| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

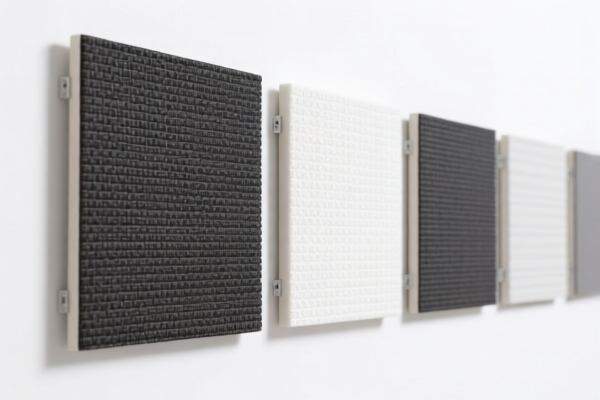

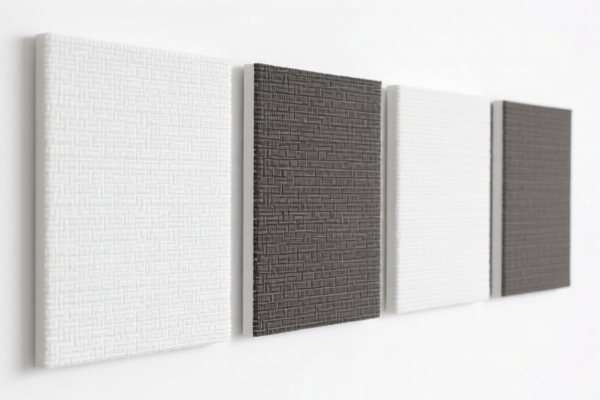

Product Name: Polyurethane Textile Composite Acoustic Panels

Classification HS Code Analysis:

Below are the HS codes and corresponding tariff details for your product, based on the provided data:

🔍 HS Code: 3921131950

Description:

- Honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials, with no restriction on the weight percentage of plant fibers.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 60.3%

🔍 HS Code: 3921131100

Description:

- Polyurethane honeycomb plastic combined with textile materials, where synthetic fibers exceed any single type of textile fiber, and plastic content exceeds 70%.

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 59.2%

🔍 HS Code: 3921131500

Description:

- Polyurethane plastic sheets combined with textile materials.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

🔍 HS Code: 3921131910

Description:

- Polyurethane plastic sheets combined with textile materials, where textile components exceed any single type of textile fiber by weight.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 2, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in your import planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to check for any ongoing investigations or duties related to polyurethane or textile composites. -

Certifications and Documentation:

Ensure that your product meets all required certifications (e.g., fire safety, acoustic performance, and environmental compliance) and that your documentation (e.g., commercial invoice, packing list, and product specifications) clearly describes the composition and use of the product.

✅ Proactive Advice:

-

Verify Material Composition:

Confirm the exact percentage of polyurethane and textile components, as this will determine the correct HS code. -

Check Unit Price and Classification:

The final HS code and tax rate may vary based on the unit price and product description. Ensure your product description is accurate and detailed. -

Consult Customs Broker or Trade Compliance Specialist:

For complex or high-value imports, it is recommended to seek professional assistance to avoid misclassification and potential penalties.

Let me know if you need help determining the most accurate HS code for your specific product configuration.

Product Name: Polyurethane Textile Composite Acoustic Panels

Classification HS Code Analysis:

Below are the HS codes and corresponding tariff details for your product, based on the provided data:

🔍 HS Code: 3921131950

Description:

- Honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials, with no restriction on the weight percentage of plant fibers.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 60.3%

🔍 HS Code: 3921131100

Description:

- Polyurethane honeycomb plastic combined with textile materials, where synthetic fibers exceed any single type of textile fiber, and plastic content exceeds 70%.

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 59.2%

🔍 HS Code: 3921131500

Description:

- Polyurethane plastic sheets combined with textile materials.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

🔍 HS Code: 3921131910

Description:

- Polyurethane plastic sheets combined with textile materials, where textile components exceed any single type of textile fiber by weight.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes:

-

April 2, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in your import planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to check for any ongoing investigations or duties related to polyurethane or textile composites. -

Certifications and Documentation:

Ensure that your product meets all required certifications (e.g., fire safety, acoustic performance, and environmental compliance) and that your documentation (e.g., commercial invoice, packing list, and product specifications) clearly describes the composition and use of the product.

✅ Proactive Advice:

-

Verify Material Composition:

Confirm the exact percentage of polyurethane and textile components, as this will determine the correct HS code. -

Check Unit Price and Classification:

The final HS code and tax rate may vary based on the unit price and product description. Ensure your product description is accurate and detailed. -

Consult Customs Broker or Trade Compliance Specialist:

For complex or high-value imports, it is recommended to seek professional assistance to avoid misclassification and potential penalties.

Let me know if you need help determining the most accurate HS code for your specific product configuration.

Customer Reviews

No reviews yet.