Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911901500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911100000 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

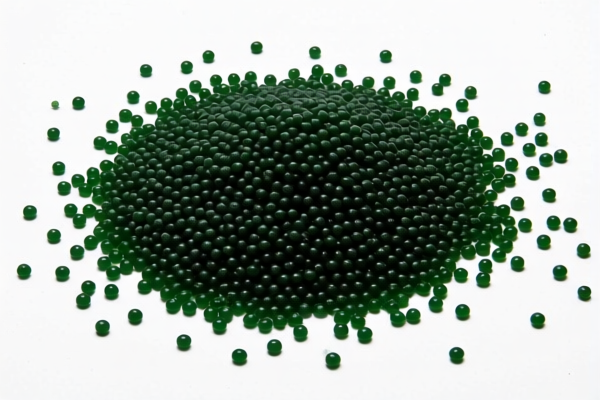

Product Name: Polyterpene Resin Granules

Classification HS CODEs and Tax Details:

- HS CODE: 3911909150

- Description: Polyterpene resin granules fall under HS CODE 3911909150.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3911901500

- Description: Polyterpene resin is classified under HS CODE 3911.90.15.00.

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3911100000

- Description: Polyterpene resins are included in HS CODE 3911100000.

- Total Tax Rate: 61.1%

-

Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3911909110

- Description: Polyterpene resin is classified as a thermoplastic primary form under HS CODE 3911909110.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3902900010

- Description: Polybutene resin granules are classified under HS CODE 3902.90.00.10.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS CODEs starting from April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category (polyterpene resins).

- Certifications: Ensure that the product meets all required customs documentation and certifications (e.g., material specifications, origin certificates, etc.).

- Unit Price and Material Verification: Confirm the exact composition and unit price of the product to ensure correct classification and avoid potential customs delays or penalties.

Proactive Advice:

- Verify the exact chemical composition and physical form of the product (e.g., whether it is a granule, powder, or other form).

- Confirm the country of origin and whether any preferential trade agreements apply.

-

Check with customs authorities or a qualified customs broker for the most up-to-date classification and tax information. Product Name: Polyterpene Resin Granules

Classification HS CODEs and Tax Details: -

HS CODE: 3911909150

- Description: Polyterpene resin granules fall under HS CODE 3911909150.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3911901500

- Description: Polyterpene resin is classified under HS CODE 3911.90.15.00.

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3911100000

- Description: Polyterpene resins are included in HS CODE 3911100000.

- Total Tax Rate: 61.1%

-

Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3911909110

- Description: Polyterpene resin is classified as a thermoplastic primary form under HS CODE 3911909110.

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3902900010

- Description: Polybutene resin granules are classified under HS CODE 3902.90.00.10.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above HS CODEs starting from April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category (polyterpene resins).

- Certifications: Ensure that the product meets all required customs documentation and certifications (e.g., material specifications, origin certificates, etc.).

- Unit Price and Material Verification: Confirm the exact composition and unit price of the product to ensure correct classification and avoid potential customs delays or penalties.

Proactive Advice:

- Verify the exact chemical composition and physical form of the product (e.g., whether it is a granule, powder, or other form).

- Confirm the country of origin and whether any preferential trade agreements apply.

- Check with customs authorities or a qualified customs broker for the most up-to-date classification and tax information.

Customer Reviews

No reviews yet.