Found 4 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903110000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921110000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921190090 | Doc | 61.5% | CN | US | 2025-05-12 |

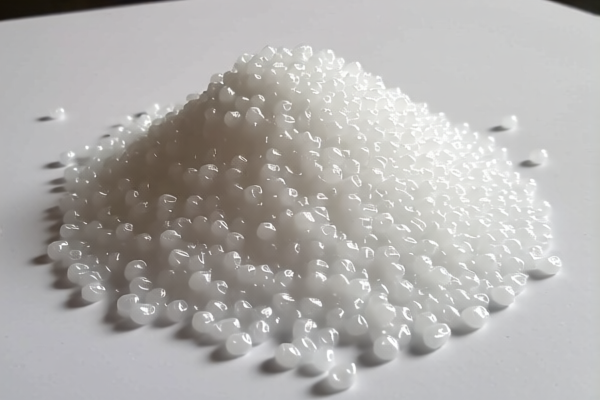

Product Name: Polystyrene Resin for Foam Plastics

Classification HS Codes and Tax Details:

- HS CODE: 3903110000

- Description: Polystyrene Resin for Foam Plastics, which belongs to the primary form of styrene polymers, consistent with the classification under HS Chapter 3903.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3903190000

- Description: Polystyrene Resin for Foam Plastics, which is a downstream product of styrene polymers, related to the scope of HS Chapter 3903.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921110000

- Description: Polystyrene Resin for Foam Plastics, which fits the description of HS Code 3921110000.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921190090

- Description: Polystyrene Resin for Foam Plastics, which fits the description of HS Code 3921190090.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after this date. Ensure your import timeline is planned accordingly.

- Anti-Dumping Duties: Not specifically mentioned for this product, but always verify if any anti-dumping or countervailing duties apply based on the origin of the goods.

- Material and Certification Verification: Confirm the exact chemical composition and whether the product is in its primary or processed form, as this can affect the correct HS code.

- Unit Price and Documentation: Ensure accurate documentation, including commercial invoices and certificates of origin, to avoid delays or penalties during customs clearance.

If you are unsure about the exact classification, it is recommended to consult a customs broker or a classification expert for confirmation.

Product Name: Polystyrene Resin for Foam Plastics

Classification HS Codes and Tax Details:

- HS CODE: 3903110000

- Description: Polystyrene Resin for Foam Plastics, which belongs to the primary form of styrene polymers, consistent with the classification under HS Chapter 3903.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3903190000

- Description: Polystyrene Resin for Foam Plastics, which is a downstream product of styrene polymers, related to the scope of HS Chapter 3903.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921110000

- Description: Polystyrene Resin for Foam Plastics, which fits the description of HS Code 3921110000.

- Total Tax Rate: 60.3%

-

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3921190090

- Description: Polystyrene Resin for Foam Plastics, which fits the description of HS Code 3921190090.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after this date. Ensure your import timeline is planned accordingly.

- Anti-Dumping Duties: Not specifically mentioned for this product, but always verify if any anti-dumping or countervailing duties apply based on the origin of the goods.

- Material and Certification Verification: Confirm the exact chemical composition and whether the product is in its primary or processed form, as this can affect the correct HS code.

- Unit Price and Documentation: Ensure accurate documentation, including commercial invoices and certificates of origin, to avoid delays or penalties during customs clearance.

If you are unsure about the exact classification, it is recommended to consult a customs broker or a classification expert for confirmation.

Customer Reviews

No reviews yet.