| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3902100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3921190010 | Doc | 61.5% | CN | US | 2025-05-12 |

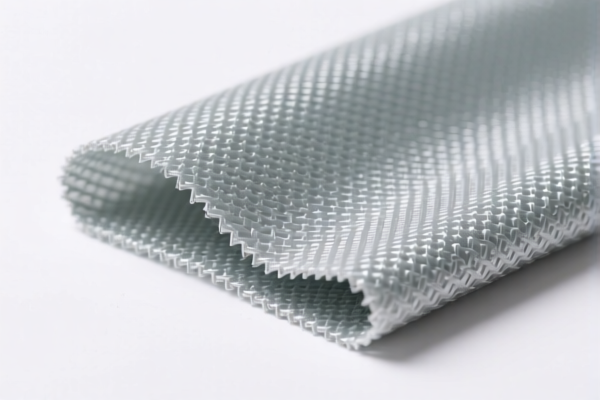

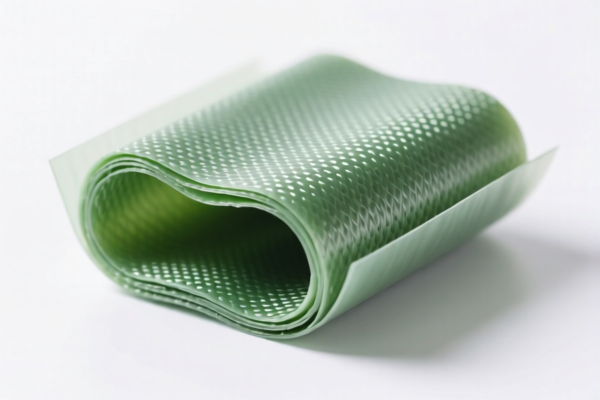

Product Name: Polypropylene Conductive Material Raw Material

Classification HS Codes and Tax Details:

- HS CODE: 3902100000

- Description: Polypropylene pipe material raw material

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3902900050

- Description 1: Polypropylene pipe material raw material

- Description 2: Polypropylene product raw material

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3917220000

- Description: Polypropylene plastic pipe material raw material

- Total Tax Rate: 58.1%

-

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921190010

- Description: Polypropylene conductive film

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties for iron or aluminum are mentioned in the provided data. However, always verify if your product is subject to any ongoing anti-dumping investigations or duties. -

Certifications Required:

Depending on the end-use (e.g., industrial, medical, or consumer), you may need to provide specific certifications (e.g., RoHS, REACH, or safety compliance). Confirm with your customs broker or local authorities.

✅ Proactive Advice:

-

Verify Material and Unit Price:

Ensure the product is correctly classified under the appropriate HS code based on its exact composition and form (e.g., whether it is a film, powder, or compounded material). -

Check for Additional Tariffs:

Be aware of the April 11, 2025 deadline for the special tariff. If your import is scheduled after this date, the 30.0% additional tariff will apply. -

Consult with Customs Broker:

For precise classification and compliance, especially if the product is a composite or modified material, consult a customs broker or a classification expert. Product Name: Polypropylene Conductive Material Raw Material

Classification HS Codes and Tax Details: -

HS CODE: 3902100000

- Description: Polypropylene pipe material raw material

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3902900050

- Description 1: Polypropylene pipe material raw material

- Description 2: Polypropylene product raw material

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3917220000

- Description: Polypropylene plastic pipe material raw material

- Total Tax Rate: 58.1%

-

Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921190010

- Description: Polypropylene conductive film

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties for iron or aluminum are mentioned in the provided data. However, always verify if your product is subject to any ongoing anti-dumping investigations or duties. -

Certifications Required:

Depending on the end-use (e.g., industrial, medical, or consumer), you may need to provide specific certifications (e.g., RoHS, REACH, or safety compliance). Confirm with your customs broker or local authorities.

✅ Proactive Advice:

-

Verify Material and Unit Price:

Ensure the product is correctly classified under the appropriate HS code based on its exact composition and form (e.g., whether it is a film, powder, or compounded material). -

Check for Additional Tariffs:

Be aware of the April 11, 2025 deadline for the special tariff. If your import is scheduled after this date, the 30.0% additional tariff will apply. -

Consult with Customs Broker:

For precise classification and compliance, especially if the product is a composite or modified material, consult a customs broker or a classification expert.

Customer Reviews

No reviews yet.