| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920200055 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920300000 | Doc | 60.8% | CN | US | 2025-05-12 |

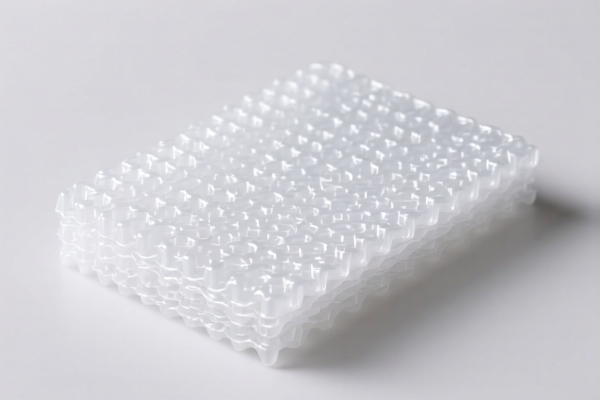

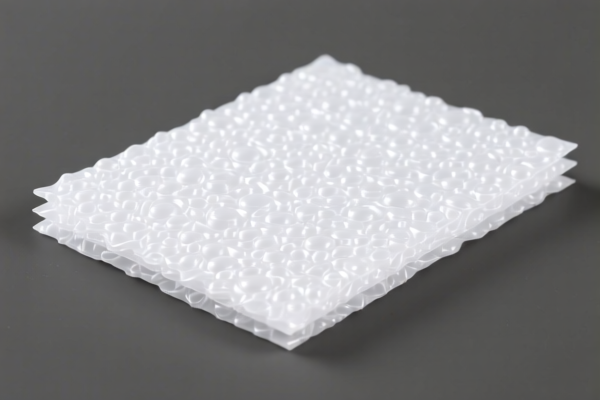

Product Name: Polystyrene Polymer Plastic Supported Sheet

Classification HS Code Analysis and Customs Compliance Guidance:

✅ HS Code Options and Tax Rates:

- HS Code: 3920995000

- Description: Other plastic sheets, plates, films, foils, and strips, non-cellular and not reinforced, laminated, supported, or otherwise combined with other materials.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Applicable if: The product is a composite of plastic and other materials, not reinforced, and not classified under more specific codes.

-

HS Code: 3903190000

- Description: Primary forms of polystyrene polymers.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Applicable if: The product is in its primary form (e.g., pellets, granules), not processed into sheets or films.

-

HS Code: 3920100000

- Description: Non-cellular plastics and non-reinforced plastics, laminated or otherwise combined with other materials.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Applicable if: The product is a composite of non-cellular, non-reinforced plastic with other materials.

-

HS Code: 3920200055

- Description: Polypropylene polymer, supported or otherwise combined with other materials, in the form of sheets, plates, films, foils, and strips.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Applicable if: The product is polypropylene-based and combined with other materials.

-

HS Code: 3920300000

- Description: Polystyrene polymer, supported or otherwise combined with other materials, in the form of sheets, plates, films, foils, and strips.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Applicable if: The product is a polystyrene polymer sheet or film combined with other materials.

⚠️ Important Notes:

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is recommended to check the latest China Customs Anti-Dumping Duty List for any applicable duties. -

Certifications Required:

Depending on the end-use (e.g., food contact, medical, or industrial), additional certifications (e.g., FDA, RoHS, REACH) may be required. Confirm with the importing country’s regulatory body.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified based on its material type (e.g., polystyrene vs. polypropylene) and structure (e.g., supported, laminated, or composite).

- Check Unit Price and Tax Impact: The additional tariffs can significantly increase the total cost. Calculate the total tax burden based on the product value and HS code.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is a composite or has multiple components.

- Update Classification Post-April 2, 2025: Be prepared for the 30.0% additional tariff and adjust pricing or sourcing strategies accordingly.

Let me know if you need help with HS code selection or customs documentation.

Product Name: Polystyrene Polymer Plastic Supported Sheet

Classification HS Code Analysis and Customs Compliance Guidance:

✅ HS Code Options and Tax Rates:

- HS Code: 3920995000

- Description: Other plastic sheets, plates, films, foils, and strips, non-cellular and not reinforced, laminated, supported, or otherwise combined with other materials.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Applicable if: The product is a composite of plastic and other materials, not reinforced, and not classified under more specific codes.

-

HS Code: 3903190000

- Description: Primary forms of polystyrene polymers.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Applicable if: The product is in its primary form (e.g., pellets, granules), not processed into sheets or films.

-

HS Code: 3920100000

- Description: Non-cellular plastics and non-reinforced plastics, laminated or otherwise combined with other materials.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Applicable if: The product is a composite of non-cellular, non-reinforced plastic with other materials.

-

HS Code: 3920200055

- Description: Polypropylene polymer, supported or otherwise combined with other materials, in the form of sheets, plates, films, foils, and strips.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Applicable if: The product is polypropylene-based and combined with other materials.

-

HS Code: 3920300000

- Description: Polystyrene polymer, supported or otherwise combined with other materials, in the form of sheets, plates, films, foils, and strips.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Applicable if: The product is a polystyrene polymer sheet or film combined with other materials.

⚠️ Important Notes:

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is recommended to check the latest China Customs Anti-Dumping Duty List for any applicable duties. -

Certifications Required:

Depending on the end-use (e.g., food contact, medical, or industrial), additional certifications (e.g., FDA, RoHS, REACH) may be required. Confirm with the importing country’s regulatory body.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified based on its material type (e.g., polystyrene vs. polypropylene) and structure (e.g., supported, laminated, or composite).

- Check Unit Price and Tax Impact: The additional tariffs can significantly increase the total cost. Calculate the total tax burden based on the product value and HS code.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is a composite or has multiple components.

- Update Classification Post-April 2, 2025: Be prepared for the 30.0% additional tariff and adjust pricing or sourcing strategies accordingly.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.