| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3903110000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3903110000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the customs classification and tariff details for Polystyrene Resin for Building Insulation, based on the provided HS codes and tax information:

🔍 Product Classification Overview

Product Name: Polystyrene Resin for Building Insulation

HS Codes and Descriptions:

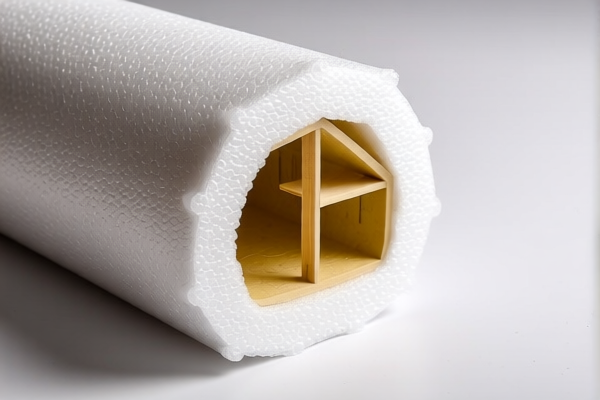

- 3903190000 – Polystyrene for building insulation

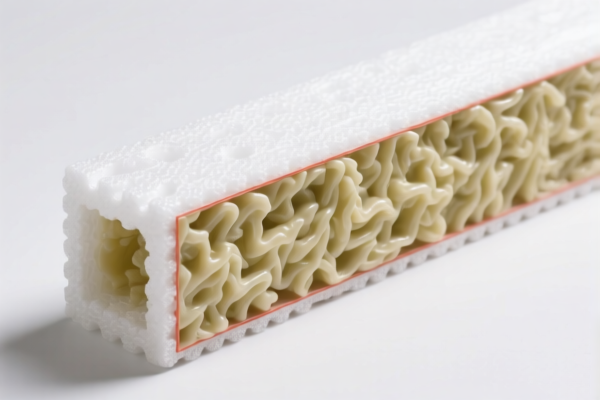

- 3921110000 – Polystyrene foam boards (for building insulation)

- 3921110000 – Polystyrene foam sheets (for building insulation)

- 3903110000 – Polystyrene resin for foaming

- 3903110000 – Polystyrene foaming resin

📊 Tariff Breakdown (as of now)

✅ Base Tariff Rate

- 6.5% for 3903110000 and 3903190000

- 5.3% for 3921110000

🚫 Additional Tariffs (Currently in Effect)

- 25.0% added to the base rate for all listed HS codes

⏳ Special Tariff After April 11, 2025

- 30.0% additional tariff will be imposed on all listed HS codes after April 11, 2025

⚠️ Anti-Dumping Duties (Not Applicable)

- No specific anti-dumping duties are listed for these HS codes at this time.

📌 Total Tax Rates

| HS Code | Description | Total Tax Rate |

|---|---|---|

| 3903190000 | Polystyrene for building insulation | 61.5% |

| 3921110000 | Polystyrene foam boards | 60.3% |

| 3921110000 | Polystyrene foam sheets | 60.3% |

| 3903110000 | Polystyrene resin for foaming | 61.5% |

| 3903110000 | Polystyrene foaming resin | 61.5% |

📢 Important Reminders and Actions

- Verify Material Specifications: Ensure the product is correctly classified under the appropriate HS code based on its form (e.g., resin vs. foam board).

- Check Unit Price: Tariff calculations depend on the declared value, so confirm the unit price and total value.

- Certifications Required: Some countries may require specific certifications (e.g., fire resistance, environmental compliance) for building insulation materials.

- Monitor April 11, 2025 Deadline: Be prepared for a 30% increase in tariffs after this date. Consider adjusting pricing or logistics accordingly.

- Consult Local Customs Authority: For the most up-to-date and region-specific tariff information.

Let me know if you need help with customs documentation or compliance checks for these products. Here is the structured and professional breakdown of the customs classification and tariff details for Polystyrene Resin for Building Insulation, based on the provided HS codes and tax information:

🔍 Product Classification Overview

Product Name: Polystyrene Resin for Building Insulation

HS Codes and Descriptions:

- 3903190000 – Polystyrene for building insulation

- 3921110000 – Polystyrene foam boards (for building insulation)

- 3921110000 – Polystyrene foam sheets (for building insulation)

- 3903110000 – Polystyrene resin for foaming

- 3903110000 – Polystyrene foaming resin

📊 Tariff Breakdown (as of now)

✅ Base Tariff Rate

- 6.5% for 3903110000 and 3903190000

- 5.3% for 3921110000

🚫 Additional Tariffs (Currently in Effect)

- 25.0% added to the base rate for all listed HS codes

⏳ Special Tariff After April 11, 2025

- 30.0% additional tariff will be imposed on all listed HS codes after April 11, 2025

⚠️ Anti-Dumping Duties (Not Applicable)

- No specific anti-dumping duties are listed for these HS codes at this time.

📌 Total Tax Rates

| HS Code | Description | Total Tax Rate |

|---|---|---|

| 3903190000 | Polystyrene for building insulation | 61.5% |

| 3921110000 | Polystyrene foam boards | 60.3% |

| 3921110000 | Polystyrene foam sheets | 60.3% |

| 3903110000 | Polystyrene resin for foaming | 61.5% |

| 3903110000 | Polystyrene foaming resin | 61.5% |

📢 Important Reminders and Actions

- Verify Material Specifications: Ensure the product is correctly classified under the appropriate HS code based on its form (e.g., resin vs. foam board).

- Check Unit Price: Tariff calculations depend on the declared value, so confirm the unit price and total value.

- Certifications Required: Some countries may require specific certifications (e.g., fire resistance, environmental compliance) for building insulation materials.

- Monitor April 11, 2025 Deadline: Be prepared for a 30% increase in tariffs after this date. Consider adjusting pricing or logistics accordingly.

- Consult Local Customs Authority: For the most up-to-date and region-specific tariff information.

Let me know if you need help with customs documentation or compliance checks for these products.

Customer Reviews

No reviews yet.