| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

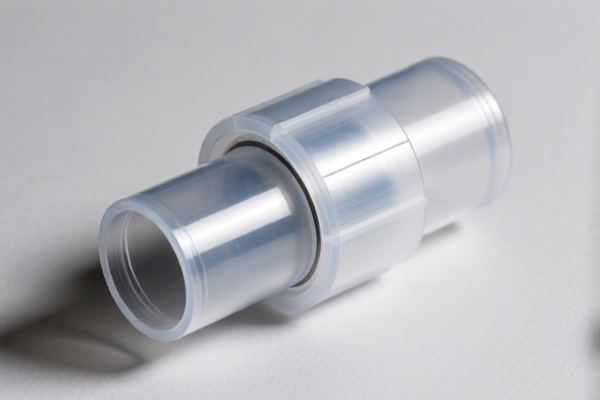

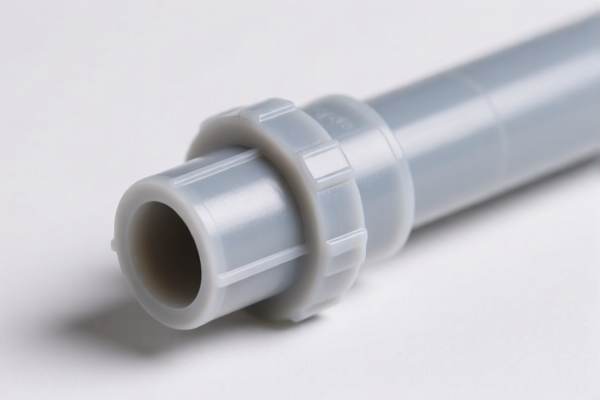

Product Classification: Polypropylene Rigid Tube Connector

HS CODE: 3917220000

🔍 Classification Summary

- Product Name: Polypropylene Rigid Tube Connector

- HS Code: 3917220000

- Description: This code applies to polypropylene rigid tubes and connectors used in industrial or plumbing applications.

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

⚠️ Important Notes on Tariffs

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to imports after this date. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently listed for this product category.

- No Specific Tariffs on Iron/Aluminum: This product is made of polypropylene (a plastic), so anti-dumping duties on metals do not apply.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of polypropylene and not a composite or mixed material, which may fall under a different HS code.

- Check Unit Price and Packaging: Tariff rates may vary based on the unit of measurement (e.g., per piece, per meter).

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or industry-specific standards) are required for import into the destination country.

- Monitor Tariff Updates: Stay informed about any changes in trade policies, especially the April 11, 2025, tariff adjustment.

📚 Example

If you import 1,000 units of polypropylene rigid tube connectors with a total value of $10,000:

- Base Tariff: $10,000 × 3.1% = $310

- General Additional Tariff: $10,000 × 25.0% = $2,500

- Special Tariff (after April 11, 2025): $10,000 × 30.0% = $3,000

- Total Tariff Cost: $5,810 (58.1% of $10,000)

Let me know if you need help with customs documentation or further classification clarification.

Product Classification: Polypropylene Rigid Tube Connector

HS CODE: 3917220000

🔍 Classification Summary

- Product Name: Polypropylene Rigid Tube Connector

- HS Code: 3917220000

- Description: This code applies to polypropylene rigid tubes and connectors used in industrial or plumbing applications.

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

⚠️ Important Notes on Tariffs

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to imports after this date. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently listed for this product category.

- No Specific Tariffs on Iron/Aluminum: This product is made of polypropylene (a plastic), so anti-dumping duties on metals do not apply.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of polypropylene and not a composite or mixed material, which may fall under a different HS code.

- Check Unit Price and Packaging: Tariff rates may vary based on the unit of measurement (e.g., per piece, per meter).

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or industry-specific standards) are required for import into the destination country.

- Monitor Tariff Updates: Stay informed about any changes in trade policies, especially the April 11, 2025, tariff adjustment.

📚 Example

If you import 1,000 units of polypropylene rigid tube connectors with a total value of $10,000:

- Base Tariff: $10,000 × 3.1% = $310

- General Additional Tariff: $10,000 × 25.0% = $2,500

- Special Tariff (after April 11, 2025): $10,000 × 30.0% = $3,000

- Total Tariff Cost: $5,810 (58.1% of $10,000)

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.