| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911100000 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

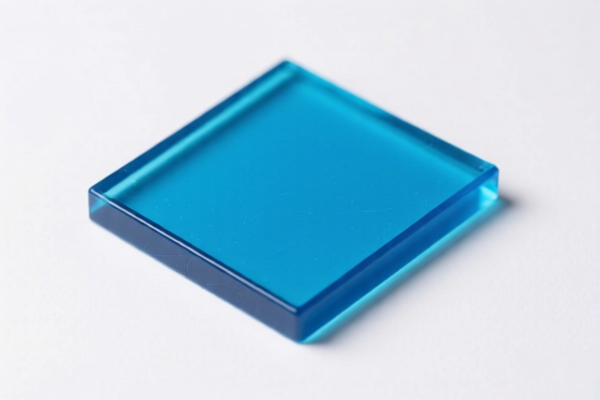

Product Name: Polysulfone Resin

Classification: HS CODEs related to Polysulfone Resin (various forms and compositions)

✅ HS CODE Overview and Tax Rates

Below is a structured summary of the HS CODEs and associated tariff rates for Polysulfone Resin and its related products:

🔢 1. HS CODE: 3911909110

Product Description: Polysulfone Resin (thermoplastic)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Notes:

- This code applies to thermoplastic forms of polysulfone resin.

- Ensure the product is not in a composite or processed form, as that may fall under a different HS CODE.

🔢 2. HS CODE: 3911909150

Product Description: Polysulfone Resin (thermosetting), including composite materials, films, and raw materials

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Notes:

- This code includes thermosetting forms of polysulfone resin, such as films, composite materials, and raw materials.

- This is the most commonly used code for polysulfone resin in various forms.

- Confirm the physical state (e.g., film, powder, composite) to ensure correct classification.

🔢 3. HS CODE: 3911100000

Product Description: Polysulfone Resin Film

Tariff Summary:

- Base Tariff Rate: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.1%

Notes:

- This code is specific to films made of polysulfone resin.

- If the product is not a film, this code may not apply.

- This code has a slightly lower base rate than 3911909150.

🔢 4. HS CODE: 3911902500

Product Description: Polysulfone-like Resin Raw Material

Tariff Summary:

- Base Tariff Rate: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.1%

Notes:

- This code is for raw materials of polysulfone-like resins.

- Ensure the product is not a composite or processed form.

- This code has a lower base rate than 3911909150.

⚠️ Important Policy Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS CODEs after April 11, 2025.

This is a time-sensitive policy and may significantly increase the total tax burden. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for polysulfone resin in the provided data. However, always verify with the latest customs announcements or consult a customs broker for confirmation.

📌 Proactive Advice for Importers

- Verify the product form: Is it a film, composite, raw material, or thermoplastic/thermosetting? This determines the correct HS CODE.

- Check the unit price and material composition: This can affect the classification and tax rate.

- Confirm certifications: Some products may require technical documentation, material safety data sheets (MSDS), or customs declarations.

- Monitor policy updates: The April 11, 2025 tariff is a key date—plan accordingly to avoid unexpected costs.

If you provide more details about the specific form or end-use of the polysulfone resin, I can help you further narrow down the correct HS CODE and tax implications.

Product Name: Polysulfone Resin

Classification: HS CODEs related to Polysulfone Resin (various forms and compositions)

✅ HS CODE Overview and Tax Rates

Below is a structured summary of the HS CODEs and associated tariff rates for Polysulfone Resin and its related products:

🔢 1. HS CODE: 3911909110

Product Description: Polysulfone Resin (thermoplastic)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Notes:

- This code applies to thermoplastic forms of polysulfone resin.

- Ensure the product is not in a composite or processed form, as that may fall under a different HS CODE.

🔢 2. HS CODE: 3911909150

Product Description: Polysulfone Resin (thermosetting), including composite materials, films, and raw materials

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Notes:

- This code includes thermosetting forms of polysulfone resin, such as films, composite materials, and raw materials.

- This is the most commonly used code for polysulfone resin in various forms.

- Confirm the physical state (e.g., film, powder, composite) to ensure correct classification.

🔢 3. HS CODE: 3911100000

Product Description: Polysulfone Resin Film

Tariff Summary:

- Base Tariff Rate: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.1%

Notes:

- This code is specific to films made of polysulfone resin.

- If the product is not a film, this code may not apply.

- This code has a slightly lower base rate than 3911909150.

🔢 4. HS CODE: 3911902500

Product Description: Polysulfone-like Resin Raw Material

Tariff Summary:

- Base Tariff Rate: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.1%

Notes:

- This code is for raw materials of polysulfone-like resins.

- Ensure the product is not a composite or processed form.

- This code has a lower base rate than 3911909150.

⚠️ Important Policy Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS CODEs after April 11, 2025.

This is a time-sensitive policy and may significantly increase the total tax burden. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for polysulfone resin in the provided data. However, always verify with the latest customs announcements or consult a customs broker for confirmation.

📌 Proactive Advice for Importers

- Verify the product form: Is it a film, composite, raw material, or thermoplastic/thermosetting? This determines the correct HS CODE.

- Check the unit price and material composition: This can affect the classification and tax rate.

- Confirm certifications: Some products may require technical documentation, material safety data sheets (MSDS), or customs declarations.

- Monitor policy updates: The April 11, 2025 tariff is a key date—plan accordingly to avoid unexpected costs.

If you provide more details about the specific form or end-use of the polysulfone resin, I can help you further narrow down the correct HS CODE and tax implications.

Customer Reviews

No reviews yet.