| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

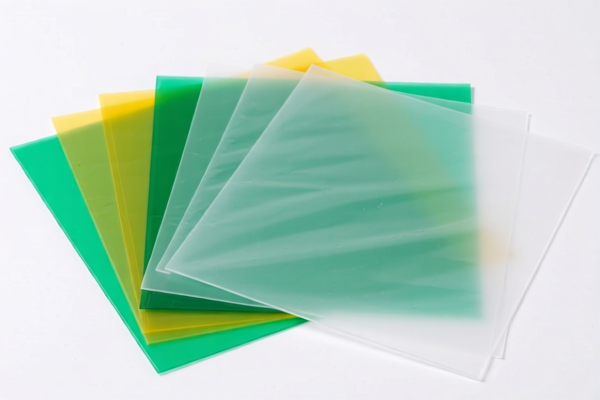

Product Name: Polypropylene plastic sheets

Classification Analysis and Tax Information:

- HS CODE: 3921905050

- Description: Polypropylene (PP) plastic sheets fall under the category of "Other plastic sheets, plates, films, foils and strips" as described in HS CODE 3921.

- Base Tariff Rate: 4.8%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

-

Note: No anti-dumping duties or special tariffs apply for this code.

-

HS CODE: 3920995000

- Description: This code applies to "Other plastic sheets, plates, films, foils and strips, not cellular, not reinforced, not laminated, not supported or otherwise combined with other materials." Polypropylene plastic sheets fit this description.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

-

Note: This code is used for multiple plastic sheet types, including polypropylene. Ensure the product is not laminated or combined with other materials, as this would change the classification.

-

HS CODE: 3920100000

- Description: This code is for "Polyethylene sheets, plates, etc." and is not applicable to polypropylene.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

-

Note: This code is for polyethylene, not polypropylene. Ensure the material is correctly identified to avoid misclassification.

-

HS CODE: 3920632000

- Description: This code is for "Polyester sheets, plates, etc." and is not applicable to polypropylene.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

- Note: This code is for polyester, not polypropylene. Confirm the material type to avoid classification errors.

✅ Proactive Advice:

- Verify Material: Confirm that the product is indeed polypropylene (PP) and not another type of plastic (e.g., polyethylene or polyester), as this will determine the correct HS CODE.

- Check Product Specifications: Ensure the plastic sheets are not laminated, reinforced, or combined with other materials, as this may change the classification to a different HS CODE.

- Review Tariff Changes: Be aware that additional tariffs of 30.0% will apply after April 11, 2025 for several of these codes.

- Certifications: Confirm if any certifications (e.g., RoHS, REACH) are required for import into the destination country.

Let me know if you need help with customs documentation or further classification clarification.

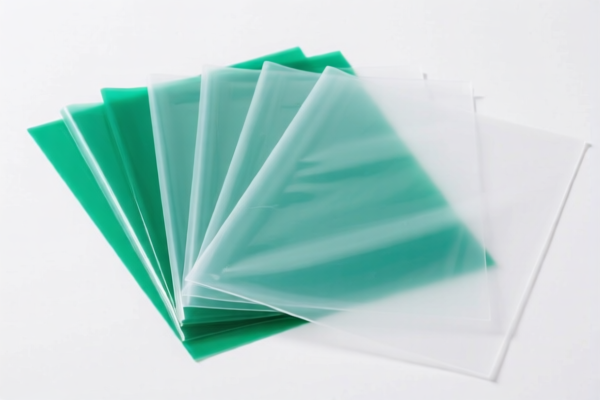

Product Name: Polypropylene plastic sheets

Classification Analysis and Tax Information:

- HS CODE: 3921905050

- Description: Polypropylene (PP) plastic sheets fall under the category of "Other plastic sheets, plates, films, foils and strips" as described in HS CODE 3921.

- Base Tariff Rate: 4.8%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

-

Note: No anti-dumping duties or special tariffs apply for this code.

-

HS CODE: 3920995000

- Description: This code applies to "Other plastic sheets, plates, films, foils and strips, not cellular, not reinforced, not laminated, not supported or otherwise combined with other materials." Polypropylene plastic sheets fit this description.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

-

Note: This code is used for multiple plastic sheet types, including polypropylene. Ensure the product is not laminated or combined with other materials, as this would change the classification.

-

HS CODE: 3920100000

- Description: This code is for "Polyethylene sheets, plates, etc." and is not applicable to polypropylene.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

-

Note: This code is for polyethylene, not polypropylene. Ensure the material is correctly identified to avoid misclassification.

-

HS CODE: 3920632000

- Description: This code is for "Polyester sheets, plates, etc." and is not applicable to polypropylene.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

- Note: This code is for polyester, not polypropylene. Confirm the material type to avoid classification errors.

✅ Proactive Advice:

- Verify Material: Confirm that the product is indeed polypropylene (PP) and not another type of plastic (e.g., polyethylene or polyester), as this will determine the correct HS CODE.

- Check Product Specifications: Ensure the plastic sheets are not laminated, reinforced, or combined with other materials, as this may change the classification to a different HS CODE.

- Review Tariff Changes: Be aware that additional tariffs of 30.0% will apply after April 11, 2025 for several of these codes.

- Certifications: Confirm if any certifications (e.g., RoHS, REACH) are required for import into the destination country.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.