| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3902900050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902300000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3902100000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured analysis and classification for Polypropylene Tube Material based on the provided HS codes and tariff details:

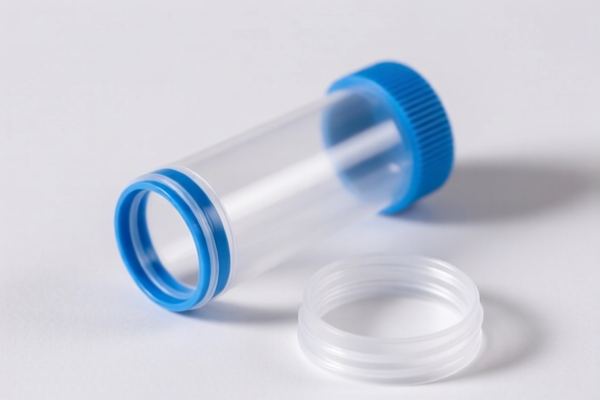

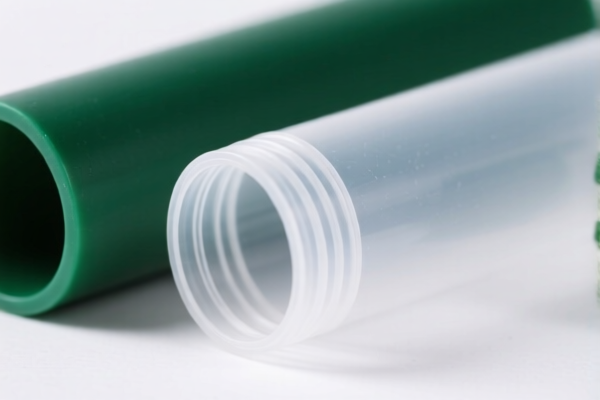

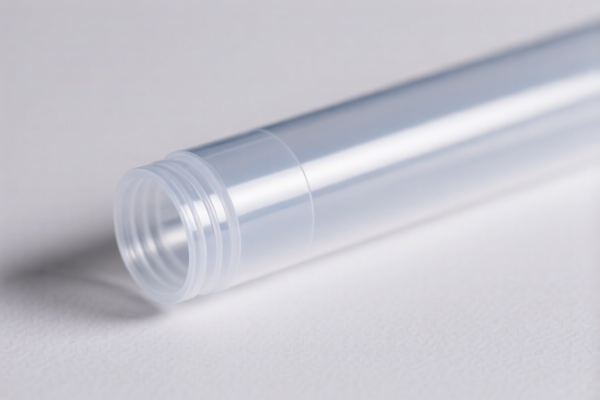

🔍 Product Classification Overview: Polypropylene Tube Material

✅ HS Code: 3902900050

- Description: Polypropylene raw material for tube production, classified as a polymer of propylene or other olefins in primary form.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to raw material, not finished products.

✅ HS Code: 3902300000

- Description: Polypropylene tube material, classified as a polymer of propylene or other olefins in primary form.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for primary form polypropylene used in tube production.

✅ HS Code: 3917320050

- Description: Polypropylene tube, classified under plastic tubes, fittings, and flexible hoses.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to finished polypropylene tubes.

✅ HS Code: 3917220000

- Description: Polypropylene plastic tube, classified under plastic tubes, fittings, and flexible hoses.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for finished polypropylene plastic tubes.

✅ HS Code: 3902100000

- Description: Polypropylene raw material for tube production, classified as a polymer of propylene or other olefins in primary form.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for raw polypropylene used in tube production.

⚠️ Important Notes and Recommendations:

- Tariff Increase Alert:

- After April 11, 2025, an additional 30.0% tariff will be applied to all the above HS codes.

-

This could significantly increase the total import cost. Ensure your import timeline is planned accordingly.

-

Material Clarification:

-

Confirm whether the product is raw material (e.g., polypropylene resin) or finished product (e.g., polypropylene tube). This will determine the correct HS code.

-

Certifications Required:

-

Check if any customs certifications or product compliance documents (e.g., Material Safety Data Sheet, technical specifications) are required for import.

-

Unit Price Verification:

- Verify the unit price and quantity to ensure accurate tariff calculation, especially with the added 30% tariff post-April 11, 2025.

📌 Proactive Advice:

- Consult a customs broker or import compliance expert to confirm the most accurate HS code based on your product's exact specifications.

- Monitor policy updates related to import tariffs, especially after April 11, 2025.

- Consider alternative sourcing or tariff mitigation strategies if the increased tariffs significantly impact your cost structure.

Let me know if you need help determining the correct HS code for your specific product. Here is the structured analysis and classification for Polypropylene Tube Material based on the provided HS codes and tariff details:

🔍 Product Classification Overview: Polypropylene Tube Material

✅ HS Code: 3902900050

- Description: Polypropylene raw material for tube production, classified as a polymer of propylene or other olefins in primary form.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to raw material, not finished products.

✅ HS Code: 3902300000

- Description: Polypropylene tube material, classified as a polymer of propylene or other olefins in primary form.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for primary form polypropylene used in tube production.

✅ HS Code: 3917320050

- Description: Polypropylene tube, classified under plastic tubes, fittings, and flexible hoses.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to finished polypropylene tubes.

✅ HS Code: 3917220000

- Description: Polypropylene plastic tube, classified under plastic tubes, fittings, and flexible hoses.

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for finished polypropylene plastic tubes.

✅ HS Code: 3902100000

- Description: Polypropylene raw material for tube production, classified as a polymer of propylene or other olefins in primary form.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for raw polypropylene used in tube production.

⚠️ Important Notes and Recommendations:

- Tariff Increase Alert:

- After April 11, 2025, an additional 30.0% tariff will be applied to all the above HS codes.

-

This could significantly increase the total import cost. Ensure your import timeline is planned accordingly.

-

Material Clarification:

-

Confirm whether the product is raw material (e.g., polypropylene resin) or finished product (e.g., polypropylene tube). This will determine the correct HS code.

-

Certifications Required:

-

Check if any customs certifications or product compliance documents (e.g., Material Safety Data Sheet, technical specifications) are required for import.

-

Unit Price Verification:

- Verify the unit price and quantity to ensure accurate tariff calculation, especially with the added 30% tariff post-April 11, 2025.

📌 Proactive Advice:

- Consult a customs broker or import compliance expert to confirm the most accurate HS code based on your product's exact specifications.

- Monitor policy updates related to import tariffs, especially after April 11, 2025.

- Consider alternative sourcing or tariff mitigation strategies if the increased tariffs significantly impact your cost structure.

Let me know if you need help determining the correct HS code for your specific product.

Customer Reviews

No reviews yet.