

- No specific anti-dumping duties on iron/aluminum apply here, as this is a plastic product.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of polymethyl methacrylate (PMMA) and not a composite or modified version that might fall under a different HS code.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., fire resistance, safety, or environmental compliance) are required for import.

- Monitor Tariff Updates: Keep an eye on the April 11, 2025, deadline for the special tariff increase.

- Consider Alternative HS Codes: If your product contains additives (e.g., flame retardants), it may fall under a different code such as 3920515050 (which has a higher base tariff of 6.5%).

📊 Comparison with Other Codes:

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3920594000 | Acrylic polymer sheets (pure PMMA) | 55.0% | Base 0.0% |

| 3920515050 | Acrylic sheets with flame retardants | 61.5% | Base 6.5% |

| 3926909989 | Other plastic products (general category) | 42.8% | Lower tax, but less specific |

🛠️ Recommendation:

If your product is pure PMMA without additives, HS CODE 3920594000 is the most accurate and appropriate classification. If it contains flame retardants or other additives, consider 3920515050. Always confirm with customs or a classification expert to avoid delays or penalties.

Customer Reviews

No reviews yet.