| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

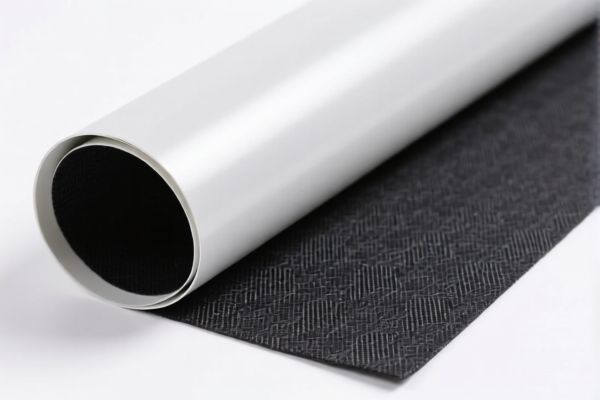

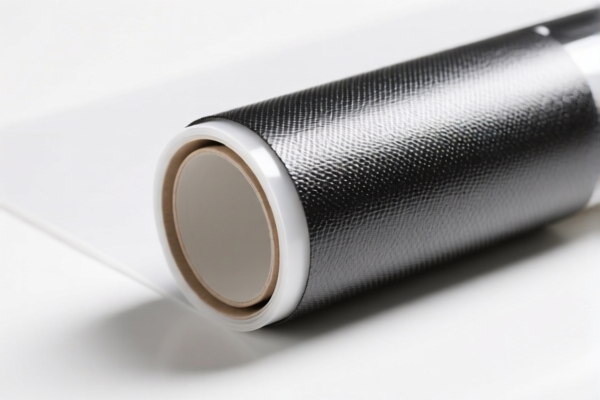

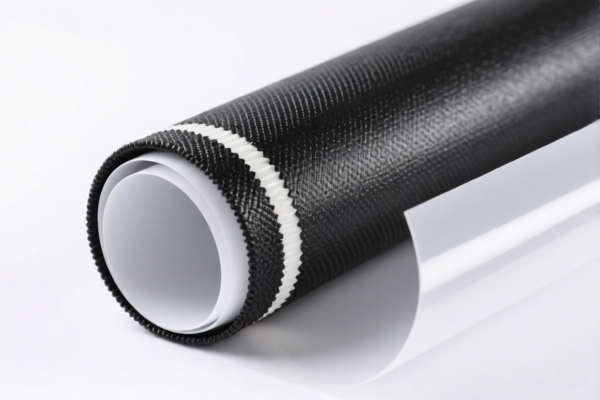

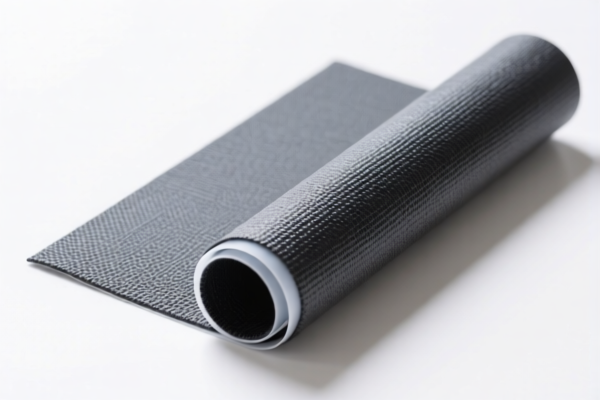

Product Name: Polyurethane Textile Composite Film

Classification: Based on HS Code (Harmonized System Code) and tariff details provided.

🔍 HS Code Classification Overview

Below are the HS codes and corresponding tariff details for Polyurethane Textile Composite Film:

- HS CODE 3921131500

- Description: Polyurethane textile composite film

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE 3921131100

- Description: Polyurethane textile composite film / packaging film / protective film

- Total Tax Rate: 59.2%

-

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE 3921131950

- Description: Polyurethane composite textile film

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes (April 11, 2025)

- All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy and may significantly increase the total import cost.

- No anti-dumping duties on iron or aluminum are currently applicable for this product category.

📌 Proactive Advice for Importers

- Verify the exact product description and composition (e.g., whether it is a "protective film," "packaging film," or "composite textile film") to ensure correct HS code classification.

- Check the unit price and total value of the goods, as this may affect the applicability of additional tariffs or other customs regulations.

- Confirm required certifications (e.g., REACH, RoHS, or other product-specific compliance documents) to avoid delays in customs clearance.

- Monitor the April 11, 2025, deadline and consider adjusting import timelines or seeking duty relief options if applicable.

✅ Summary Table for Quick Reference

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3921131500 | Polyurethane textile composite film | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921131100 | Polyurethane textile composite film | 4.2% | 25.0% | 30.0% | 59.2% |

| 3921131950 | Polyurethane composite textile film | 5.3% | 25.0% | 30.0% | 60.3% |

If you need further assistance with HS code verification or customs documentation, feel free to provide more product details.

Product Name: Polyurethane Textile Composite Film

Classification: Based on HS Code (Harmonized System Code) and tariff details provided.

🔍 HS Code Classification Overview

Below are the HS codes and corresponding tariff details for Polyurethane Textile Composite Film:

- HS CODE 3921131500

- Description: Polyurethane textile composite film

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE 3921131100

- Description: Polyurethane textile composite film / packaging film / protective film

- Total Tax Rate: 59.2%

-

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE 3921131950

- Description: Polyurethane composite textile film

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes (April 11, 2025)

- All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy and may significantly increase the total import cost.

- No anti-dumping duties on iron or aluminum are currently applicable for this product category.

📌 Proactive Advice for Importers

- Verify the exact product description and composition (e.g., whether it is a "protective film," "packaging film," or "composite textile film") to ensure correct HS code classification.

- Check the unit price and total value of the goods, as this may affect the applicability of additional tariffs or other customs regulations.

- Confirm required certifications (e.g., REACH, RoHS, or other product-specific compliance documents) to avoid delays in customs clearance.

- Monitor the April 11, 2025, deadline and consider adjusting import timelines or seeking duty relief options if applicable.

✅ Summary Table for Quick Reference

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3921131500 | Polyurethane textile composite film | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921131100 | Polyurethane textile composite film | 4.2% | 25.0% | 30.0% | 59.2% |

| 3921131950 | Polyurethane composite textile film | 5.3% | 25.0% | 30.0% | 60.3% |

If you need further assistance with HS code verification or customs documentation, feel free to provide more product details.

Customer Reviews

No reviews yet.