| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

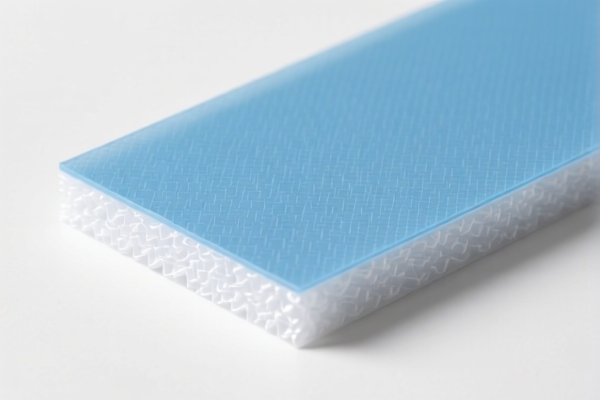

Product Name: Polystyrene Polymer Plastic Composite Sheet

Classification Reference: Based on the provided HS codes and descriptions, the product may fall under one of the following classifications. Please verify the exact composition and specifications of your product to ensure accurate classification.

🔍 HS Code Classification Overview

| HS Code | Product Description | Total Tax Rate | Tax Breakdown |

|---|---|---|---|

| 3920100000 | Polyethylene composite sheet | 59.2% | - Base tariff: 4.2% - Additional tariff: 25.0% - After April 2, 2025: Additional tariff 30.0% |

| 3920991000 | Polyethylene composite material sheet | 61.0% | - Base tariff: 6.0% - Additional tariff: 25.0% - After April 2, 2025: Additional tariff 30.0% |

| 3921902550 | Polyester fiber plastic composite sheet | 61.5% | - Base tariff: 6.5% - Additional tariff: 25.0% - After April 2, 2025: Additional tariff 30.0% |

| 3921902550 | Polypropylene fiber plastic composite sheet | 61.5% | - Base tariff: 6.5% - Additional tariff: 25.0% - After April 2, 2025: Additional tariff 30.0% |

| 3920690000 | Polyester composite sheet | 59.2% | - Base tariff: 4.2% - Additional tariff: 25.0% - After April 2, 2025: Additional tariff 30.0% |

⚠️ Important Notes and Alerts

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are listed for these HS codes in the provided data. However, it is recommended to check the latest anti-dumping duty lists from the customs authority for any applicable duties. -

Material and Certification Verification:

Ensure that your product's material composition (e.g., whether it is polyethylene, polyester, or polypropylene-based) matches the HS code description.

Also, confirm if certifications (e.g., RoHS, REACH, or other import compliance documents) are required for the destination market.

✅ Proactive Advice for Importers

- Verify the exact composition of your product (e.g., base polymer, fiber type, and additives) to ensure correct HS code classification.

- Check the unit price and total value of the product, as this may affect the applicable tariff rate (e.g., preferential rates for certain countries).

- Consult with customs brokers or legal advisors to confirm the most up-to-date HS code and tariff information, especially for products with complex compositions.

- Plan for the April 2, 2025 tariff increase to avoid unexpected costs in your import budget.

If you provide more details about the material composition and intended market, I can help you further refine the HS code and tax implications.

Product Name: Polystyrene Polymer Plastic Composite Sheet

Classification Reference: Based on the provided HS codes and descriptions, the product may fall under one of the following classifications. Please verify the exact composition and specifications of your product to ensure accurate classification.

🔍 HS Code Classification Overview

| HS Code | Product Description | Total Tax Rate | Tax Breakdown |

|---|---|---|---|

| 3920100000 | Polyethylene composite sheet | 59.2% | - Base tariff: 4.2% - Additional tariff: 25.0% - After April 2, 2025: Additional tariff 30.0% |

| 3920991000 | Polyethylene composite material sheet | 61.0% | - Base tariff: 6.0% - Additional tariff: 25.0% - After April 2, 2025: Additional tariff 30.0% |

| 3921902550 | Polyester fiber plastic composite sheet | 61.5% | - Base tariff: 6.5% - Additional tariff: 25.0% - After April 2, 2025: Additional tariff 30.0% |

| 3921902550 | Polypropylene fiber plastic composite sheet | 61.5% | - Base tariff: 6.5% - Additional tariff: 25.0% - After April 2, 2025: Additional tariff 30.0% |

| 3920690000 | Polyester composite sheet | 59.2% | - Base tariff: 4.2% - Additional tariff: 25.0% - After April 2, 2025: Additional tariff 30.0% |

⚠️ Important Notes and Alerts

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are listed for these HS codes in the provided data. However, it is recommended to check the latest anti-dumping duty lists from the customs authority for any applicable duties. -

Material and Certification Verification:

Ensure that your product's material composition (e.g., whether it is polyethylene, polyester, or polypropylene-based) matches the HS code description.

Also, confirm if certifications (e.g., RoHS, REACH, or other import compliance documents) are required for the destination market.

✅ Proactive Advice for Importers

- Verify the exact composition of your product (e.g., base polymer, fiber type, and additives) to ensure correct HS code classification.

- Check the unit price and total value of the product, as this may affect the applicable tariff rate (e.g., preferential rates for certain countries).

- Consult with customs brokers or legal advisors to confirm the most up-to-date HS code and tariff information, especially for products with complex compositions.

- Plan for the April 2, 2025 tariff increase to avoid unexpected costs in your import budget.

If you provide more details about the material composition and intended market, I can help you further refine the HS code and tax implications.

Customer Reviews

No reviews yet.