| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3902300000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5501400000 | Doc | 62.5% | CN | US | 2025-05-12 |

| 3901909000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901205000 | Doc | 61.5% | CN | US | 2025-05-12 |

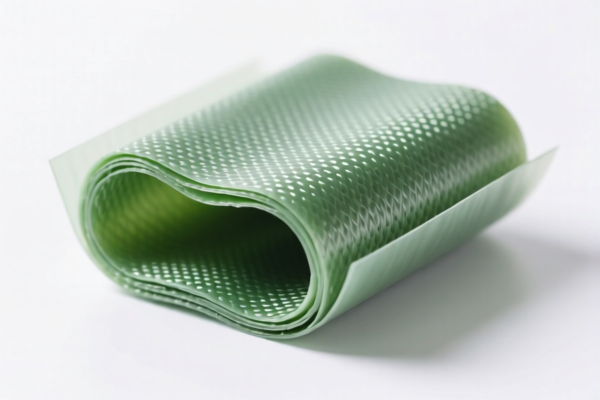

Product Classification and Customs Tariff Analysis for Polypropylene Composite Material Raw Materials

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product: Polypropylene Composite Material Raw Material.

✅ HS CODE: 3902300000

Description: Polypropylene composite material raw material, classified under propylene or other olefins polymers, primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

- Notes:

- This code applies to raw materials in primary polymer form.

- Ensure the product is not processed into finished goods or composite structures, which may fall under different HS codes.

✅ HS CODE: 3902900050

Description: Polypropylene product raw material, classified under propylene or other olefins polymers, primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

- Notes:

- This code is for raw materials used in the production of polypropylene products.

- Confirm the product is in its primary polymer form and not compounded or blended with other materials.

✅ HS CODE: 5501400000

Description: Polypropylene fiber raw material, classified under synthetic fiber short staple, specifically polypropylene synthetic fiber short staple.

- Base Tariff Rate: 7.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 62.5%

- Notes:

- This code applies to short staple synthetic fibers made from polypropylene.

- If the product is in fiber form, this is the correct classification.

- Be aware of the higher total tariff compared to polymer raw materials.

✅ HS CODE: 3901909000

Description: Polyethylene composite film raw material, classified under ethylene polymers, primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

- Notes:

- This code is for polyethylene-based composite film raw materials.

- Ensure the product is in primary polymer form and not processed into films or composites.

✅ HS CODE: 3901205000

Description: Polyethylene composite film raw material, classified under ethylene polymers, primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

- Notes:

- This code is for specific types of polyethylene raw materials.

- Confirm the exact chemical structure and processing stage to avoid misclassification.

📌 Important Reminders:

- Verify Material and Unit Price: Ensure the product is in primary polymer form and not compounded or processed.

- Check Required Certifications: Some HS codes may require material safety data sheets (MSDS) or customs declarations.

- April 11, 2025, Special Tariff: Be aware of the 30% additional tariff after this date.

- Anti-Dumping Duties: Not applicable for these HS codes, but always check for specific anti-dumping or countervailing duties based on the country of origin.

🛑 Action Required:

- Confirm the exact chemical composition and processing stage of the product.

- Consult with a customs broker or classification expert if the product is blended or compounded with other materials.

- Keep updated records of material specifications and supplier documentation for customs compliance. Product Classification and Customs Tariff Analysis for Polypropylene Composite Material Raw Materials

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product: Polypropylene Composite Material Raw Material.

✅ HS CODE: 3902300000

Description: Polypropylene composite material raw material, classified under propylene or other olefins polymers, primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

- Notes:

- This code applies to raw materials in primary polymer form.

- Ensure the product is not processed into finished goods or composite structures, which may fall under different HS codes.

✅ HS CODE: 3902900050

Description: Polypropylene product raw material, classified under propylene or other olefins polymers, primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

- Notes:

- This code is for raw materials used in the production of polypropylene products.

- Confirm the product is in its primary polymer form and not compounded or blended with other materials.

✅ HS CODE: 5501400000

Description: Polypropylene fiber raw material, classified under synthetic fiber short staple, specifically polypropylene synthetic fiber short staple.

- Base Tariff Rate: 7.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 62.5%

- Notes:

- This code applies to short staple synthetic fibers made from polypropylene.

- If the product is in fiber form, this is the correct classification.

- Be aware of the higher total tariff compared to polymer raw materials.

✅ HS CODE: 3901909000

Description: Polyethylene composite film raw material, classified under ethylene polymers, primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

- Notes:

- This code is for polyethylene-based composite film raw materials.

- Ensure the product is in primary polymer form and not processed into films or composites.

✅ HS CODE: 3901205000

Description: Polyethylene composite film raw material, classified under ethylene polymers, primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

- Notes:

- This code is for specific types of polyethylene raw materials.

- Confirm the exact chemical structure and processing stage to avoid misclassification.

📌 Important Reminders:

- Verify Material and Unit Price: Ensure the product is in primary polymer form and not compounded or processed.

- Check Required Certifications: Some HS codes may require material safety data sheets (MSDS) or customs declarations.

- April 11, 2025, Special Tariff: Be aware of the 30% additional tariff after this date.

- Anti-Dumping Duties: Not applicable for these HS codes, but always check for specific anti-dumping or countervailing duties based on the country of origin.

🛑 Action Required:

- Confirm the exact chemical composition and processing stage of the product.

- Consult with a customs broker or classification expert if the product is blended or compounded with other materials.

- Keep updated records of material specifications and supplier documentation for customs compliance.

Customer Reviews

No reviews yet.