| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911901500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911100000 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

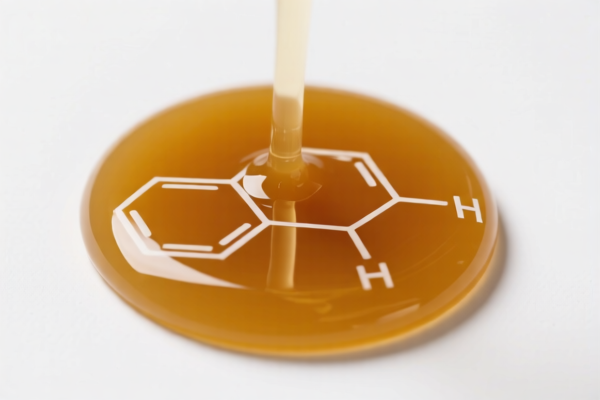

Product Name: Polyterpene Resin

Classification: Multiple HS codes may apply depending on the specific form and characteristics of the product.

🔍 HS Code Classification Overview

Below are the relevant HS codes and their associated tax details for Polyterpene Resin:

✅ HS CODE: 3911901500

- Description: Polyterpene resin is classified under this code.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may be suitable for specific forms or grades of polyterpene resin.

✅ HS CODE: 3911100000

- Description: Includes polyterpene resins under the broader category of "petroleum resins, coumarone-indene resins, polyterpenes, etc."

- Total Tax Rate: 61.1%

- Tax Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply if the product is in a primary form or has specific chemical characteristics.

✅ HS CODE: 3911909110

- Description: Applies to polyterpene resins in thermoplastic form.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for thermoplastic polyterpene resins.

✅ HS CODE: 3911909150

- Description: Applies to polyterpene resins in thermosetting form.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for thermosetting polyterpene resins. It also includes "polyterpene resin particles" under this classification.

⚠️ Important Notes and Recommendations

-

Tariff Increase Alert:

A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the physical form (thermoplastic vs. thermosetting) and chemical composition of the polyterpene resin to ensure correct HS code classification. -

Certifications Required:

Check if any customs documentation, product certifications, or origin declarations are required for the product. -

Unit Price Consideration:

The total tax rate is based on the HS code, but the actual cost may vary depending on the unit price and trade terms (e.g., FOB, CIF).

📌 Proactive Advice

- Consult a customs broker or classification expert if the product has mixed components or is a modified form of polyterpene resin.

- Keep records of product specifications, chemical analysis, and supplier documentation to support customs classification.

- Monitor policy updates after April 11, 2025, as the special tariff may affect your import costs significantly.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: Polyterpene Resin

Classification: Multiple HS codes may apply depending on the specific form and characteristics of the product.

🔍 HS Code Classification Overview

Below are the relevant HS codes and their associated tax details for Polyterpene Resin:

✅ HS CODE: 3911901500

- Description: Polyterpene resin is classified under this code.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may be suitable for specific forms or grades of polyterpene resin.

✅ HS CODE: 3911100000

- Description: Includes polyterpene resins under the broader category of "petroleum resins, coumarone-indene resins, polyterpenes, etc."

- Total Tax Rate: 61.1%

- Tax Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may apply if the product is in a primary form or has specific chemical characteristics.

✅ HS CODE: 3911909110

- Description: Applies to polyterpene resins in thermoplastic form.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for thermoplastic polyterpene resins.

✅ HS CODE: 3911909150

- Description: Applies to polyterpene resins in thermosetting form.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for thermosetting polyterpene resins. It also includes "polyterpene resin particles" under this classification.

⚠️ Important Notes and Recommendations

-

Tariff Increase Alert:

A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the physical form (thermoplastic vs. thermosetting) and chemical composition of the polyterpene resin to ensure correct HS code classification. -

Certifications Required:

Check if any customs documentation, product certifications, or origin declarations are required for the product. -

Unit Price Consideration:

The total tax rate is based on the HS code, but the actual cost may vary depending on the unit price and trade terms (e.g., FOB, CIF).

📌 Proactive Advice

- Consult a customs broker or classification expert if the product has mixed components or is a modified form of polyterpene resin.

- Keep records of product specifications, chemical analysis, and supplier documentation to support customs classification.

- Monitor policy updates after April 11, 2025, as the special tariff may affect your import costs significantly.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.