| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

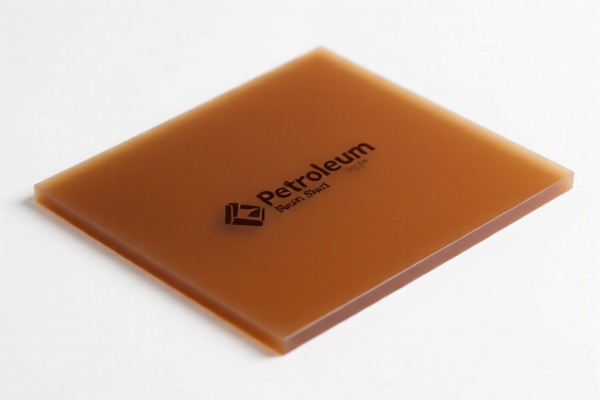

Product Name: Polystyrene Resin Sheet

Classification HS Code: 3903190000 (for polystyrene resin sheets in primary form)

Note: If the product is a sheet made of polystyrene resin, and is not cellularized or reinforced, and is not laminated or combined with other materials, then HS Code 3903190000 is the most accurate classification.

🔍 HS Code Details: 3903190000

- HS CODE: 3903190000

- Description: Polymers of styrene, in primary form (e.g., polystyrene resin sheets)

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 Key Tax Rate Changes (April 11, 2025 onwards)

- Additional Tariff: 25.0% (applies to all imports)

- Special Tariff (after April 11, 2025): 30.0% (increased from 25.0%)

- Total Tax Rate (after April 11, 2025): 6.5% + 25.0% + 30.0% = 61.5%

⚠️ Important Notes and Alerts

- Anti-dumping duties: Not applicable for polystyrene resin sheets (unless specific anti-dumping measures are in place for this product, which should be verified separately).

- April 11, 2025 Policy Update: The additional tariff will increase from 25.0% to 30.0% after this date. Ensure your import timeline aligns with this change.

- Material Verification: Confirm that the product is not cellularized, not reinforced, and not laminated with other materials. If it is, it may fall under a different HS code (e.g., 3920995000).

✅ Proactive Advice for Importers

- Verify Material Composition: Ensure the product is pure polystyrene resin and not a composite or modified material.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH) are required for customs clearance.

- Consult Tariff Updates: Stay informed about tariff changes after April 11, 2025, and consider import timing to optimize costs.

- Review HS Code Classification: If the product is laminated, cellular, or reinforced, it may be classified under 3920995000 or another code.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Product Name: Polystyrene Resin Sheet

Classification HS Code: 3903190000 (for polystyrene resin sheets in primary form)

Note: If the product is a sheet made of polystyrene resin, and is not cellularized or reinforced, and is not laminated or combined with other materials, then HS Code 3903190000 is the most accurate classification.

🔍 HS Code Details: 3903190000

- HS CODE: 3903190000

- Description: Polymers of styrene, in primary form (e.g., polystyrene resin sheets)

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

📌 Key Tax Rate Changes (April 11, 2025 onwards)

- Additional Tariff: 25.0% (applies to all imports)

- Special Tariff (after April 11, 2025): 30.0% (increased from 25.0%)

- Total Tax Rate (after April 11, 2025): 6.5% + 25.0% + 30.0% = 61.5%

⚠️ Important Notes and Alerts

- Anti-dumping duties: Not applicable for polystyrene resin sheets (unless specific anti-dumping measures are in place for this product, which should be verified separately).

- April 11, 2025 Policy Update: The additional tariff will increase from 25.0% to 30.0% after this date. Ensure your import timeline aligns with this change.

- Material Verification: Confirm that the product is not cellularized, not reinforced, and not laminated with other materials. If it is, it may fall under a different HS code (e.g., 3920995000).

✅ Proactive Advice for Importers

- Verify Material Composition: Ensure the product is pure polystyrene resin and not a composite or modified material.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH) are required for customs clearance.

- Consult Tariff Updates: Stay informed about tariff changes after April 11, 2025, and consider import timing to optimize costs.

- Review HS Code Classification: If the product is laminated, cellular, or reinforced, it may be classified under 3920995000 or another code.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.