Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5402480070 | Doc | 63.0% | CN | US | 2025-05-12 |

| 5402630000 | Doc | 62.5% | CN | US | 2025-05-12 |

| 5806321010 | Doc | 61.0% | CN | US | 2025-05-12 |

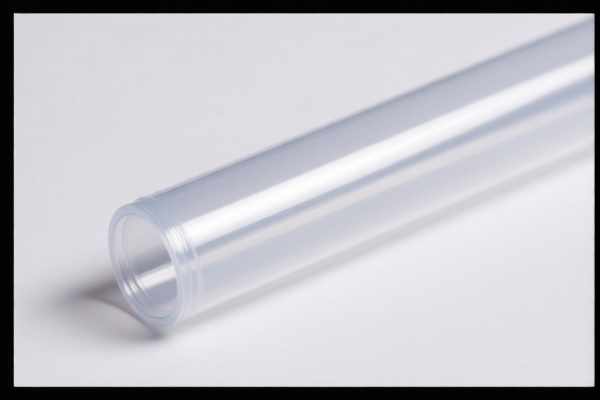

Product Classification: Polypropylene Rigid Tube (Industrial Grade)

HS CODE: 3920.99.10.90 (for polypropylene tubes, not elsewhere specified)

🔍 Classification Notes:

- The product "Polypropylene Rigid Tube (Industrial Grade)" is typically classified under HS CODE 3920.99.10.90.

- This code applies to polypropylene tubes that are rigid, not specifically listed under other more specific codes (e.g., 3920.99.10.10 for tubes of polyethylene, etc.).

📊 Tariff Breakdown (as of current regulations):

- Base Tariff Rate: 5.0%

- Additional Tariffs (if applicable): 25.0% (general additional tariffs)

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is polypropylene, not iron or aluminum)

📌 Total Tax Rate:

- Total Tariff Rate: 60.0% (5.0% + 25.0% + 30.0%)

Note: This is the total if all applicable tariffs are applied after April 11, 2025.

⚠️ Important Alerts:

- April 11, 2025: A special additional tariff of 30.0% will be imposed on this product. Ensure your customs clearance is planned accordingly.

- Material Verification: Confirm that the product is indeed made of polypropylene and not a blend or composite material, which may change the HS code.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific industrial standards) are required for import into the destination country.

✅ Proactive Advice:

- Verify Material Composition: Ensure the product is 100% polypropylene and not mixed with other polymers.

- Check Unit Price: Tariff calculations depend on the declared value, so ensure accurate pricing.

- Consult Customs Broker: For complex cases, especially if the product is used in regulated industries (e.g., chemical or pharmaceutical), consult a customs broker for compliance.

Let me know if you need help with a specific import scenario or documentation.

Product Classification: Polypropylene Rigid Tube (Industrial Grade)

HS CODE: 3920.99.10.90 (for polypropylene tubes, not elsewhere specified)

🔍 Classification Notes:

- The product "Polypropylene Rigid Tube (Industrial Grade)" is typically classified under HS CODE 3920.99.10.90.

- This code applies to polypropylene tubes that are rigid, not specifically listed under other more specific codes (e.g., 3920.99.10.10 for tubes of polyethylene, etc.).

📊 Tariff Breakdown (as of current regulations):

- Base Tariff Rate: 5.0%

- Additional Tariffs (if applicable): 25.0% (general additional tariffs)

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is polypropylene, not iron or aluminum)

📌 Total Tax Rate:

- Total Tariff Rate: 60.0% (5.0% + 25.0% + 30.0%)

Note: This is the total if all applicable tariffs are applied after April 11, 2025.

⚠️ Important Alerts:

- April 11, 2025: A special additional tariff of 30.0% will be imposed on this product. Ensure your customs clearance is planned accordingly.

- Material Verification: Confirm that the product is indeed made of polypropylene and not a blend or composite material, which may change the HS code.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific industrial standards) are required for import into the destination country.

✅ Proactive Advice:

- Verify Material Composition: Ensure the product is 100% polypropylene and not mixed with other polymers.

- Check Unit Price: Tariff calculations depend on the declared value, so ensure accurate pricing.

- Consult Customs Broker: For complex cases, especially if the product is used in regulated industries (e.g., chemical or pharmaceutical), consult a customs broker for compliance.

Let me know if you need help with a specific import scenario or documentation.

Customer Reviews

No reviews yet.