| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3902900050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902300000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5501400000 | Doc | 62.5% | CN | US | 2025-05-12 |

| 5515290035 | Doc | 55.0% | CN | US | 2025-05-12 |

Product Classification and Tax Information for Polypropylene Corrosion Resistant Material Raw Material

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product:

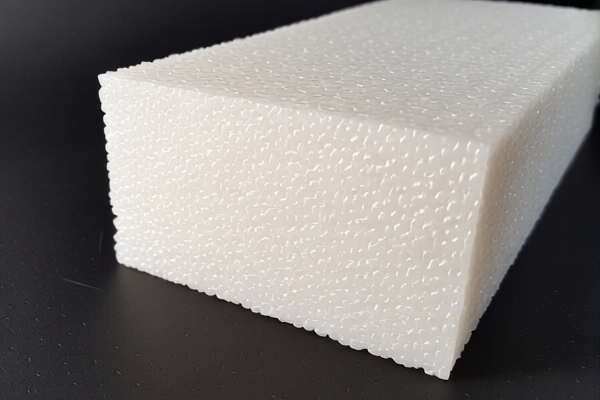

✅ HS CODE: 3902900050

Product Description: Polypropylene corrosion-resistant material raw material, classified under HS code 3902.90.00.50. This code applies to polypropylene, a polymer of propylene or other olefins, in primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3902300000

Product Description: Polypropylene granules raw material, classified under HS code 3902.30.00.00. This code applies to polypropylene, a copolymer of propylene or other olefins, in primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

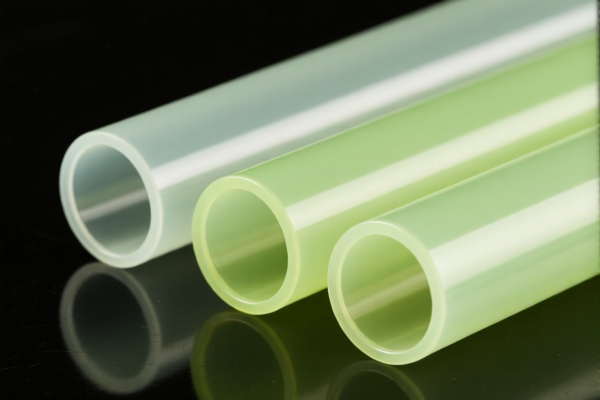

✅ HS CODE: 3902100000

Product Description: Polypropylene pipe material raw material, classified under HS code 3902.10.00.00. This code applies to polypropylene, a polymer of propylene or other olefins, in primary form, including pipe material.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 5501400000

Product Description: Polypropylene fiber raw material, classified under HS code 5501.40.00.00. This code applies to synthetic short fibers, specifically polypropylene short fibers.

- Base Tariff Rate: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.5%

✅ HS CODE: 5515290035

Product Description: Corrosion-resistant fabric made from polypropylene fiber, classified under HS code 5515.29.00.35. This code applies to other synthetic short fiber woven fabrics, specifically those made from polypropylene or modacrylic fibers.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Anti-Dumping Duties: Not applicable for polypropylene materials in this context.

- Certifications Required: Confirm if any specific certifications (e.g., material safety, environmental compliance) are required for customs clearance.

- Material Verification: Verify the exact material composition and unit price to ensure correct HS code classification and tax calculation.

- Documentation: Maintain proper documentation (e.g., commercial invoice, packing list, certificate of origin) to support the declared HS code and tax rate.

If you have further details about the product (e.g., specific application, country of origin, or intended use), I can provide more tailored guidance. Product Classification and Tax Information for Polypropylene Corrosion Resistant Material Raw Material

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product:

✅ HS CODE: 3902900050

Product Description: Polypropylene corrosion-resistant material raw material, classified under HS code 3902.90.00.50. This code applies to polypropylene, a polymer of propylene or other olefins, in primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3902300000

Product Description: Polypropylene granules raw material, classified under HS code 3902.30.00.00. This code applies to polypropylene, a copolymer of propylene or other olefins, in primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3902100000

Product Description: Polypropylene pipe material raw material, classified under HS code 3902.10.00.00. This code applies to polypropylene, a polymer of propylene or other olefins, in primary form, including pipe material.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 5501400000

Product Description: Polypropylene fiber raw material, classified under HS code 5501.40.00.00. This code applies to synthetic short fibers, specifically polypropylene short fibers.

- Base Tariff Rate: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.5%

✅ HS CODE: 5515290035

Product Description: Corrosion-resistant fabric made from polypropylene fiber, classified under HS code 5515.29.00.35. This code applies to other synthetic short fiber woven fabrics, specifically those made from polypropylene or modacrylic fibers.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Anti-Dumping Duties: Not applicable for polypropylene materials in this context.

- Certifications Required: Confirm if any specific certifications (e.g., material safety, environmental compliance) are required for customs clearance.

- Material Verification: Verify the exact material composition and unit price to ensure correct HS code classification and tax calculation.

- Documentation: Maintain proper documentation (e.g., commercial invoice, packing list, certificate of origin) to support the declared HS code and tax rate.

If you have further details about the product (e.g., specific application, country of origin, or intended use), I can provide more tailored guidance.

Customer Reviews

No reviews yet.