| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3902900050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902300000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 5501400000 | Doc | 62.5% | CN | US | 2025-05-12 |

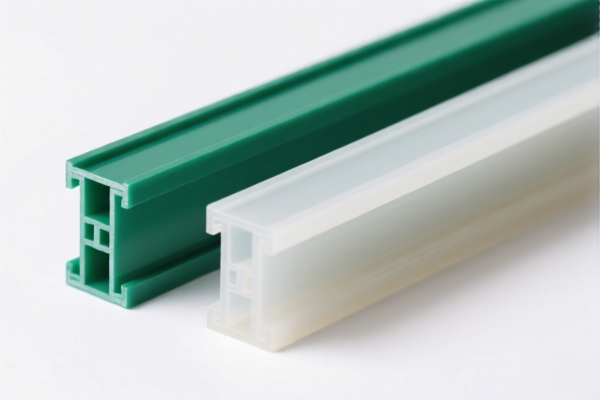

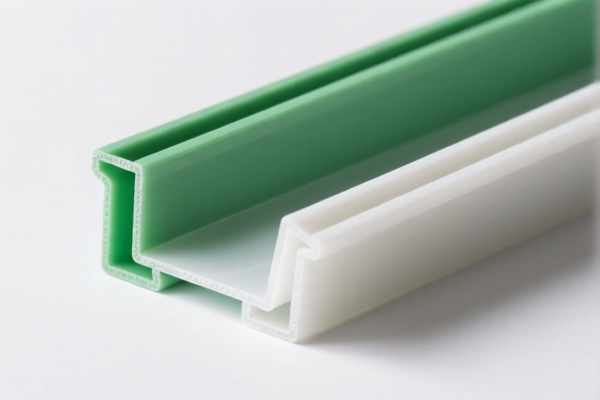

Here is the structured analysis and customs compliance guidance for Polypropylene Profile Raw Material based on the provided HS codes and tariff information:

✅ HS CODE: 3902900050

Product Description: Polypropylene profile raw material, in primary form (polymer of propylene or other olefins).

Total Tax Rate: 61.5%

Breakdown of Tariff Rates:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for polypropylene in primary form, not finished products.

✅ HS CODE: 3902100000

Product Description: Polypropylene profile raw material, in primary form (polymer of propylene or other olefins).

Total Tax Rate: 61.5%

Breakdown of Tariff Rates:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is also for polypropylene in primary form, but may be more specific to certain types of polypropylene.

✅ HS CODE: 3902300000

Product Description: Polypropylene profile raw material, in primary form (copolymer of propylene or other olefins).

Total Tax Rate: 61.5%

Breakdown of Tariff Rates:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for polypropylene copolymer in primary form.

✅ HS CODE: 3917220000

Product Description: Polypropylene profile raw material, possibly in a processed form (e.g., extruded or molded).

Total Tax Rate: 58.1%

Breakdown of Tariff Rates:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code may apply to semi-finished or processed polypropylene products, not just raw material.

✅ HS CODE: 5501400000

Product Description: Polypropylene profile raw material in the form of synthetic fiber short staple (e.g., used in textiles).

Total Tax Rate: 62.5%

Breakdown of Tariff Rates:

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for synthetic fiber short staple, not raw polymer. If your product is in this form, this code applies.

⚠️ Important Notes and Recommendations:

-

Tariff Increase Alert:

A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the exact form of the polypropylene (e.g., raw polymer, copolymer, fiber, or processed product) to ensure correct HS code classification. -

Certifications Required:

Check if any certifications (e.g., RoHS, REACH, or customs documentation) are required for import into the destination country. -

Unit Price and Classification:

Verify the unit price and product description to avoid misclassification, which could lead to delays or penalties. -

Anti-Dumping Duties:

While not explicitly mentioned here, be aware that anti-dumping duties may apply to certain polypropylene imports, especially from specific countries. Confirm with customs or a trade compliance expert if applicable.

📌 Proactive Advice:

- Consult a customs broker or trade compliance expert to confirm the most accurate HS code for your specific product.

- Keep records of material specifications, supplier documentation, and product samples for customs audits.

- Monitor policy updates after April 11, 2025, as the special tariff may change or expand.

Let me know if you need help with HS code selection or customs documentation. Here is the structured analysis and customs compliance guidance for Polypropylene Profile Raw Material based on the provided HS codes and tariff information:

✅ HS CODE: 3902900050

Product Description: Polypropylene profile raw material, in primary form (polymer of propylene or other olefins).

Total Tax Rate: 61.5%

Breakdown of Tariff Rates:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for polypropylene in primary form, not finished products.

✅ HS CODE: 3902100000

Product Description: Polypropylene profile raw material, in primary form (polymer of propylene or other olefins).

Total Tax Rate: 61.5%

Breakdown of Tariff Rates:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is also for polypropylene in primary form, but may be more specific to certain types of polypropylene.

✅ HS CODE: 3902300000

Product Description: Polypropylene profile raw material, in primary form (copolymer of propylene or other olefins).

Total Tax Rate: 61.5%

Breakdown of Tariff Rates:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for polypropylene copolymer in primary form.

✅ HS CODE: 3917220000

Product Description: Polypropylene profile raw material, possibly in a processed form (e.g., extruded or molded).

Total Tax Rate: 58.1%

Breakdown of Tariff Rates:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code may apply to semi-finished or processed polypropylene products, not just raw material.

✅ HS CODE: 5501400000

Product Description: Polypropylene profile raw material in the form of synthetic fiber short staple (e.g., used in textiles).

Total Tax Rate: 62.5%

Breakdown of Tariff Rates:

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code is for synthetic fiber short staple, not raw polymer. If your product is in this form, this code applies.

⚠️ Important Notes and Recommendations:

-

Tariff Increase Alert:

A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the exact form of the polypropylene (e.g., raw polymer, copolymer, fiber, or processed product) to ensure correct HS code classification. -

Certifications Required:

Check if any certifications (e.g., RoHS, REACH, or customs documentation) are required for import into the destination country. -

Unit Price and Classification:

Verify the unit price and product description to avoid misclassification, which could lead to delays or penalties. -

Anti-Dumping Duties:

While not explicitly mentioned here, be aware that anti-dumping duties may apply to certain polypropylene imports, especially from specific countries. Confirm with customs or a trade compliance expert if applicable.

📌 Proactive Advice:

- Consult a customs broker or trade compliance expert to confirm the most accurate HS code for your specific product.

- Keep records of material specifications, supplier documentation, and product samples for customs audits.

- Monitor policy updates after April 11, 2025, as the special tariff may change or expand.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.