| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920300000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

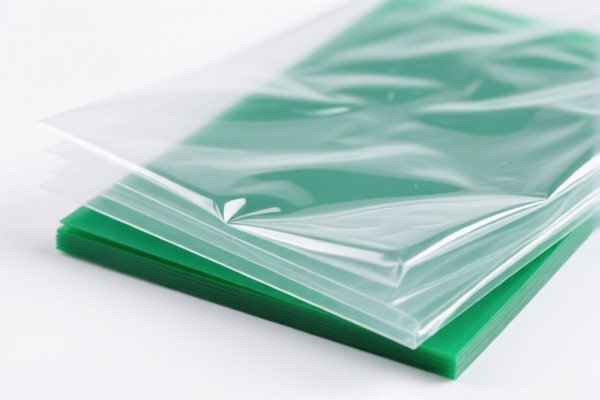

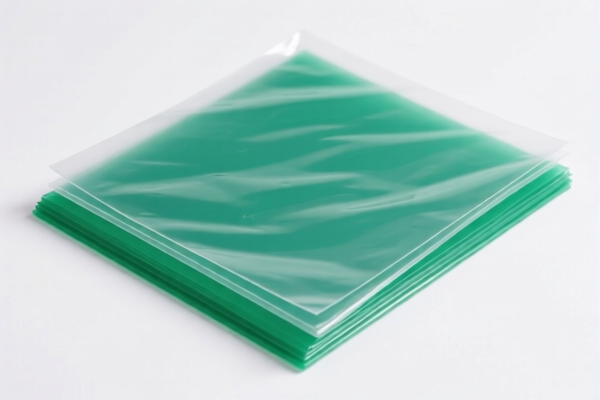

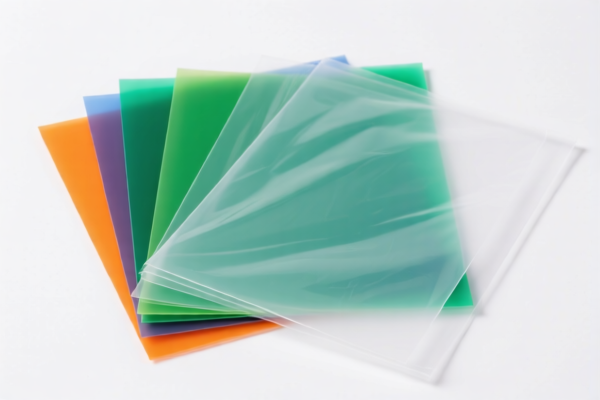

Product Classification: Polystyrene Polymer Plastic Sheets

HS CODE: 3920300000, 3920995000, 3903190000, 3921110000, 3921905050

🔍 Classification Overview

Polystyrene polymer plastic sheets fall under several HS codes depending on their form, composition, and whether they are combined with other materials. Below is a breakdown of the relevant HS codes and their associated tariffs:

📌 HS Code: 3920300000

Description: Non-cellular and non-reinforced polystyrene polymer plastic sheets, films, foils, and strips.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code is for pure polystyrene sheets without any reinforcement or combination with other materials.

- Ensure the product is non-cellular (i.e., not foam) and not reinforced (e.g., with fibers or fillers).

📌 HS Code: 3920995000

Description: Other non-cellular and non-reinforced plastic sheets, films, foils, and strips, layered, supported, or combined with other materials.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code applies to plastic sheets that are combined with other materials (e.g., layered or laminated).

- If your product is not pure polystyrene or is combined with other materials, this may be the correct classification.

📌 HS Code: 3903190000

Description: Primary forms of styrene polymers.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for raw or primary forms of polystyrene (e.g., pellets or resins), not finished sheets.

- If your product is in raw polymer form, this is the correct code.

📌 HS Code: 3921110000

Description: Polystyrene foam plastic sheets.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This code is for foam sheets made of polystyrene.

- If your product is cellular (i.e., foam), this is the correct classification.

📌 HS Code: 3921905050

Description: Other plastic sheets, films, foils, and strips.

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- This code is for other plastic sheets that do not fall under the above categories.

- The additional tariff is 0%, which may be beneficial for certain products.

- Ensure your product does not fall under any of the more specific codes (e.g., 3920300000 or 3921110000).

⚠️ Important Alerts

- April 11, 2025 Special Tariff: All the above codes will have an additional 30% tariff applied after this date.

- Anti-dumping duties: Not applicable for polystyrene polymer sheets (unless specific to iron/aluminum, which is not the case here).

- Material Verification: Confirm the exact composition of your product (e.g., is it foam, reinforced, or combined with other materials?).

- Certifications: Check if any customs certifications or product standards are required for import (e.g., RoHS, REACH, etc.).

✅ Proactive Advice

- Verify the product form (sheet, foam, combined, etc.) and material composition to ensure correct HS code.

- Check the unit price and total value to determine if any preferential tariffs apply.

- Consult a customs broker or import compliance expert for final classification and documentation.

Let me know if you need help determining the correct HS code for your specific product.

Product Classification: Polystyrene Polymer Plastic Sheets

HS CODE: 3920300000, 3920995000, 3903190000, 3921110000, 3921905050

🔍 Classification Overview

Polystyrene polymer plastic sheets fall under several HS codes depending on their form, composition, and whether they are combined with other materials. Below is a breakdown of the relevant HS codes and their associated tariffs:

📌 HS Code: 3920300000

Description: Non-cellular and non-reinforced polystyrene polymer plastic sheets, films, foils, and strips.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code is for pure polystyrene sheets without any reinforcement or combination with other materials.

- Ensure the product is non-cellular (i.e., not foam) and not reinforced (e.g., with fibers or fillers).

📌 HS Code: 3920995000

Description: Other non-cellular and non-reinforced plastic sheets, films, foils, and strips, layered, supported, or combined with other materials.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes:

- This code applies to plastic sheets that are combined with other materials (e.g., layered or laminated).

- If your product is not pure polystyrene or is combined with other materials, this may be the correct classification.

📌 HS Code: 3903190000

Description: Primary forms of styrene polymers.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for raw or primary forms of polystyrene (e.g., pellets or resins), not finished sheets.

- If your product is in raw polymer form, this is the correct code.

📌 HS Code: 3921110000

Description: Polystyrene foam plastic sheets.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This code is for foam sheets made of polystyrene.

- If your product is cellular (i.e., foam), this is the correct classification.

📌 HS Code: 3921905050

Description: Other plastic sheets, films, foils, and strips.

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

Key Notes:

- This code is for other plastic sheets that do not fall under the above categories.

- The additional tariff is 0%, which may be beneficial for certain products.

- Ensure your product does not fall under any of the more specific codes (e.g., 3920300000 or 3921110000).

⚠️ Important Alerts

- April 11, 2025 Special Tariff: All the above codes will have an additional 30% tariff applied after this date.

- Anti-dumping duties: Not applicable for polystyrene polymer sheets (unless specific to iron/aluminum, which is not the case here).

- Material Verification: Confirm the exact composition of your product (e.g., is it foam, reinforced, or combined with other materials?).

- Certifications: Check if any customs certifications or product standards are required for import (e.g., RoHS, REACH, etc.).

✅ Proactive Advice

- Verify the product form (sheet, foam, combined, etc.) and material composition to ensure correct HS code.

- Check the unit price and total value to determine if any preferential tariffs apply.

- Consult a customs broker or import compliance expert for final classification and documentation.

Let me know if you need help determining the correct HS code for your specific product.

Customer Reviews

No reviews yet.